Synopsys' (SNPS) Q4 Earnings Beat Estimates, Revenues Meet

Synopsys’ SNPS fourth-quarter fiscal 2021 non-GAAP earnings of $1.82 per share beat the Zacks Consensus Estimate of $1.78 and improved 15.2% year over year.

Further, revenues surged 12.4% year over year to $1.15 billion, driven by growth across its business segments. Quarterly revenues met the Zacks Consensus Estimate.

Synopsys benefited from the increasing demand for its products amid the rapid adoption of Big Data, faster computation and Machine Learning. Also, complex, connected, specialized, and secure chips and systems are gaining strong momentum, driving Synopsys’ business.

Moreover, the robust adoption of SNPS’ Verification Continuum Platform and Fusion Compiler product within the Fusion Design Platform was a major growth driver during the fourth quarter.

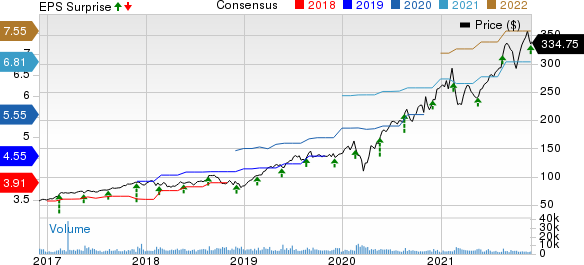

Synopsys, Inc. Price, Consensus and EPS Surprise

Synopsys, Inc. price-consensus-eps-surprise-chart | Synopsys, Inc. Quote

Quarter in Detail

In the license-type revenue group, Time-Based Product revenues (60% of total revenues) of $688.1 million were up 13.4% year over year. Upfront Product revenues (24%) improved 12.3% to $274.3 million. Maintenance and Service revenues (16%) increased 8.8% year over year to $190 million from the year-ago quarter’s $174.7 million.

Segment-wise, Semiconductor & System Design revenues (91% of total revenues) were $1.04 billion, up 11.5% year over year. Within the segment, EDA (Electronic Design Automation) revenues (56% of revenues) were $617.2 million and IP & Systems Integration revenues (36% of revenues) came in at $420.6 million.

Software Integrity revenues totaled $110 million, contributing approximately 9% to the top line in the reported quarter.

Geographically, Synopsys’ revenues in North America (47% of the total) were $545.3 million and $116.3 million in Europe (10%). Revenues from Korea (10%), China (14%) and Other (19%) came in at $113.7 million, $157.3 million and $220 million, respectively.

Non-GAAP operating margin was 29.5%, expanding 30 basis points (bps) year over year. Semiconductor & System Design delivered an adjusted operating margin of 31.3%, shrinking 10 bps year over year, while Software Integrity margin expanded 530 bps year over year to 12.1%.

Balance Sheet & Cash Flow

Synopsys had cash and short-term investments of $1.58 billion as of Oct 31, 2021, compared with $1.53 billion as of Jul 31, 2021.

Total long-term debt came in at $25.1 million in the reported quarter, up from $24.8 million as of Jul 31.

Operating cash flow in the fourth quarter was $371 million. During fiscal 2021, Synopsys generated operating cash flow of $1.49 billion.

Guidance

For the first quarter of fiscal 2022, Synopsys expects revenues between $1.25 billion and $1.28 billion. Management estimates non-GAAP earnings between $2.35 and $2.40 per share. Non-GAAP expenses are anticipated in the band of $802-$812 million.

For fiscal 2022, management projects revenues of $4.19-$4.22 billion. Non-GAAP earnings for the fiscal year are expected between $7.73 and $7.80 per share. Non-GAAP expenses are projected in the range of $3.225-$3.255 billion. Also, Synopsys forecasts operating cash flow of $1.4-$1.5 billion.

Further, management anticipates strong demand for SNPS’ advanced solutions and cloud computing services along with the growing customer acceptance for its new capabilities to drive growth for its robust product portfolio.

Zacks Rank & Key Picks

Currently, Synopsys carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology sector include Google-parent Alphabet GOOGL, Diodes DIOD and PTC Inc. PTC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alphabet’s fourth-quarter 2021 earnings has been revised downward by a penny to $26.71 per share over the past seven days. For 2021, earnings estimates have moved upward by 43 cents to $108.29 per share in the last seven days.

Alphabet’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 41.5%. The GOOGL stock has rallied 61.2% in the year-to-date (YTD) period.

The Zacks Consensus Estimate for Diodes’ fourth-quarter 2021 earnings has been revised upward by 23.9% to $1.45 per share over the past 30 days. For 2021, earnings estimates have moved upward by 6.3% to $5.06 per share over the last 30 days.

Diodes’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 10%. Shares of DIOD have rallied 51.7% YTD.

The consensus mark for PTC Inc.’s first-quarter fiscal 2022 earnings has been raised to $1.00 per share from 90 cents 30 days ago. For fiscal 2022, earnings estimates have been revised upward by 28 cents to $4.19 per share in the last 30 days.

PTC Inc.’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, the average surprise being 47.8%. Shares of PTC have declined 9% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Diodes Incorporated (DIOD) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

PTC Inc. (PTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.