Sysco's (SYY) Q4 Earnings Beat Estimates, Sales Advance Y/Y

Sysco Corporation SYY posted fourth-quarter fiscal 2023 results, with the top and the bottom line increasing year over year and the latter beating the Zacks Consensus Estimate. The company saw impressive sales, continued market share gains and volume gains. Management has made notable progress in the Recipe for Growth plan and cost management.

Quarter in Detail

Sysco’s adjusted earnings of $1.34 per share surpassed the Zacks Consensus Estimate of $1.33. The bottom line rose 16.5% from the year-ago period figure.

The global food product maker and distributor reported sales of $19,728.2 million, which jumped 4.1% year over year but missed the Zacks Consensus Estimate of $19,853 million. Foreign currency had an adverse impact of 0.2% on the top line.

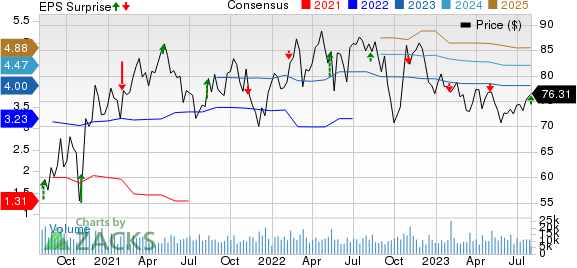

Sysco Corporation Price, Consensus and EPS Surprise

Sysco Corporation price-consensus-eps-surprise-chart | Sysco Corporation Quote

The gross profit jumped 7% to $3,685.2 million, and the gross margin expanded 51 basis points (bps) to 18.7%. This year-over-year growth in the gross profit was mainly driven by elevated volumes, efficient product cost inflation management and progress in the company’s partnership growth management efforts.

SYY witnessed product cost inflation of 2.1%, measured by the estimated change in product costs, mainly in the frozen and canned and dry categories.

Operating expenses rose 1.4% year over year due to cost inflation and increased volumes. These were somewhat offset by greater productivity.

The operating income of $969.4 million grew 26.5% from the year-ago period.

Segment Details

U.S. Foodservice Operations: In the reported quarter, the segment witnessed robust sales, overall share gains and higher profitability. Sales jumped 2.5% to $13,745.8 million. Local case volume within U.S. Foodservice inched up 0.8%, while total case volume within U.S. Foodservice increased 2.3%.

International Foodservice Operations: The segment’s sales advanced 12.2% to $3,649.3 million in the quarter. However, foreign exchange fluctuations affected the segment’s sales by 1.4%. On a constant-currency (cc) basis, sales advanced 13.6%.

SYGMA’s sales inched up 1.4% to $2,004.1 million.

Meanwhile, the Other segment’s sales rose 3.9% to almost $329 million.

Image Source: Zacks Investment Research

Other Updates

Sysco ended the quarter with cash and cash equivalents of $745.2 million, long-term debt of almost $10,348 million and total shareholders’ equity of $2,008.6 million. For the year ended Jul 1, 2023, the company generated cash flow from operations of $2,867.6 million, and free cash flow amounted to $2,116.4 million.

During fiscal 2023, Sysco returned $1.5 billion to shareholders through share buybacks worth $500.1 million and dividends of $996 million.

Shares of this Zacks Rank #3 (Hold) company have gained 0.7% in the past three months against the industry’s decline of 3.4%.

Some Better-Ranked Staple Bets

Here, we have highlighted three better-ranked stocks, namely TreeHouse Foods, Inc. THS, Celsius Holdings CELH and McCormick & Company, Incorporated MKC.

TreeHouse Foods, a manufacturer of packaged foods and beverages, currently sports a Zacks Rank #1 (Strong Buy). THS has a trailing four-quarter earnings surprise of 49.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TreeHouse Foods’ current financial year’s sales suggests a decline of 12.4% from the year-ago reported numbers.

Celsius Holdings, which offers functional drinks and liquid supplements, carries a Zacks Rank #2 (Buy) at present. CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal year’s sales and earnings implies surges of 69.6% and 154.4%, respectively, from the prior-year numbers.

McCormick, a manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors, currently carries a Zacks Rank #2. MKC has a trailing four-quarter earnings surprise of 4.2%, on average.

The Zacks Consensus Estimate for McCormick’s current fiscal-year sales and earnings suggests growth of 6.4% and 5.1%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report