Sweetgreen (NYSE:SG) Misses Q3 Sales Targets

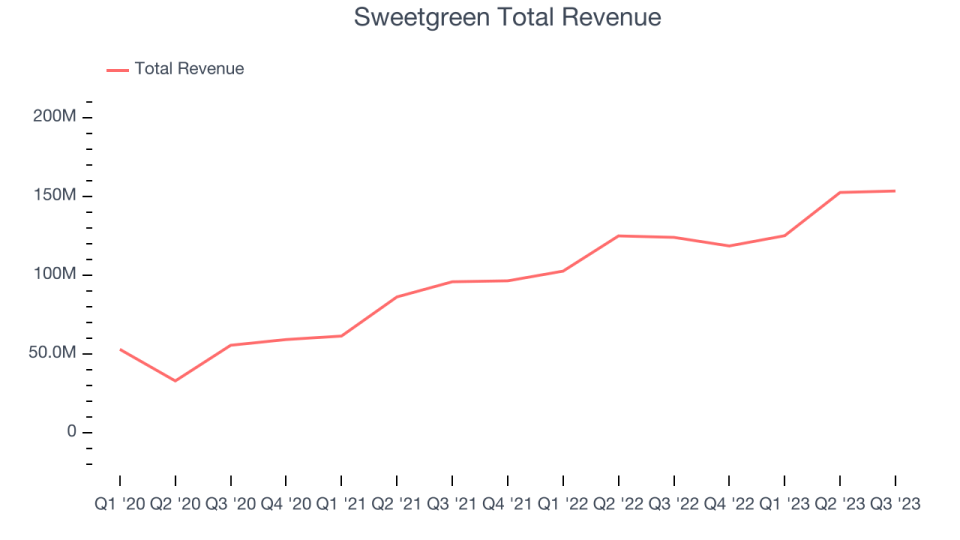

Casual salad chain Sweetgreen (NYSE:SG) missed analysts' expectations in Q3 FY2023, with revenue up 23.7% year on year to $153.4 million. Its full-year revenue guidance of $580 million at the midpoint also came in slightly below analysts' estimates. Turning to EPS, Sweetgreen made a GAAP loss of $0.22 per share, improving from its loss of $0.43 per share in the same quarter last year.

Is now the time to buy Sweetgreen? Find out by accessing our full research report, it's free.

Sweetgreen (SG) Q3 FY2023 Highlights:

Revenue: $153.4 million vs analyst estimates of $154.6 million (0.79% miss)

EPS: -$0.22 vs analyst estimates of -$0.23 (2.36% beat)

The company reconfirmed its revenue guidance for the full year of $580 million at the midpoint

Gross Margin (GAAP): 19%, up from 16% in the same quarter last year

Same-Store Sales were up 4% year on year

Store Locations: 220 at quarter end, increasing by 45 over the last 12 months

“We delivered another solid quarter that included 20%+ revenue growth, 300 basis points of restaurant level margin expansion from the prior year period, and positive Adjusted EBITDA,” said Jonathan Neman, Co-Founder and Chief Executive Officer.

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

Sweetgreen is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

As you can see below, the company's annualized revenue growth rate of 45% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Sweetgreen generated an excellent 23.7% year-on-year revenue growth rate, but its $153.4 million of revenue fell short of Wall Street's high expectations. Looking ahead, the analysts covering the company expect sales to grow 21.7% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Number of Stores

When a chain like Sweetgreen is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Since last year, Sweetgreen's restaurant count increased by 45, or 25.7%, to 220 locations in the most recently reported quarter.

Taking a step back, Sweetgreen has rapidly opened new restaurants over the last eight quarters, averaging 24.7% annual increases in new locations. This growth is much higher than other restaurant businesses and gives Sweetgreen a chance to scale towards a mid-sized company over time. Analyzing a restaurant's location growth is important because expansion means Sweetgreen has more opportunities to feed customers and generate sales.

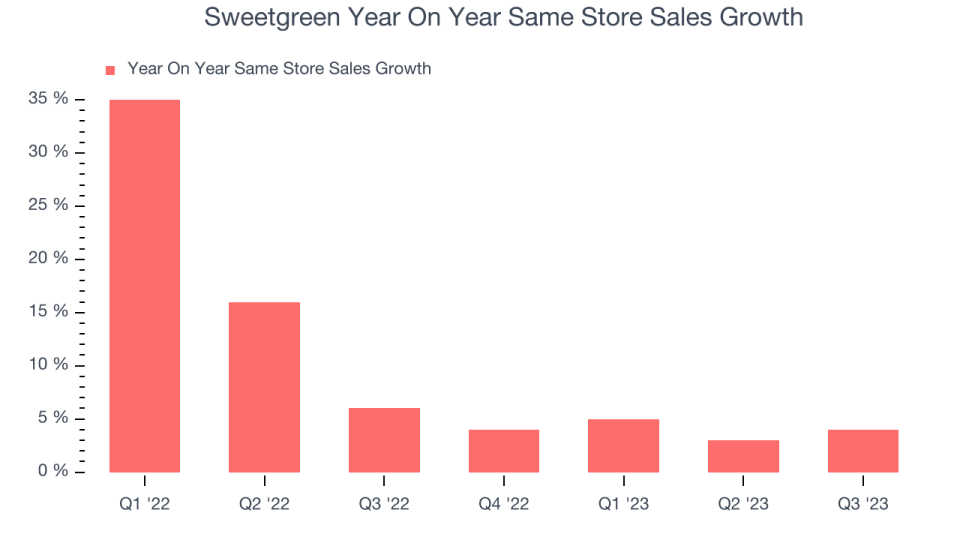

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its restaurants that have been open for at least a year, give or take. This is a key performance indicator because it measures organic growth and demand.

Sweetgreen's demand has outpaced the broader restaurant sector over the last eight quarters. On average, the company has grown its same-store sales by a robust 10.4% year on year. This performance gives it the confidence to rapidly open new restaurants. When a company has strong demand, more locations should help it reach more customers seeking its meals and boost revenue growth.

In the latest quarter, Sweetgreen's same-store sales rose 4% year on year. This growth was a deceleration from the 6% year-on-year increase it posted 12 months ago, showing the business is still performing well but lost a bit of steam.

Key Takeaways from Sweetgreen's Q3 Results

With a market capitalization of $1.17 billion and more than $274.7 million in cash on hand, Sweetgreen can continue prioritizing growth.

We struggled to find many strong positives in these results. Although its adjusted EBITDA and full-year adjusted EBITDA guidance beat analysts' estimates, its gross margin, revenue, and full-year revenue guidance fell short of Wall Street's expectations. Overall, this was a mediocre quarter for Sweetgreen. Investors were likely hoping for stronger top-line growth, especially since it opened more new restaurant locations than expected. The company is down 2.27% and currently trades at $10.78 per share.

Sweetgreen may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.