Sylebra Capital Ltd Bolsters Stake in Impinj Inc

Recent Acquisition by Sylebra Capital Ltd (Trades, Portfolio)

On November 13, 2023, Sylebra Capital Ltd (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 3,982,248 shares of Impinj Inc (NASDAQ:PI), a leading provider of RAIN RFID solutions. This transaction, which saw a share change of 33,682, had a modest trade impact of 0.1% on the firm's portfolio, with the shares purchased at a price of $73.16 each. This move has increased Sylebra Capital Ltd (Trades, Portfolio)'s position in Impinj Inc to 11.94% of its portfolio, reflecting a 14.72% ownership in the traded company.

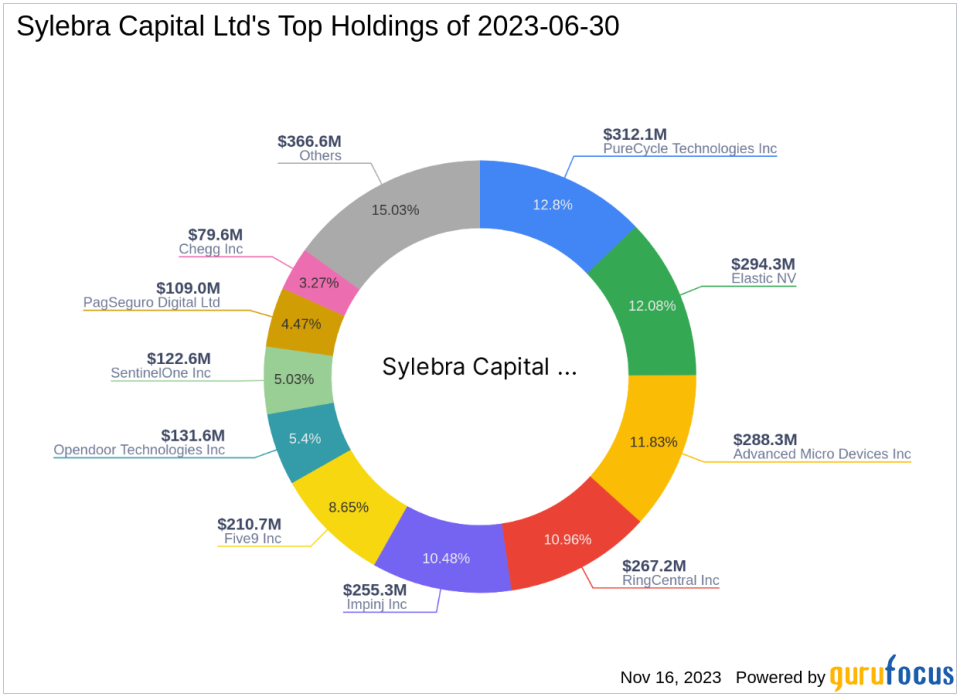

Insight into Sylebra Capital Ltd (Trades, Portfolio)

Sylebra Capital Ltd (Trades, Portfolio), a prominent investment firm based in Hong Kong, is known for its strategic market plays and a keen investment philosophy that focuses on long-term value. With a portfolio equity of $2.44 billion and 22 stocks under management, the firm has a strong inclination towards the technology and industrials sectors. Its top holdings include Advanced Micro Devices Inc (NASDAQ:AMD) and Impinj Inc (NASDAQ:PI), among others. The firm's significant sector allocations further underscore its expertise in identifying growth opportunities within these industries.

Overview of Impinj Inc

Impinj Inc, headquartered in the USA, has been a pioneer in the hardware industry since its IPO on July 21, 2016. The company's innovative platform enables wireless connectivity to everyday items, enhancing their identity, location, and authenticity. With a strong presence across the Americas, Asia Pacific, and EMEA, Impinj's key revenue streams are derived from its Endpoint Integrated Circuits (ICs) and Systems segments. The company's market capitalization stands at $2.14 billion, with a current stock price of $79.01.

