Synchrony (SYF) & HABRI Join Forces to Boost Human-Animal Bond

Synchrony Financial SYF created a strategic alliance with The Human Animal Bond Research Institute (“HABRI”), a not-for-profit organization, to enhance the human-animal bond. The partnership is in line with SYF’s focus on the well-being of individuals and their families, extending to the health of their pets.

Synchrony's dedication to overall health and wellbeing, including pet health, demonstrated through initiatives like CareCredit and Pets Best, aligns with HABRI's research and education initiatives. It promotes awareness of the beneficial influence of companion animals on overall well-being.

The consumer financial services company is expected to aid HABRI by funding its research. It is expected to promote HABRI's science-based education within CareCredit's extensive veterinary network, reaching 95% of veterinary university hospitals, along with around 75% of veterinary hospitals in the country.

Synchrony is also expected to support HABRI's mission by engaging in public policy initiatives and advocating for legislation that aids pet owners and boosts pet care access. The partnership is expected to benefit SYF by leveraging its position in the health and pet care industry, promoting its financial solutions and expanding its customer base.

Moves like this help the company to enhance its Health & Wellness platform. Average active accounts in the platform rose 10.2% year over year in 2022. This year, our model suggests the metric to further increase by 12%. We expect purchase volume and period-end loan receivables to rise more than 16% and nearly 21%, respectively, in 2023.

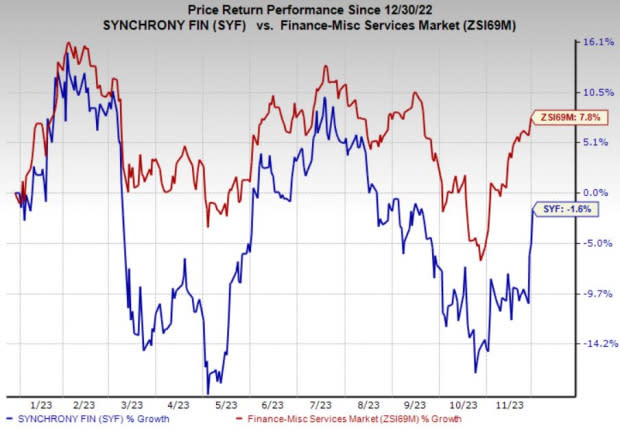

Price Performances

Shares of Synchrony have declined 1.6% in the year-to-date period against the industry’s 7.8% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Synchrony currently has a Zacks Rank #3 (Hold).

Investors interested in the broader Finance space can consider some better-ranked companies like Blue Owl Capital Corporation OBDC, StoneX Group Inc. SNEX and Globe Life Inc. GL. While Blue Owl Capital and StoneX currently sport a Zacks Rank #1 (Strong Buy) each, Globe Life carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus mark for Blue Owl Capital’s current year earnings is pegged at $1.91 per share, indicating 35.5% year-over-year growth. Furthermore, the consensus estimate for OBDC’s revenues in 2023 suggests 30.4% year-over-year growth.

The Zacks Consensus Estimate for StoneX’s current year earnings has improved 1.4% over the past month. It beat earnings estimates thrice in the past four quarters and missed once, with an average surprise of 14.4%. Also, the consensus mark for SNEX’s revenues in the current year suggests 19% year-over-year growth.

The Zacks Consensus Estimate for Globe Life’s current year earnings is pegged at $10.60 per share, which indicates 30.1% year-over-year growth. It has witnessed six upward estimate revisions against none in the opposite direction in the past 60 days. It beat earnings estimates in all the past four quarters, with an average surprise of 2.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synchrony Financial (SYF) : Free Stock Analysis Report

Globe Life Inc. (GL) : Free Stock Analysis Report

StoneX Group Inc. (SNEX) : Free Stock Analysis Report

Blue Owl Capital Corporation (OBDC) : Free Stock Analysis Report