Sweetgreen Inc (SG) Reports Narrowed Losses and Revenue Growth in FY 2023

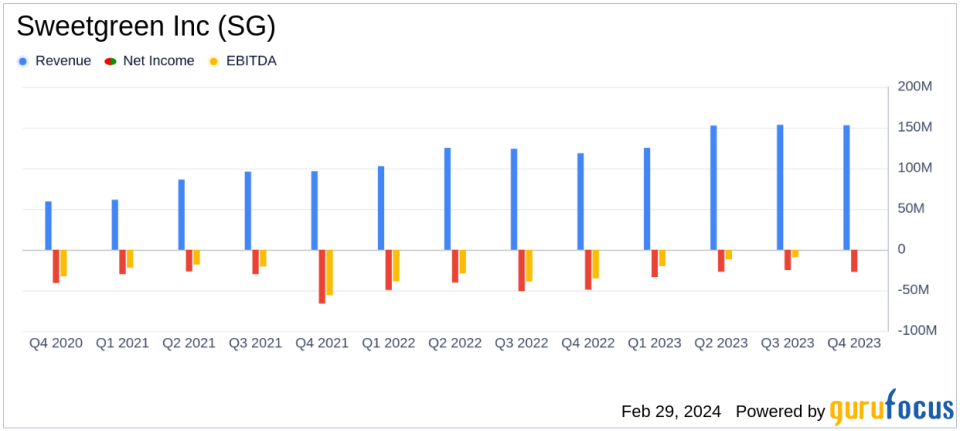

Total Revenue: Increased by 24% to $584.0 million for FY 2023.

Same-Store Sales Change: Reported a 4% increase for FY 2023.

Net Loss: Decreased to $(113.4) million in FY 2023 from $(190.4) million in FY 2022.

Adjusted EBITDA: Improved to $(2.8) million for FY 2023 from $(49.9) million in FY 2022.

Restaurant-Level Profit Margin: Increased to 17% for FY 2023, up from 15% in FY 2022.

Net New Restaurant Openings: 35 new openings in FY 2023 compared to 36 in the previous year.

On February 29, 2024, Sweetgreen Inc (NYSE:SG) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, known for its mission-driven approach to offering healthier food options, reported a significant 24% increase in total revenue for the fiscal year, amounting to $584.0 million. This growth is attributed to the addition of 45 net new restaurant openings and a 6% increase in same-store sales, which included a 5% benefit from menu price increases and a 1% increase in traffic/mix.

Financial Performance and Challenges

Sweetgreen Inc (NYSE:SG) experienced a reduction in net loss to $(113.4) million in FY 2023 from $(190.4) million in FY 2022, showing a significant improvement in its financial health. The net loss margin also improved to (19)% from (41)% in the previous fiscal year. Adjusted EBITDA, a key metric for evaluating a company's operational performance, showed a notable improvement to $(2.8) million from $(49.9) million in FY 2022. Despite these positive trends, the company still faces challenges, including a competitive market and the need to maintain growth momentum while managing operational costs effectively.

Financial Achievements

The company's restaurant-level profit margin increased to 17% for FY 2023, up from 15% in FY 2022, indicating improved efficiency in restaurant operations. This is particularly important for the restaurant industry, where margins are often tight and operational efficiency can be a significant driver of profitability. The increase in restaurant-level profit margin reflects the impact of menu price increases, labor optimization, and improvements in supply chain sourcing.

Income Statement and Balance Sheet Highlights

Key details from the income statement show that the loss from operations decreased to $(122.3) million in FY 2023 from $(193.3) million in FY 2022, with the loss from operations margin improving to (21)% from (41)%. The balance sheet indicates that Sweetgreen Inc (NYSE:SG) ended the fiscal year with $257.2 million in cash and cash equivalents, a decrease from $331.6 million in the previous year. Total assets stood at $856.6 million, while total liabilities were $374.0 million.

Looking Ahead

For fiscal year 2024, Sweetgreen Inc (NYSE:SG) anticipates 23-27 net new restaurant openings, revenue ranging from $655 million to $670 million, and a same-store sales change between 3-5%. The company also expects an adjusted EBITDA between $8 million to $15 million, signaling a move towards profitability. CEO Jonathan Neman expressed optimism for the year ahead, citing a strong foundation, focus on menu innovation, and the Infinite Kitchen initiative to drive traffic and demand.

As Sweetgreen Inc (NYSE:SG) continues to expand and innovate within the restaurant industry, investors and potential GuruFocus.com members should monitor the company's ability to maintain growth, manage costs, and improve profitability in the coming fiscal year.

For a more detailed analysis and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Sweetgreen Inc for further details.

This article first appeared on GuruFocus.