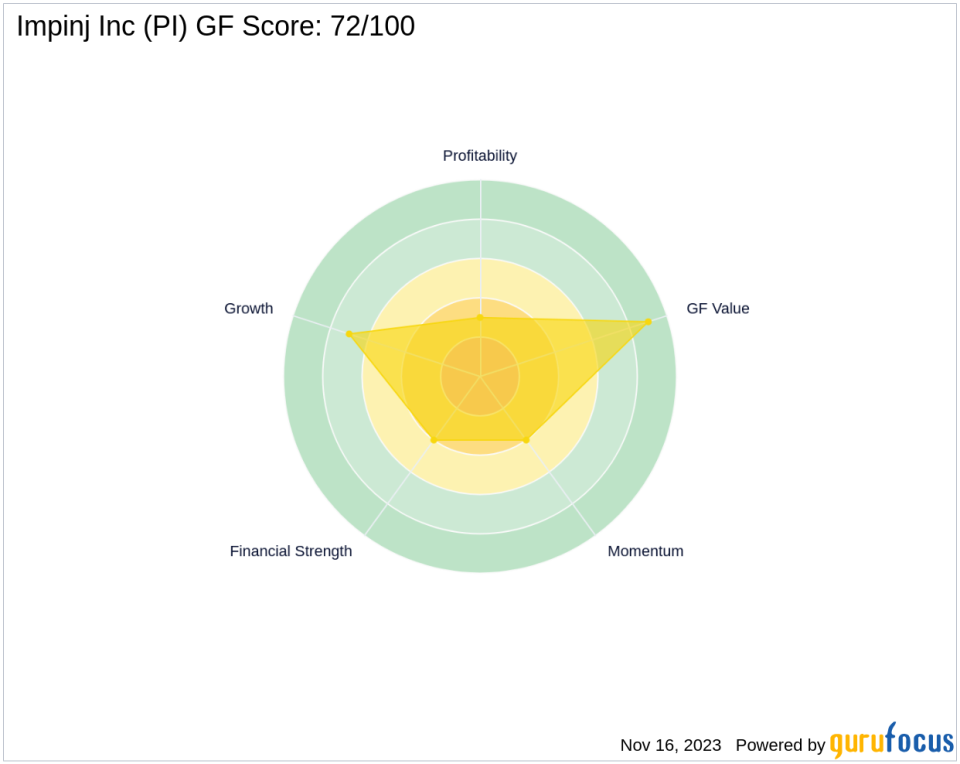

Impinj Inc's Financial and Market Position

Despite a PE Percentage of 0.00 indicating current losses, Impinj Inc is considered modestly undervalued with a GF Value of $101.07 and a price to GF Value ratio of 0.78. The stock has experienced an 8% gain since the transaction and a remarkable 338.94% increase since its IPO. However, the year-to-date performance shows a decline of 28.34%. The company's GF Score stands at 72/100, suggesting a likely average performance in the future.

Analysis of Sylebra Capital Ltd (Trades, Portfolio)'s Position

Sylebra Capital Ltd (Trades, Portfolio)'s acquisition has solidified its position in Impinj Inc, making it one of the firm's top holdings. The firm's stake in Impinj now represents a significant portion of its portfolio, indicating a strong conviction in the company's potential. This strategic move aligns with Sylebra Capital Ltd (Trades, Portfolio)'s investment philosophy and its focus on technology and industrial sectors.

Market Sentiment and Technical Indicators

The market sentiment towards Impinj Inc appears positive, with technical indicators like the RSI showing strong momentum. The RSI 14 Day stands at 74.87, suggesting that the stock may be approaching overbought territory. However, the stock's current valuation in relation to the GF Value indicates that it may still be a worthwhile investment.

Impinj Inc within the Hardware Industry

Impinj Inc's strategic position within the hardware industry is noteworthy. While the largest guru shareholder's details are not provided, Sylebra Capital Ltd (Trades, Portfolio)'s recent transaction places it as a key investor in the company. This move could signal confidence in Impinj's market position and future growth prospects within the industry.

Transaction Influence on Stock and Portfolio

The recent acquisition by Sylebra Capital Ltd (Trades, Portfolio) has not only increased its influence over Impinj Inc but also may have positive implications for the stock's performance. The firm's significant stake could attract additional investor interest and potentially drive up the stock's value. For Sylebra Capital Ltd (Trades, Portfolio), this transaction enhances its portfolio's potential for growth, particularly within the technology sector where it already holds a substantial interest.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.