Synchrony (SYF) Frees Up Capital With the Sale of Pets Best

Synchrony Financial SYF recently announced that it is divesting its Pets Best subsidiary to Poodle Holdings in a combination of cash and equity deal. This sale would result in an after-tax gain on sale of $750 million. However, the deal price was kept under wraps. Following the news of the divestiture, the company’s shares jumped 5.1% on Nov 28.

SYF acquired Pets Best in 2019, and the business gained from the sudden spike in pet adoptions after the pandemic. Per a market research firm, IBISWorld, the pet insurance industry’s revenues in the United States grew 19% from 2018 to 2023, benefiting the players in the industry. Despite the sale of Pets Best, SYF is aiming to benefit from the growing market by taking an equity position in Independence Pet Holdings, an affiliate of Poodle Holdings. Synchrony will benefit from an expanded reach as it will be able to offer Care Credit to more pet owners through Independence Pet Holdings.

This sale will benefit Synchrony’s capital levels, and help it comply with regulations regarding capital adequacy for banks with assets of more than $100 billion. SYF currently has $113 billion in assets. This move will free up capital and boost SYF’s current earnings while providing a greater amount of protection for depositor’s funds. More freed-up capital implies a higher capital adequacy ratio and should result in investor confidence in the company’s prospects. SYF can also build up reserves for loan losses using this capital, resulting in the stability of its earnings.

Synchrony can also invest in other companies through attractive acquisition opportunities or return more capital to shareholders through dividends and share repurchases. Both these options will increase shareholder value in the future. This divestiture is expected to close in the first quarter of 2024, pending regulatory approvals and other closing conditions.

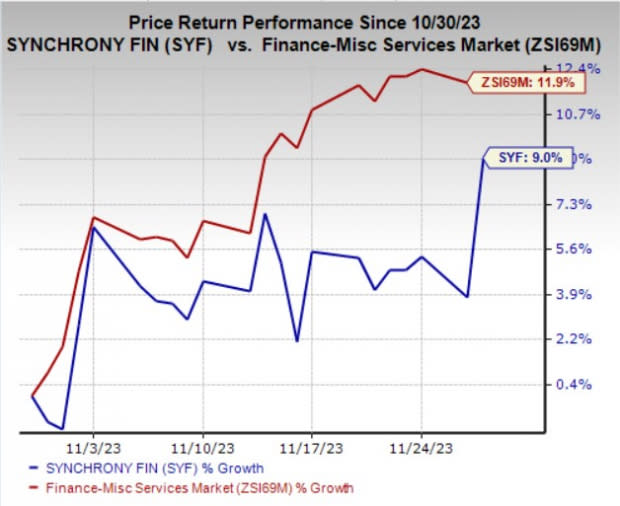

Price Performance

Shares of Synchrony have gained 9% in the past month compared with the industry’s 11.9% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Synchrony currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Finance space can consider better-ranked companies like Blue Owl Capital Corporation OBDC, StoneX Group Inc. SNEX, and Globe Life Inc. GL. While Blue Owl Capital and StoneX Group presently sport a Zacks Rank #1 (Strong Buy), Globe Life carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus mark for Blue Owl Capital’s current-year earnings per share (EPS) is pegged at $1.91, indicating 35.5% year-over-year growth. Furthermore, the consensus estimate for OBDC’s revenues in 2023 suggests 30.4% year-over-year growth. It beat earnings estimates in each of the past four quarters, with an average surprise of 3.4%.

The Zacks Consensus Estimate for StoneX’s current-year revenues indicates 19% growth from the prior-year period. It beat earnings estimates thrice in the past four quarters and missed once, with an average surprise of 14.4%.

The Zacks Consensus Estimate for Globe Life’s current-year EPS is pegged at $10.60, which indicates 30.1% year-over-year growth. It has witnessed two upward estimate revisions against none in the opposite direction in the past month. It beat earnings estimates in each of the past four quarters, with an average surprise of 2.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synchrony Financial (SYF) : Free Stock Analysis Report

Globe Life Inc. (GL) : Free Stock Analysis Report

StoneX Group Inc. (SNEX) : Free Stock Analysis Report

Blue Owl Capital Corporation (OBDC) : Free Stock Analysis Report