Sylebra Capital Ltd Bolsters Stake in Impinj Inc

Transaction Overview

On November 14, 2023, Sylebra Capital Ltd (Trades, Portfolio) made a notable addition to its investment portfolio by acquiring 48,311 shares of Impinj Inc (NASDAQ:PI), a leading provider of RAIN RFID solutions. This transaction increased Sylebra Capital's holding to a total of 4,030,559 shares, marking a significant trade impact of 0.16% on its portfolio. The shares were purchased at a price of $79.44, reflecting the firm's confidence in the stock's potential. This move adjusted Sylebra Capital's position in Impinj Inc to 13.12% of its portfolio, with a 14.89% stake in the company.

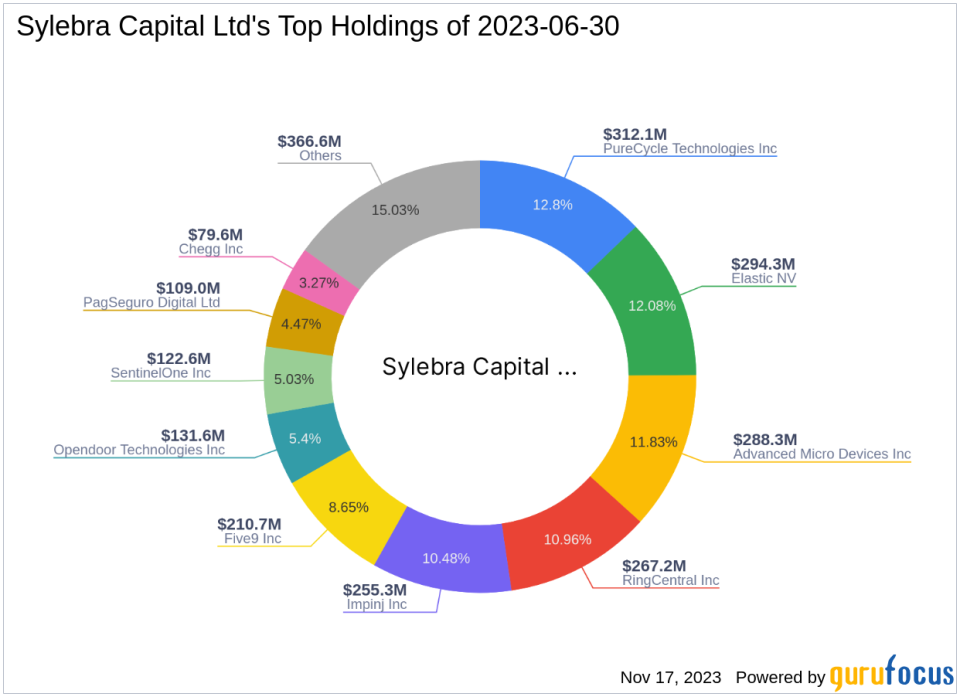

Profile of Sylebra Capital Ltd (Trades, Portfolio)

Sylebra Capital Ltd (Trades, Portfolio) stands as a prominent investment firm with a strategic focus on the technology and industrials sectors. With an equity portfolio valued at $2.44 billion, the firm's top holdings include Advanced Micro Devices Inc (NASDAQ:AMD), Impinj Inc (NASDAQ:PI), and RingCentral Inc (NYSE:RNG), among others. Sylebra Capital's investment philosophy emphasizes identifying high-growth opportunities within its preferred sectors, aiming to capitalize on market trends and innovations. The firm's top sector allocations further underscore its commitment to technology and industrials, reflecting a well-defined investment strategy.

Impinj Inc's Stock Overview

Impinj Inc, traded under the symbol PI, is a company that has revolutionized wireless connectivity for everyday items through its RAIN RFID platform. Since its IPO on July 21, 2016, Impinj has seen a remarkable price increase of 341.39%. Despite a year-to-date decline of 27.94%, the company's market capitalization stands at $2.15 billion, with a current stock price of $79.45. GuruFocus deems the stock as modestly undervalued, with a GF Value of $101.07 and a price to GF Value ratio of 0.79. This assessment suggests that Impinj Inc may present a buying opportunity for value investors.

