S&T Bancorp Inc (STBA) Reports Record Earnings for Full Year 2023

Net Income: Increased 6.83% to a record $144.8 million for 2023.

Earnings Per Share (EPS): Grew 8.09% to a record $3.74 for 2023.

Net Interest Margin (NIM): Remained solid at 3.92% for Q4 and 4.13% for the full year.

Loan Portfolio: Total portfolio loans rose by $469.4 million, or 6.53%, year-over-year.

Deposits: Total deposits increased by $298.9 million in Q4, with significant growth in customer and brokered deposits.

Asset Quality: Nonperforming assets remained low at 0.30% of total loans plus OREO.

Dividend: Declared a $0.33 per share cash dividend, marking a 3.13% increase from the previous year.

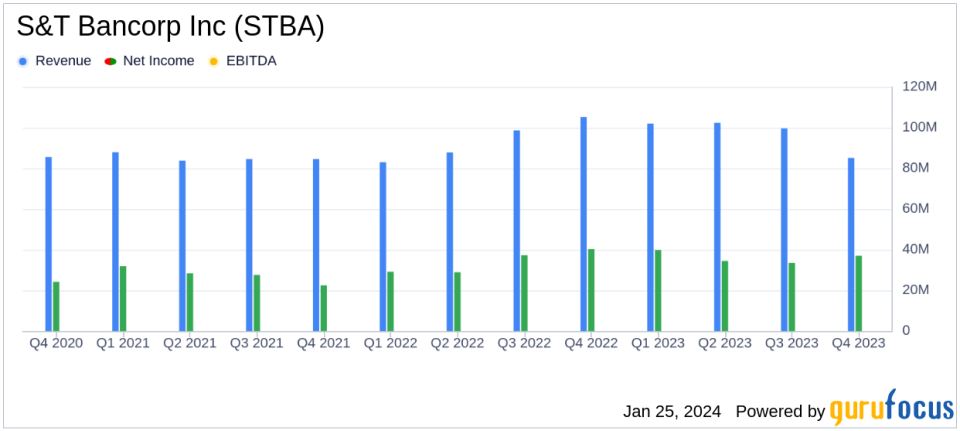

S&T Bancorp Inc (NASDAQ:STBA), a prominent bank holding company, announced its fourth quarter and full year 2023 earnings on January 25, 2024. The company, which operates in five markets and offers a range of financial services, reported a net income of $37.0 million, or $0.96 per diluted share, for the fourth quarter of 2023. This performance reflects an increase from the net income of $33.5 million, or $0.87 per diluted share, for the third quarter of 2023, and a slight decrease from $40.3 million, or $1.03 per diluted share, for the fourth quarter of 2022. The full year 2023 net income reached a record $144.8 million, up 6.83% from the previous year, with EPS also hitting a record high of $3.74, an 8.09% increase. The details of the earnings can be found in the company's 8-K filing.

Financial Performance and Challenges

The bank's strong return metrics were highlighted by a return on average assets (ROA) of 1.55%, return on average equity (ROE) of 11.79%, and return on average tangible equity (ROTE) of 17.00% for the fourth quarter. While the net interest margin (NIM) slightly decreased to 3.92% from 4.09% in the previous quarter, it remained robust. The bank also experienced a healthy annualized growth in total portfolio loans of 7.25% and an increase in total deposits, driven by both customer deposits and brokered deposits.

Despite these strong results, the bank faced challenges in the form of increased funding costs, which led to a decrease in net interest income for the fourth quarter. Additionally, the bank's provision for credit losses saw a decrease, primarily due to an improvement in loan risk ratings. However, net charge-offs remained relatively stable, indicating a strong asset quality.

Income Statement and Balance Sheet Highlights

For the full year, S&T Bancorp Inc (NASDAQ:STBA) reported a 10.65% increase in net interest income, amounting to $33.6 million compared to 2022. The bank's total portfolio loans grew by $469.4 million, or 6.53%, compared to the end of the previous year. Nonperforming assets remained low, and the bank maintained a stable allowance for credit losses at 1.41% of total portfolio loans.

Noninterest income for the fourth quarter increased by $5.9 million to $18.1 million, mainly due to higher other income from gains on OREO and valuation adjustments. Noninterest expense also increased, primarily due to higher salaries and employee benefits. The bank's efficiency ratio for 2023 improved to 51.35% from 52.34% in 2022, reflecting higher revenue and controlled expenses.

"It was a great year for S&T with record net income and earnings per share for the second year in a row," said Chris McComish, chief executive officer. "Our highly engaged teams that go above and beyond every day to provide an award-winning customer experience are fundamental to our success. For the quarter, I am pleased that we achieved balanced loan and deposit growth, while delivering excellent returns and efficiency. Our people-forward purpose positions us well for continued growth."

Looking Ahead

With a strong financial foundation and a commitment to customer service, S&T Bancorp Inc (NASDAQ:STBA) is well-positioned for future growth. The bank's solid performance in 2023, despite some economic headwinds, demonstrates its resilience and strategic focus. Investors and stakeholders can look forward to continued progress as the bank builds on its record earnings and maintains its reputation for excellence in the banking industry.

For more detailed information and analysis on S&T Bancorp Inc (NASDAQ:STBA)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from S&T Bancorp Inc for further details.

This article first appeared on GuruFocus.