Taconic Capital Advisors LP Reduces Stake in Infint Acquisition Corp

On August 22, 2023, Taconic Capital Advisors LP, a New York-based hedge fund sponsor, reduced its stake in Infint Acquisition Corp (NYSE:IFIN), a blank check company. This article aims to provide a comprehensive analysis of this transaction, its implications for value investors, and an overview of both the guru and the traded company.

Details of the Transaction

Taconic Capital Advisors LP reduced its stake in Infint Acquisition Corp by 40.67%, selling 305,000 shares at a price of $11.01 per share. This transaction had a -0.19% impact on the guru's portfolio, leaving them with a total of 445,000 shares in the company. The remaining stake in Infint Acquisition Corp now represents 0.27% of Taconic Capital Advisors LP's portfolio and 2.89% of the company's total shares.

Profile of Taconic Capital Advisors LP

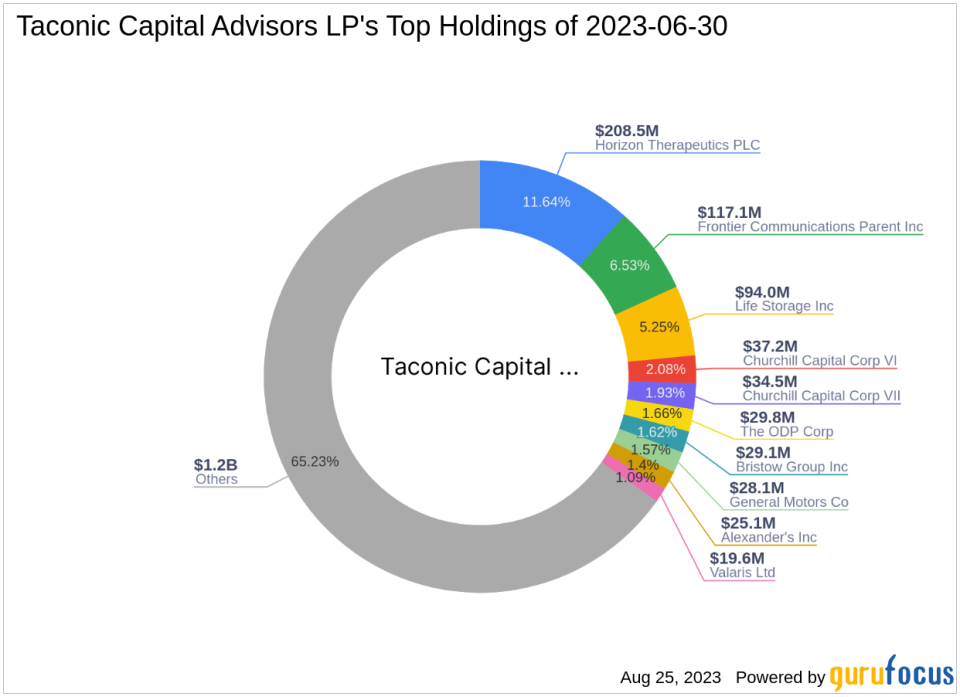

Taconic Capital Advisors LP was established in 1999 by Frank Peter Brosens and Christopher Lord Delong, both former Goldman Sachs Partners. The firm follows a disciplined, replicable investment process that aims to identify investment opportunities with three distinct elements: inefficiencies, catalysts, and a margin of safety. Taconic Capital Advisors invests in the public equity and fixed income markets on a global scale, with a particular focus on the consumer discretionary sector. The firm's top holdings include Horizon Therapeutics PLC(NASDAQ:HZNP), Life Storage Inc(LSI), Churchill Capital Corp VII(NYSE:CVII), Churchill Capital Corp VI(NYSE:CCVI), and Frontier Communications Parent Inc(NASDAQ:FYBR). As of the most recent quarter, Taconic Capital Advisors oversees over $1.79 billion in total assets under management.

Overview of Infint Acquisition Corp

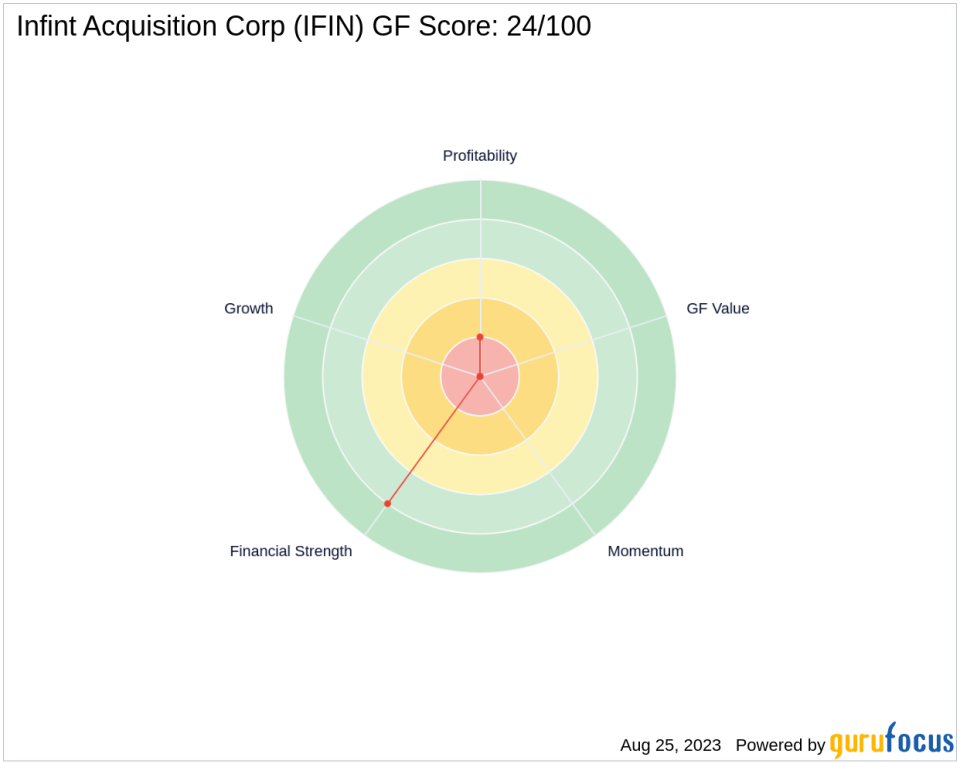

Infint Acquisition Corp (NYSE:IFIN) is a US-based blank check company. The company has a market capitalization of $169.438 million and its stock is currently priced at $10.99. The company's financial performance is characterized by a PE percentage of 70.00. However, due to insufficient data, the GF Valuation and GF Value Rank cannot be evaluated. The company's financial health is reflected in its Financial Strength rank of 8/10, Profitability Rank of 2/10, and Growth Rank of 0/10. The company's GF Score is 24/100, indicating poor future performance potential.

Analysis of the Transaction's Impact on Infint Acquisition Corp

The reduction of Taconic Capital Advisors LP's stake in Infint Acquisition Corp may have a significant impact on the company's stock price and financial performance. The transaction may also influence the company's future prospects and potential investment opportunities for value investors.

Implications for Value Investors

Understanding guru transactions and their impact on the market is crucial for value investors. This transaction, in particular, may present potential investment opportunities and risks that value investors should consider. It is important to note that all data and rankings are accurate as of August 25, 2023.

Conclusion

In conclusion, Taconic Capital Advisors LP's recent transaction involving Infint Acquisition Corp provides valuable insights into the guru's investment strategy and the traded company's financial performance. This analysis underscores the importance of understanding guru transactions in the context of value investing.

This article first appeared on GuruFocus.