Sylvamo Corp (SLVM) Reports Solid Operating Cash Flow and Shareholder Returns in 2023

Net Income: $253 million from continuing operations for the full year 2023.

Adjusted EBITDA: $607 million, representing a 16% margin.

Free Cash Flow: $294 million, with $127 million returned to shareholders.

Share Repurchases: Approximately $70 million spent to buy back 1.57 million shares.

Dividends: Paid regular and special dividends totaling $57 million.

Fourth Quarter Sales: Increased by 7.5% to $964 million compared to the third quarter.

Outlook: Adjusted EBITDA projected to be $105 million to $125 million for the first quarter of 2024.

On February 15, 2024, Sylvamo Corp (NYSE:SLVM), a leading uncoated papers company, released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for its broad portfolio of paper products and large-scale paper mills, operates across Europe, Latin America, and North America. In 2023, Sylvamo faced less favorable market conditions for uncoated freesheet but adapted effectively to maintain a strong financial position.

Financial Performance and Challenges

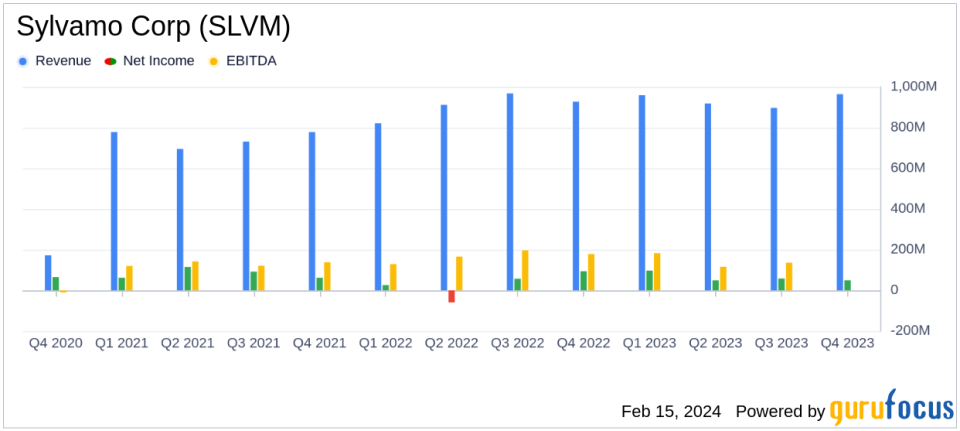

Sylvamo Corp reported a net income from continuing operations of $253 million, or $5.93 per diluted share, for the year 2023. Adjusted operating earnings stood at $278 million, or $6.51 per diluted share, with an adjusted EBITDA of $607 million, reflecting a solid 16% margin. The company generated a robust $504 million in cash from operating activities and achieved a free cash flow of $294 million.

Despite these strong results, the company faced challenges in the fourth quarter, with a decrease in net income from continuing operations to $49 million, down from $58 million in the previous quarter. Adjusted EBITDA also declined to $117 million, with a reduced margin of 12%, compared to $158 million and an 18% margin in the third quarter. These declines were attributed to a combination of factors, including price and mix decreases, increased planned maintenance outage expenses, and higher operations and other costs.

Strategic Initiatives and Shareholder Value

Chairman and CEO Jean-Michel Ribieras highlighted the company's strategic initiatives, including the acquisition of a 500,000-ton uncoated freesheet mill in Sweden, which has already generated strong cash flow. Sylvamo also launched Project Horizon, a cost reduction program aimed at saving at least $110 million by the end of 2024. The company's investment in Brazilian forestlands, valued at approximately $1 billion, provides a competitive edge and contributes to shareholder value.

In 2023, we earned $607 million in adjusted EBITDA, generated $294 million of free cash flow and returned $127 million in cash to shareowners. We are proud of the way our teams adapted when challenged by uncoated freesheet market conditions that were significantly less favorable than expected. We continued to deliver on our promises to customers and shareowners.

Financial Statements Highlights

The company's balance sheet ended the year with net debt of $730 million, which includes $950 million of gross debt and $220 million in cash on hand. Sylvamo also continued its shareholder-friendly actions by repurchasing 1,574,133 shares of common stock for approximately $70 million and declaring a first-quarter dividend of $0.30 per share.

Looking ahead to the first quarter of 2024, Sylvamo expects adjusted EBITDA to range between $105 million and $125 million. The company anticipates slight decreases in price and mix, a seasonal decrease in volume, and increased input and transportation costs. However, operations and other costs are expected to improve, and planned maintenance outage expenses are projected to decrease.

For value investors and potential GuruFocus.com members, Sylvamo Corp's ability to generate strong operating cash flow and return substantial cash to shareholders, even amidst market challenges, demonstrates the company's resilience and commitment to long-term value creation. The strategic investments and cost-saving initiatives underway are poised to further strengthen Sylvamo's financial health and competitive position in the forest products industry.

For more detailed information on Sylvamo Corp's financial performance, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Sylvamo Corp for further details.

This article first appeared on GuruFocus.