Synaptics Inc (SYNA) Posts Mixed Q2 Fiscal 2024 Results with Revenue Dip and Non-GAAP Earnings Beat

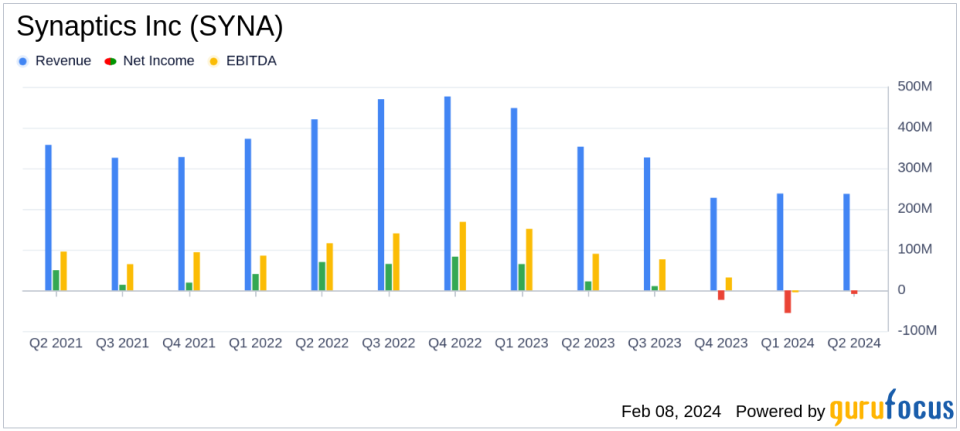

Revenue: Reported a decrease to $237.0 million in Q2 Fiscal 2024 from $353.1 million in the same quarter last year.

GAAP Gross Margin: Declined to 46.0% compared to 52.9% in Q2 Fiscal 2023.

Non-GAAP Gross Margin: Improved to 52.5%, reflecting the company's ability to manage costs effectively.

GAAP Loss Per Share: Posted a loss of $0.23 per basic share, indicating challenges in profitability.

Non-GAAP Diluted Earnings Per Share: Achieved $0.57, showcasing strength in core operations.

Cash Position: Maintained a strong cash and cash equivalents balance of $846.1 million.

Future Outlook: Anticipates a significant topline revenue increase for Core IoT products in the coming quarter.

On February 8, 2024, Synaptics Inc (NASDAQ:SYNA) released its 8-K filing, detailing the financial results for the second quarter of fiscal 2024, which ended on December 30, 2023. The company, a global leader in semiconductor solutions for various electronic devices, reported a decrease in revenue to $237.0 million, down from $353.1 million in the same period last year. The GAAP gross margin also saw a decline to 46.0%, while the non-GAAP gross margin stood at a healthier 52.5%.

Despite the revenue dip, Synaptics Inc (NASDAQ:SYNA) managed to post a non-GAAP diluted earnings per share of $0.57, which is indicative of the company's ability to control costs and maintain profitability in its core operations. The GAAP net loss was reported at $9.0 million, or $0.23 per basic share, reflecting the ongoing challenges the company faces in a competitive market.

Company's Performance and Challenges

President and CEO Michael Hurlston highlighted the stabilization of the business and the expected growth in the Core-IoT area, led by wireless products. He stated,

Our business overall has stabilized, and we have clearly hit the bottom of our cycle."

This suggests that the company has navigated through the toughest phase of its business cycle and is poised for a rebound.

However, challenges persist, as CFO Dean Butler noted the impact of inventory accumulation, declines in demand, and seasonal effects on some products. These factors contribute to the complexity of forecasting and may pose risks to the company's financial health if not managed effectively.

Financial Achievements and Industry Significance

The company's strong non-GAAP gross margin is particularly noteworthy in the semiconductor industry, where margins are closely watched as indicators of operational efficiency and pricing power. Synaptics Inc (NASDAQ:SYNA)'s ability to maintain a non-GAAP gross margin above 50% is a testament to its competitive positioning and cost management strategies.

Furthermore, the company's robust cash position, with $846.1 million in cash and cash equivalents, provides it with the financial flexibility to invest in technology roadmaps and navigate market uncertainties. This financial strength is crucial for semiconductor companies that require significant capital for research and development to stay ahead in innovation.

Financial Metrics and Importance

Key financial details from the balance sheet show that Synaptics Inc (NASDAQ:SYNA) has a healthy balance sheet with a total stockholders' equity of $1,220.3 million. The company's ability to generate strong positive cash flows, as indicated by the CFO, is critical for sustaining investments in technology and product development, which are essential for long-term growth in the semiconductor sector.

The company's outlook for the third quarter of fiscal year 2024 includes a revenue forecast of $220M to $250M and a non-GAAP gross margin projection of 52.0% to 54.0%. These figures will be closely monitored by investors as indicators of the company's ability to execute its growth strategy in the Core IoT segment.

Analysis of Company's Performance

While Synaptics Inc (NASDAQ:SYNA) faces headwinds from inventory accumulation and demand fluctuations, its strategic focus on the Core IoT segment and its solid financial footing position it for potential growth. The company's emphasis on wireless products and AI-enhanced technologies aligns with industry trends towards more connected and intelligent devices.

Investors and potential GuruFocus.com members should consider the company's resilience in maintaining non-GAAP profitability and its proactive measures to address market challenges. As the semiconductor industry continues to evolve, Synaptics Inc (NASDAQ:SYNA)'s strategic initiatives and financial discipline will be key factors in its ability to capitalize on emerging opportunities.

For a more detailed analysis and updates on Synaptics Inc (NASDAQ:SYNA)'s financial performance, visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Synaptics Inc for further details.

This article first appeared on GuruFocus.