System1 Inc (SST) Surpasses Guidance with Revenue and Adjusted EBITDA Growth in Q4

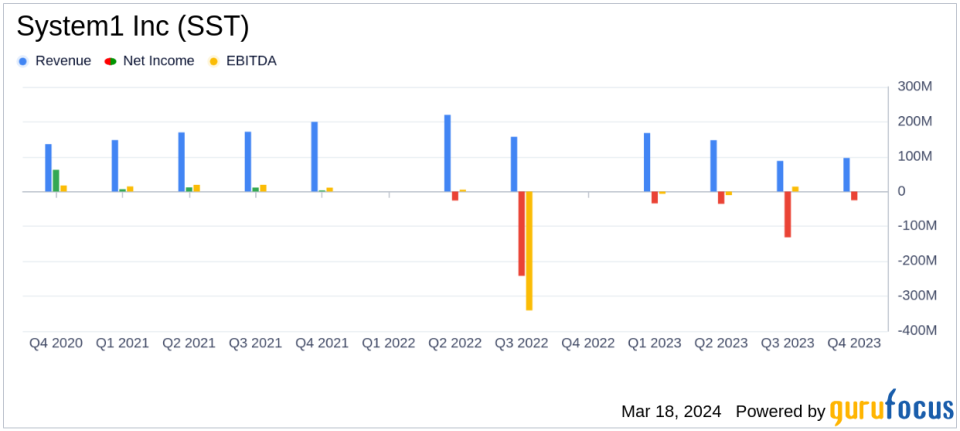

Quarterly Revenue: Increased by 9% over the previous quarter to $96.1 million.

Gross Profit: Slight increase of 1% over the previous quarter to $25 million.

Adjusted EBITDA: Significant increase of 24% over the previous quarter to $10 million.

Annual Revenue: System1 Inc reported a total revenue of $402.0 million for the fiscal year 2023.

Net Loss: GAAP Net Loss decreased by 2% over the previous quarter to $25 million, with an annual net loss of $111.3 million.

Strategic Moves: Sale of Total Security business and a successful debt repurchase strategy.

On March 18, 2024, System1 Inc (NYSE:SST) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, which operates a responsive acquisition marketing platform, reported key financial results that exceeded the high-end of its guidance range, despite a challenging online advertising environment.

System1 Inc's technology and data science expertise serve various customer segments, including health and wellness, automotive, personal finance, travel, and entertainment. The company's revenue streams are primarily derived from its Owned and Operated Advertising (O&O) segment, with significant contributions from its Partner Network and Subscription services.

Financial Performance and Strategic Highlights

System1 Inc's fourth-quarter revenue saw a 9% increase over the prior quarter, reaching $96.1 million. The company's gross profit also rose slightly by 1% to $25 million, while adjusted gross profit, a non-GAAP metric, increased to $37.5 million. Notably, the adjusted EBITDA experienced a robust 24% increase over the previous quarter, amounting to $10 million.

For the full year, System1 Inc reported a revenue of $402.0 million and a gross profit of $103.4 million. The adjusted gross profit for the year stood at $153.3 million. However, the company faced a GAAP net loss of $111.3 million for the year. Despite these challenges, System1 Inc's strategic decisions, including the divestiture of its anti-virus subscription business Total Security and a modified Dutch auction to repurchase term debt, have positioned the company for a more streamlined cost structure and improved liquidity.

Operational and Market Challenges

The online advertising landscape continues to pose challenges for System1 Inc, as indicated by the company's net loss figures. However, the management remains optimistic about the future, citing macro tailwinds such as increased advertiser demand and the forthcoming deprecation of third-party cookies in Chrome. The integration of AI within their RAMP platform and a resurgence in the Partner Network business are expected to drive growth in the coming years.

"We are pleased to report results for Q4 that exceeded our guidance for Revenue, Adjusted Gross Profit and Adjusted EBITDA, despite what continued to be a challenging online advertising environment," said Michael Blend, System1s Co-Founder & Chief Executive Officer.

"With the sale of our Total Security consumer subscription business last quarter, we enter 2024 with a streamlined cost structure, a capital-efficient advertising business and substantial liquidity available on our balance sheet," added Tridivesh Kidambi, Chief Financial Officer of System1.

Looking Ahead

System1 Inc has provided guidance for the first quarter of 2024, expecting revenue between $82 million and $84 million, with an adjusted EBITDA between $(2) million and $(1) million. These projections reflect the company's strategic initiatives and ongoing efforts to optimize its operations in a dynamic market.

Investors and stakeholders are encouraged to review the detailed financial statements and reconciliations provided by System1 Inc, which offer a comprehensive view of the company's financial health and operational performance.

For more in-depth analysis and updates on System1 Inc (NYSE:SST) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from System1 Inc for further details.

This article first appeared on GuruFocus.