Synchronoss Technologies Inc (SNCR) Reports Steady Earnings Amid Strategic Shift to Cloud

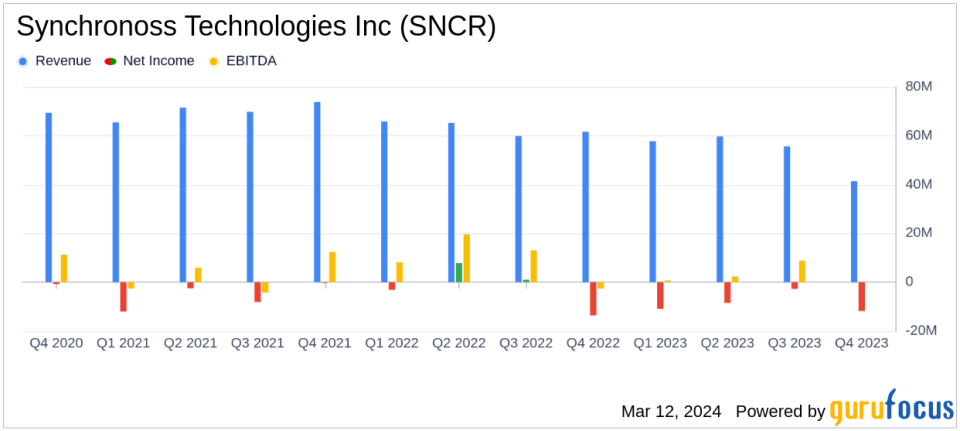

Revenue Stability: Q4 2023 total revenue maintained at $41.4 million, mirroring the prior year's performance.

Gross Profit and Margin Improvement: Gross profit rose 2.5% YOY to $26.5 million in Q4, with gross margins increasing to 63.9%.

Operational Efficiency: Income from operations turned positive at $0.2 million in Q4, a significant improvement from a $5.8 million loss YOY.

Net Loss Widening: Q4 net loss expanded to $(35.0) million, largely due to divestiture losses.

Adjusted EBITDA Growth: Q4 adjusted EBITDA surged 127% YOY to $10.0 million, reflecting cost-saving initiatives.

Cash Position Strengthened: Cash and cash equivalents grew to $24.6 million at year-end 2023, up from $17.6 million in the previous quarter.

2024 Outlook: SNCR expects GAAP revenue between $170.0 million and $175.0 million and adjusted EBITDA between $42.0 million and $45.0 million.

On March 12, 2024, Synchronoss Technologies Inc (NASDAQ:SNCR) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, a global leader in personal Cloud platforms, has completed its strategic transformation into a pure-play Cloud company, with the divestiture of its Messaging and NetworkX businesses.

Synchronoss Technologies Inc specializes in cloud- and software-based activation solutions for mobile carriers, enterprises, retailers, and original equipment manufacturers. The company's solutions are delivered through scalable and on-demand platforms, generating revenue primarily from subscriptions and transaction-based fees, with a significant portion of revenue coming from the United States.

Financial Performance and Strategic Highlights

The company's fourth-quarter revenue of $41.4 million included year-over-year Cloud growth and exceeded expectations. Synchronoss reaffirmed its 2024 guidance, reflecting confidence in its strategic direction and operational efficiency. The launch of Synchronoss Personal Cloud as Anshin Data Box with SoftBank marked a significant expansion in the Japanese market, showcasing the adaptability and global appeal of its Cloud offerings.

Following the divestiture of non-core businesses, Synchronoss Technologies Inc achieved a leaner operational structure, removing $15 million in annualized costs from the go-forward Cloud business. This restructuring is expected to result in gross margins greater than 75% and adjusted EBITDA margins surpassing 25% in 2024. The company also introduced an "AI-powered" Personal Cloud Platform, enhancing user experience and functionality.

Financial Results and Analysis

The fourth quarter saw a slight increase in gross profit to $26.5 million, up from $25.8 million in the prior year, with gross margins improving due to a higher concentration of Cloud revenue. Income from operations turned positive at $0.2 million, compared to a loss of $(5.8) million in the prior year period. However, the net loss widened to $(35.0) million, primarily due to the divestiture of Messaging and NetworkX.

Adjusted EBITDA for the quarter increased significantly to $10.0 million, up from $4.4 million in the prior year period, reflecting the impact of cost-saving initiatives. The company's cash position strengthened, with cash and cash equivalents totaling $24.6 million at the end of 2023.

For the full year 2023, total revenue decreased by 5.5% to $164.2 million, with a net loss of $(64.5) million, or $(6.62) per share. Despite the revenue decrease, adjusted EBITDA for the year increased by 13% to $31.4 million.

CFO Lou Ferraro highlighted the effectiveness of the company's strategic refocus, with improved adjusted EBITDA and margins underscoring the profitability profile of the standalone Cloud business. The company's outlook for 2024 is positive, with expectations of continued subscriber growth and enhanced cash flow generation.

Value investors may find Synchronoss Technologies Inc's transition to a pure-play Cloud company and the resulting operational efficiencies particularly compelling, as the company sets the stage for potential growth and improved profitability in the coming year.

For more detailed financial information and the full earnings report, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Synchronoss Technologies Inc for further details.

This article first appeared on GuruFocus.