Synchrony (SYF) Strengthens Ties to Offer Improved Health Care

Synchrony Financial SYF recently expanded its multi-year partnership with the leading California-based high-quality, personally fitted arch support manufacturer and retailer, The Good Feet Store. As a result of the renewal, SYF’s CareCredit health and wellness credit card can be availed as a payment option across the 250-plus retail outlets of The Good Feet Store.

Customers will get access to varied and flexible financing options while purchasing products related to dental care, sleep care and personalized arch support from The Good Feet Stores. The availability of a suitable financing solution that removes the need to make lumpsum payments and does not exert pressure on one’s finances is expected to boost the purchasing power of consumers and bring about improved health outcomes for them.

While current CareCredit cardholders can already engage in purchases at The Good Feet Store locations, the procedure to apply for a new card also seems hassle-free in nature. Consumers can apply for it either at The Good Feet Store locations or through any smart device and a quick inspection will commence to determine one’s pre-eligibility for the CareCredit credit card. A swift credit decision follows and once approved, individuals can instantly use their account for making product purchases.

The recent announcement is expected to further solidify the longstanding partnership between Synchrony and The Good Feet Store since 2009. Both companies continue to reap the benefits of their alliance and in the year 2023, the tie-up with The Good Feet Store accounted for 35% growth in SYF’s overall transaction volume. At the same time, The Good Feet Store earned 30% of its sales from existing CareCredit cardholders.

The renewed deal is likely to drive the performance of the Health & Wellness sales platform of Synchrony, of which the CareCredit brand is a part. The brand boasts a retail finance and wellness experience of more than 35 years, which may have prompted The Good Feet Store to undergo the partnership renewal with SYF. Health & Wellness accounted for 16% of SYF's total interest and fees on loans during the first nine months ended Sep 30, 2023. In the same time frame, the partner network of the platform expanded with new additions of AmeriVet Veterinary Partners, Hand & Stone and Marquee Dental Partners as well as renewed agreements with the American Dental Association, Academy of General Dentistry and The Aspen Group.

Synchrony’s financing options have an extensive reach across varied industries. A day before the latest partnership expansion was announced, in a bid to delve deeper into the pet industry, SYF teamed up with Destination Pet to offer CareCredit card as the financing solution across the US locations of the veterinary care and pet services provider. An active pursuit of acquisitions and renewal of alliances with national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers widen credit accessibility for consumers, enhance the portfolio of SYF, bring new clients, retain existing ones and generate increased repeat sales.

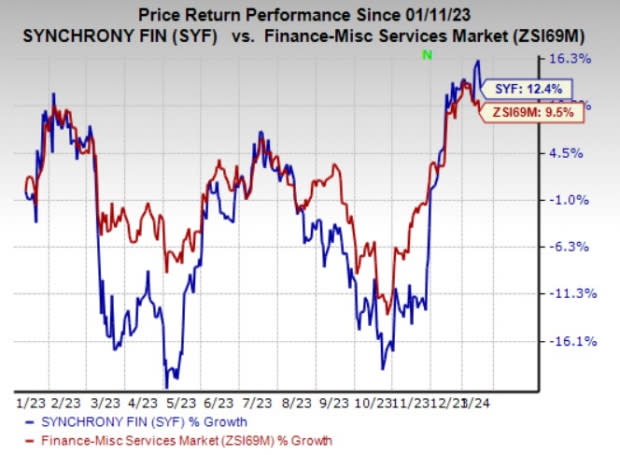

Shares of Synchrony have gained 12.4% in the past year compared with the industry’s 9.5% growth. SYF currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Finance space are Equity Bancshares, Inc. EQBK, American Express Company AXP and MFA Financial, Inc. MFA. While Equity Bancshares currently sports a Zacks Rank #1 (Strong Buy), American Express and MFA Financial carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Equity Bancshares outpaced estimates in three of the last four quarters and missed the mark once, the average surprise being 2.86%. The Zacks Consensus Estimate for EQBK’s 2024 earnings suggests an improvement of 21.2% while the consensus mark for revenues suggests a 53.1% surge from the respective 2023 estimate. The consensus mark for EQBK’s 2024 earnings has moved 1.9% north in the past 30 days.

American Express’ earnings outpaced estimates in two of the trailing four quarters and missed the mark twice, the average surprise being 0.14%. The Zacks Consensus Estimate for AXP’s 2024 earnings suggests an improvement of 10.7% while the consensus mark for revenues suggests growth of 9.4% from the corresponding 2023 estimate. The consensus mark for AXP’s 2024 earnings has moved 0.2% north in the past 30 days.

The bottom line of MFA Financial outpaced estimates in three of the last four quarters and missed the mark once, the average surprise being 13.08%. The Zacks Consensus Estimate for MFA’s 2024 earnings suggests an improvement of 5.7%, while the same for revenues suggests a 10.2% rise from the respective 2023 estimate. The consensus mark for MFA’s 2024 earnings has moved 0.6% north in the past 60 days.

Shares of Equity Bancshares, American Express and MFA Financial have gained 0.8%, 19.4% and 5.3%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP) : Free Stock Analysis Report

MFA Financial, Inc. (MFA) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

Equity Bancshares, Inc. (EQBK) : Free Stock Analysis Report