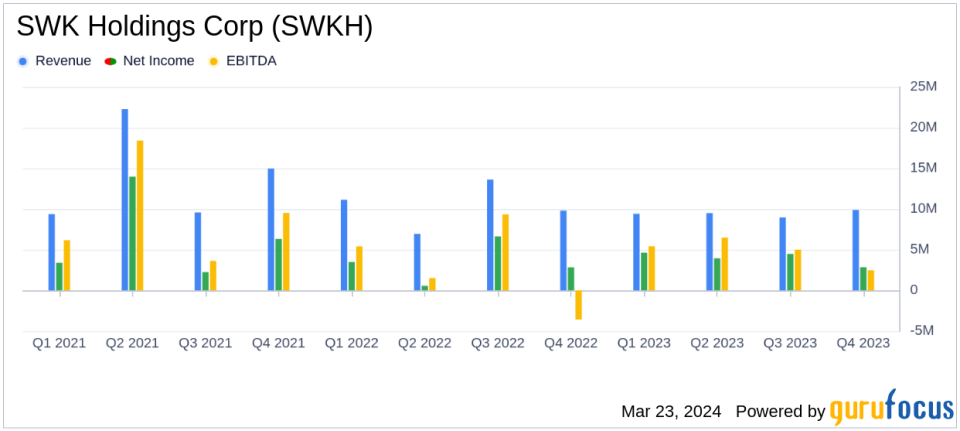

SWK Holdings Corp (SWKH) Earnings: A Mixed Bag with Revenue Uptick and Net Income Dip

Revenue: Reported $9.9 million, a slight increase from $9.8 million in Q4 2022, surpassing the estimated $9.3 million.

Net Income: GAAP net income remained flat at $2.8 million, while Non-GAAP adjusted net income rose to $2.8 million from $1.6 million in Q4 2022.

Earnings Per Share (EPS): Not explicitly stated in the provided data, making it unclear how it compares to the estimated $0.305.

Finance Receivables Segment: Realized yield increased to 14.1%, with a portfolio growth to $288.4 million.

Challenges: Net income affected by an $8.4 million goodwill impairment at Enteris subsidiary.

Stock Repurchase: Repurchased 14,233 shares in Q4 and an additional 51,169 shares year-to-date through March 14th.

Strategic Moves: Signed an Exclusive Option and Asset Purchase Agreement post-quarter, potentially enhancing future revenue.

SWK Holdings Corp (NASDAQ:SWKH), a life science-focused specialty finance company, released its 8-K filing on March 21, 2024, announcing its financial results for the fourth quarter ended December 31, 2023. The company reported a modest revenue increase to $9.9 million, slightly above the estimated $9.3 million, while maintaining its GAAP net income at $2.8 million. Despite this, Non-GAAP adjusted net income saw a significant rise, indicating underlying strength in the company's operations.

SWK Holdings Corp provides innovative financial solutions to the life sciences sector, focusing on monetizing cash flow streams from commercial-stage products. The company's Finance Receivables segment is a key revenue generator, with the Pharmaceutical Development Services offering additional support. The recent quarter's performance underscores the company's ability to navigate a complex market, though challenges such as goodwill impairment have impacted net income.

The strategic agreement signed post-quarter with a partner for Enteris assets could reduce cash burn and bolster future revenues, reflecting proactive management in optimizing the company's asset base. This move, along with the share repurchase program, demonstrates SWKH's commitment to shareholder value.

Financial Highlights and Challenges

SWKH's financial achievements this quarter include an increase in the Finance Receivables segment's portfolio to $288.4 million, up 16.1% from the previous year, and a realized yield of 14.1%. However, the company faced an $8.4 million goodwill impairment charge at its Enteris subsidiary, which affected net income.

The balance sheet strength is evident, with book value per share increasing to $22.43 from $21.80 year-over-year. The non-GAAP tangible financing book value per share also saw a rise, indicating a solid underlying financial position. These metrics are crucial for assessing the company's true value and financial health, particularly relevant to value investors.

SWKH's cash position and liquidity remain robust, with cash and cash equivalents totaling $4.5 million and a net increase in total assets to $334.3 million. The company's strategic financial management, including the issuance of senior unsecured notes and upsizing of its credit facility, positions it well for future growth and investment opportunities.

Operational Insights and Future Prospects

Operational achievements during the quarter include the closure of four transactions and a share repurchase initiative, signaling confidence in the company's intrinsic value. The Exclusive Option and Asset Purchase agreement post-quarter could significantly impact the company's financial trajectory, reducing cash burn and securing guaranteed annual revenue payments.

Looking ahead, SWKH's increased finance receivables portfolio and available liquidity to fund new deals, coupled with ongoing demand for its loan and royalty products, provide a positive outlook for 2024. The company's strategic focus on its core Specialty Finance segment and efforts to monetize Enteris assets are expected to enhance shareholder returns.

For investors, SWKH's ability to sustain revenue growth amidst challenges and its strategic initiatives to improve financial health are key indicators of its potential for long-term value creation. The company's focus on the life science sector positions it at the forefront of an industry with critical importance and high growth potential.

For further details and insights, investors are encouraged to review the full earnings report and join the conference call and live audio webcast scheduled for today at 10:00 a.m. ET.

Explore the complete 8-K earnings release (here) from SWK Holdings Corp for further details.

This article first appeared on GuruFocus.