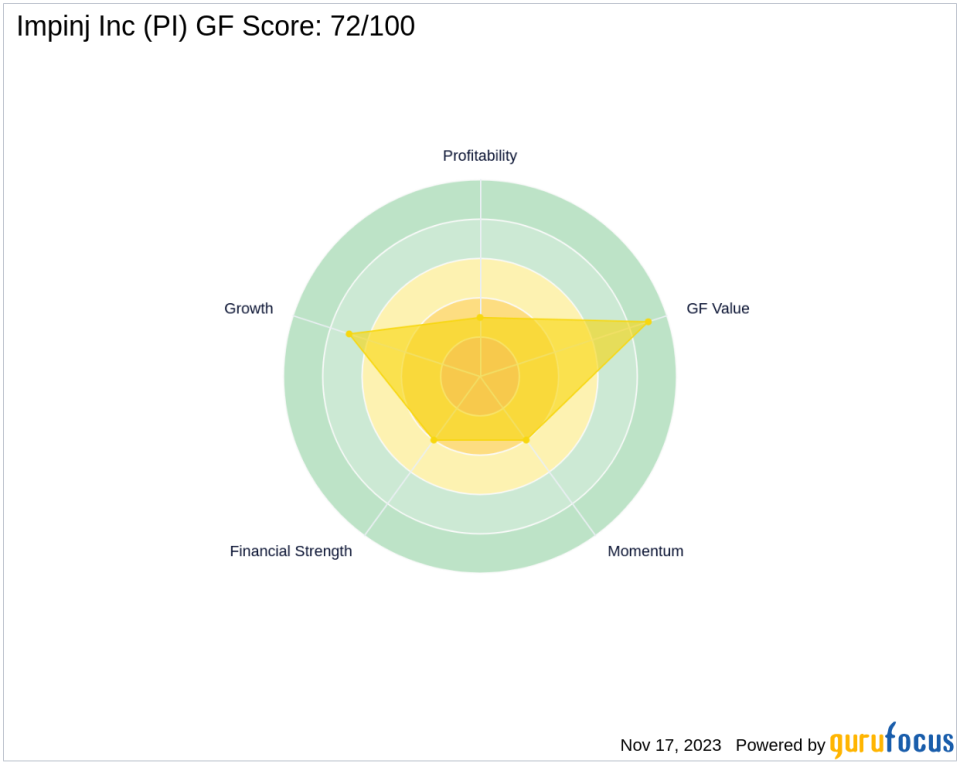

Financial Health and Performance Metrics

Impinj Inc's financial health is a mixed picture, with a Financial Strength rank of 4/10 and a Profitability Rank of 3/10. The company's Growth Rank is more promising at 7/10, indicating potential in its expansion strategies. Key performance metrics such as Return on Equity (ROE) and Return on Assets (ROA) stand at -122.14% and -7.87%, respectively, which are areas of concern. However, the company's revenue growth over the past three years has been steady at 13.00%, suggesting a solid operational foundation.

Market Performance and Valuation

Impinj Inc's stock performance has been volatile since its IPO, with significant gains offset by recent declines. The company's valuation, as indicated by the GF Value Rank of 9/10, suggests that the stock is undervalued, potentially offering a margin of safety for investors. The Momentum Rank of 4/10, however, indicates that the stock may not have strong short-term upward dynamics.

Comparative Analysis with Largest Shareholder

Leucadia National currently holds the title of the largest guru shareholder in Impinj Inc, although specific share percentage data is not available. As a company with a diverse range of investments, Leucadia National's profile and investment approach provide a benchmark for evaluating Sylebra Capital's recent transaction.

Implications for Value Investors

Sylebra Capital Ltd (Trades, Portfolio)'s increased stake in Impinj Inc signals a strong belief in the company's value proposition and future prospects. For value investors, this trade could indicate an opportune moment to consider Impinj Inc, especially given its modest undervaluation and solid growth potential.

Closing Summary

Sylebra Capital Ltd (Trades, Portfolio)'s recent acquisition of additional shares in Impinj Inc underscores the firm's strategic investment approach and confidence in the company's future. With a GF Value suggesting undervaluation and a solid growth trajectory, Impinj Inc aligns with the principles of value investing, making it a stock to watch closely in the technology sector.

Transaction Analysis

The impact of Sylebra Capital Ltd (Trades, Portfolio)'s transaction on its portfolio is notable, with Impinj Inc now representing a significant portion of its investments. The firm's increased stake could influence investor sentiment and potentially catalyze further interest in the stock, especially among value-oriented investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.