Sylebra Capital Ltd Increases Stake in Impinj Inc

Value investors often keep a close eye on the transactions of investment gurus, as these can provide valuable insights into potential investment opportunities. One such transaction that has recently caught the attention of the market is Sylebra Capital Ltd (Trades, Portfolio)'s acquisition of additional shares in Impinj Inc. (NASDAQ:PI). This article will delve into the details of this transaction, provide an overview of the guru and the traded company, and analyze the potential implications of this move for value investors.

Details of the Transaction

On August 11, 2023, Sylebra Capital Ltd (Trades, Portfolio) added 263,740 shares of Impinj Inc (NASDAQ:PI), a company based in the USA that operates a platform enabling wireless connectivity to everyday items. This trade action resulted in a 9.26% change in the firm's holdings, increasing its total shares in Impinj Inc to 3,111,825. The shares were traded at a price of $58.26 each, making the transaction's impact on the firm's portfolio 0.63%. Following this transaction, Impinj Inc now constitutes 7.39% of Sylebra Capital Ltd (Trades, Portfolio)'s portfolio, with the firm holding an 11.59% stake in the company.

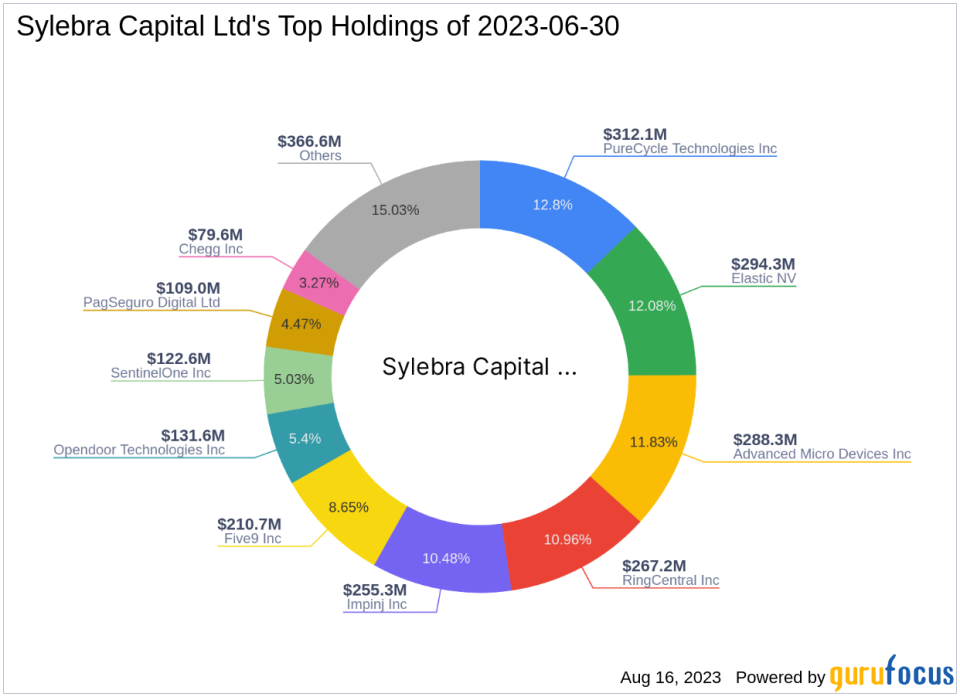

Profile of the Firm

Sylebra Capital Ltd (Trades, Portfolio) is a Hong Kong-based investment firm with a focus on the technology and industrials sectors. The firm's equity stands at $2.44 billion, spread across 22 stocks. Its top holdings include Advanced Micro Devices Inc (NASDAQ:AMD), Impinj Inc (NASDAQ:PI), RingCentral Inc (NYSE:RNG), Elastic NV (NYSE:ESTC), and PureCycle Technologies Inc (NASDAQ:PCT).

Overview of Impinj Inc

Impinj Inc, which went public on July 21, 2016, operates a platform that delivers each item's identity, location, and authenticity to business and consumer applications. The company's platform includes endpoint integrated circuits (ICs) product and a connectivity layer. Impinj Inc has a market cap of $1.6 billion and a current stock price of $59.67. However, its PE percentage is 0.00, indicating that the company is currently at a loss. According to GuruFocus's GF Valuation and the company's low Piotroski F-score of 3 out of 9, the stock is potentially a value trap, with a GF Value of 103.89 and a price to GF Value ratio of 0.57.

