Sylebra Capital Ltd Boosts Stake in Impinj Inc

On August 30, 2023, Sylebra Capital Ltd (Trades, Portfolio), a Hong Kong-based investment firm, increased its stake in Impinj Inc, a leading provider of wireless connectivity solutions. This article will delve into the details of the transaction, provide an overview of both Sylebra Capital Ltd (Trades, Portfolio) and Impinj Inc, and analyze the potential implications of this investment move.

Transaction Overview

Sylebra Capital Ltd (Trades, Portfolio) added 126,427 shares of Impinj Inc to its portfolio, bringing its total holdings to 3,869,196 shares. The transaction, which took place at a price of $63.32 per share, increased Sylebra's position in Impinj Inc to 10.02% of its portfolio and 14.41% of Impinj's total shares. This move signifies Sylebra's confidence in Impinj's growth potential and strategic direction.

Sylebra Capital Ltd (Trades, Portfolio) Profile

Sylebra Capital Ltd (Trades, Portfolio) is an investment firm located at 28 Hennessy Road, 20th Floor, Hong Kong. The firm manages a portfolio of 22 stocks, with a total equity of $2.44 billion. Its top holdings include Advanced Micro Devices Inc (NASDAQ:AMD), Impinj Inc (NASDAQ:PI), RingCentral Inc (NYSE:RNG), Elastic NV (NYSE:ESTC), and PureCycle Technologies Inc (NASDAQ:PCT). The firm's investment strategy is primarily focused on the technology and industrials sectors.

Impinj Inc Profile

Impinj Inc (NASDAQ:PI), based in the USA, is a leading provider of wireless connectivity solutions. The company's platform includes endpoint integrated circuits (ICs) and a connectivity layer that enables wireless identification, location, and authentication of everyday items. Impinj Inc, which went public on July 21, 2016, has a market capitalization of $1.83 billion and a current stock price of $68.21.

Impinj Inc's Financial Performance

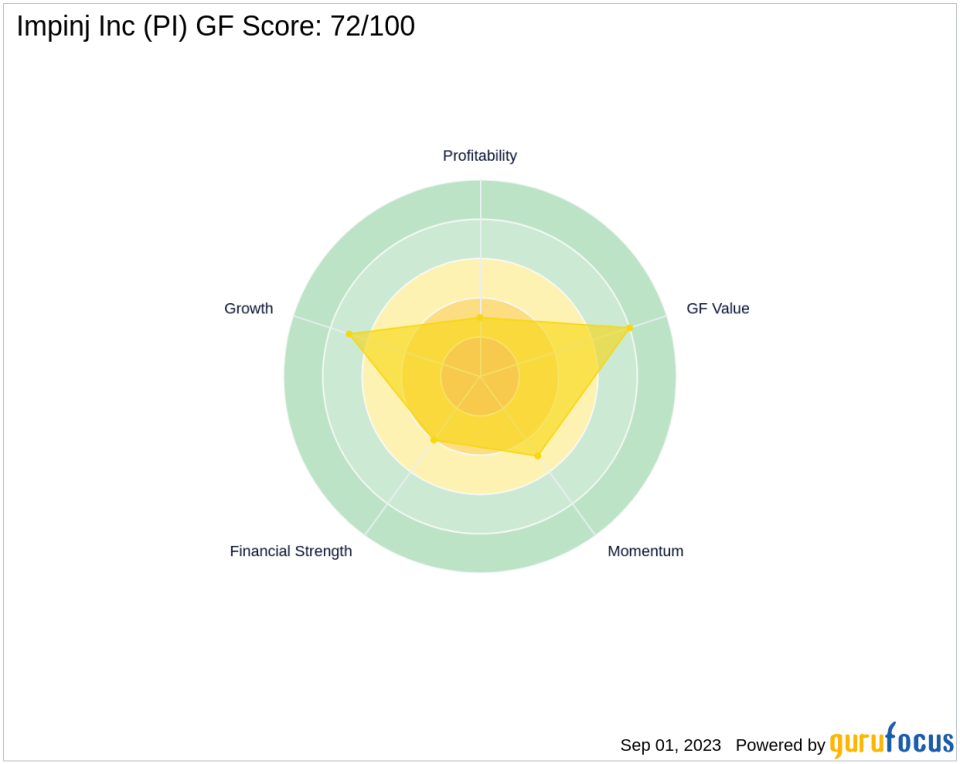

Impinj Inc's financial performance is characterized by a GF Score of 72/100, indicating a likely average performance. The company's GF Value is $103.75, suggesting that the stock may be undervalued. However, with a Price to GF Value ratio of 0.66, investors should exercise caution as this could indicate a possible value trap. Since its IPO, the stock has gained 278.94%, but it has declined by 38.14% year-to-date.

Impinj Inc's Balance Sheet, Profitability, and Growth

Impinj Inc's financial strength, as indicated by its balance sheet rank of 4/10, is moderate. The company's profitability rank is 3/10, while its growth rank is 7/10. Impinj Inc's GF Value Rank and Momentum Rank are 8/10 and 5/10, respectively. The company's Piotroski F-Score is 3, and its Altman Z score is 3.09, indicating financial stability.

Impinj Inc's Industry Performance

Impinj Inc operates in the hardware industry. The company's return on equity (ROE) is -105.58, and its return on assets (ROA) is -4.24. Impinj Inc has experienced significant growth in its gross margin (1.10) and operating margin (8.10). The company's revenue growth over the past three years is 13.00%, while its EBITDA growth is 7.90%.

Conclusion

Sylebra Capital Ltd (Trades, Portfolio)'s increased stake in Impinj Inc underscores the firm's confidence in Impinj's growth prospects and strategic direction. While Impinj's financial performance and industry position suggest potential for future growth, investors should exercise caution due to the company's current valuation. As always, investors are encouraged to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.