Synchrony (SYF) Expands CareCredit Network With PatientNow

Synchrony Financial SYF recently announced its partnership with PatientNow to simplify processes for cosmetic practices and the medical spa industry by combining the products and technology of both companies. SYF has made its CareCredit health and wellness credit card available to 4,800 cosmetic and aesthetic businesses through PatientNow as the primary financing option.

PatientNow offers practice management solutions based on the cloud to its customers through innovative solutions that help providers manage their costs while providing quality service. This partnership with Synchrony bodes well for both companies as they will be able to enhance their offerings. Moreover, SYF, through PatientNow, will be able to venture into this new space and increase the footprint of its CareCredit card.

This move bodes well for Synchrony, as wider adoption of CareCredit is anticipated to fuel the top line in the future. With SYF’s CareCredit expansion, it is evident that the company is focused on expanding the business with attention paid to health systems. Health and Wellness purchase volume improved 10.4% in the fourth quarter of 2024 due to growing active accounts in Cosmetic, Dental and Pet. This move will also lead to increased contributions from this segment and a rise in the loan receivables portfolio, paving the way for higher interest income and fees on loans. The company expects loan receivables growth of around 6-8% in 2024.

This partnership will aid providers by reducing their administrative costs and modernizing their practice. They will also benefit from a boost in revenues due to a wider customer reach. Patients will benefit from financing options that are not heavy on their pocket. Synchrony is also including new features like its quick screen, self-service options for customers and personalized URLs, further solidifying its value proposition.

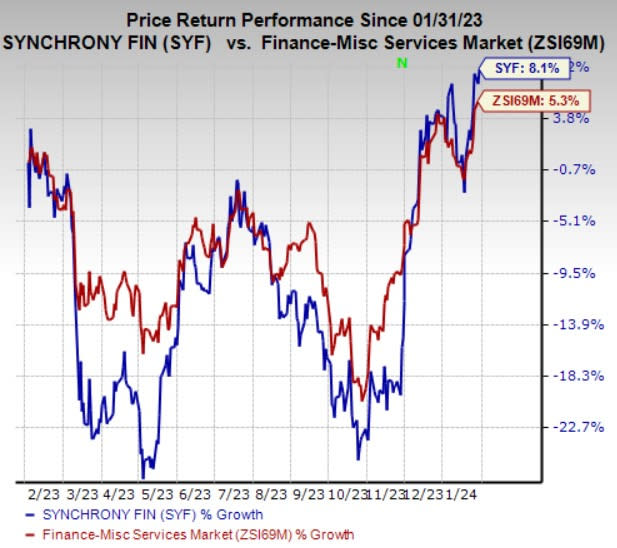

Shares of Synchrony have gained 8.1% in the past year compared with the industry’s 5.3% growth. SYF currently carries a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the Finance space are Artisan Partners Asset Management Inc. APAM, Euronet Worldwide, Inc. EEFT and Trinity Capital Inc. TRIN. Artisan Partners currently sports a Zacks Rank #1 (Strong Buy), while Euronet and Trinity Capital carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Artisan Partners outpaced estimates in each of the last four quarters, the average surprise being 22.3%. The Zacks Consensus Estimate for APAM’s 2024 earnings suggests an improvement of 6.4%, while the consensus mark for revenues suggests growth of 4.6% from the respective 2023 estimate. The consensus mark for APAM’s 2024 earnings has moved 4.8% north in the past 30 days.

Euronet’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 4.7%. The Zacks Consensus Estimate for EEFT’s 2024 earnings suggests an improvement of 12.8%, while the consensus mark for revenues suggests growth of 7.8% from the corresponding 2023 estimate. The consensus mark for EEFT’s 2024 earnings has moved 0.1% north in the past 30 days.

The bottom line of Trinity Capital outpaced estimates in two of the last four quarters, matched the mark once and missed the same in the remaining one occasion, the average surprise being 4.2%. The Zacks Consensus Estimate for TRIN’s 2024 earnings suggests an improvement of 1.1%, while the consensus mark for revenues suggests growth of 10.2% from the respective 2023 estimate. The consensus mark for TRIN’s 2024 earnings has moved 0.9% north in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

Trinity Capital Inc. (TRIN) : Free Stock Analysis Report