Analysis of Impinj Inc's Performance

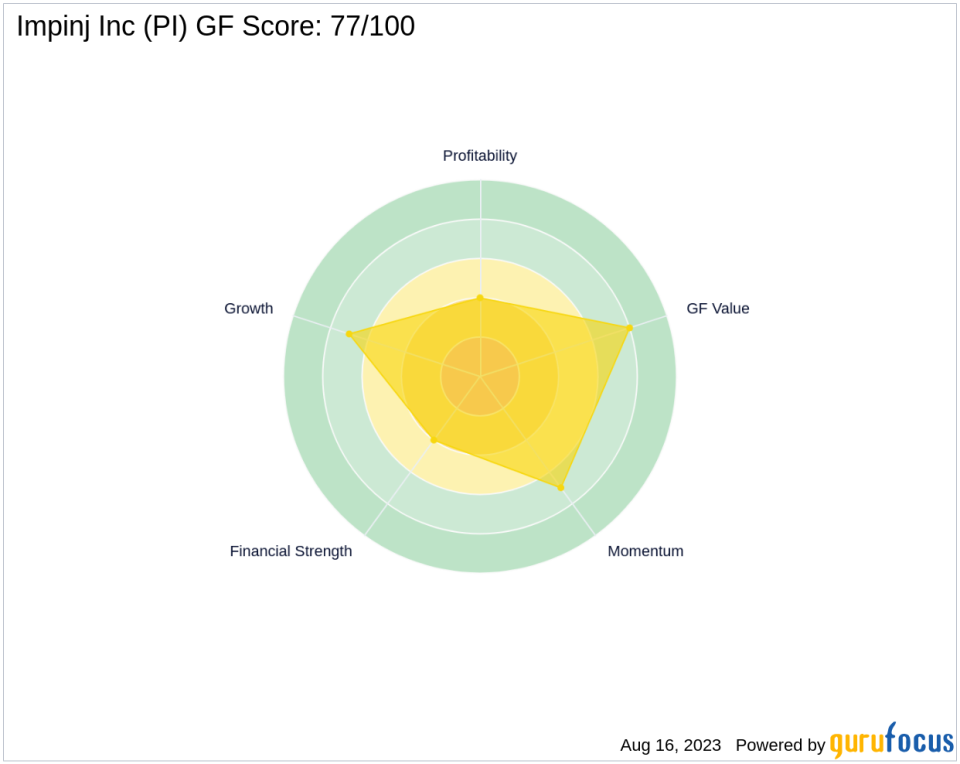

Since its IPO, Impinj Inc's stock has gained 231.5%, but it has declined by 45.88% year-to-date. The stock's GF Score is 77/100, indicating good outperformance potential. Its Financial Strength is ranked 4/10, while its Profitability Rank and Growth Rank are both 4/10. The stock's GF Value Rank is 8/10, and its Momentum Rank is 7/10. Impinj Inc's Piotroski F-Score is 3, and its Altman Z score is 2.75.

Impinj Inc's Financial Health

Impinj Inc's financial health is a mixed bag. The company's interest coverage is 0.00, indicating that it is not generating enough earnings to cover its interest expenses. Its ROE is -105.58, and its ROA is -4.24. However, the company has seen growth in its gross margin (1.10) and operating margin (8.10). Its revenue growth over the past three years is 13.00%, and its EBITDA growth over the same period is 7.90%.

Impinj Inc's Stock Momentum

The stock's RSI 5 Day is 52.12, its RSI 9 Day is 35.55, and its RSI 14 Day is 31.38. The stock's Momentum Index 6 - 1 Month is -35.30, and its Momentum Index 12 - 1 Month is -11.03.

Conclusion

In conclusion, Sylebra Capital Ltd (Trades, Portfolio)'s recent acquisition of additional shares in Impinj Inc is a significant move that could have implications for the firm's portfolio and the stock's performance. While Impinj Inc's financial health and performance metrics present a mixed picture, the firm's increased stake in the company indicates confidence in its potential. As always, value investors should conduct their own research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.