Taking a Closer Look at Visa's Digital Mastery

Visa Inc. (NYSE:V) would always outperform in an environment of low interest rates and improved consumer spending power.

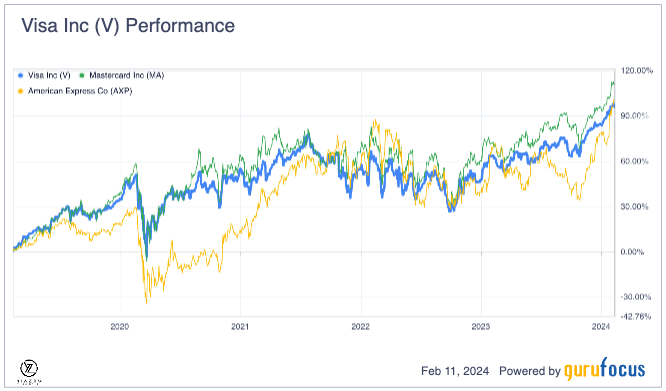

The payment company's stock gained 40% in 2023, compared to the 24% gain of the S&P 500. Consequently, it emerged as a preferred stock for gaining exposure in electronic payments.

Shares of the credit services giant have risen steadily over the past two years on the back of a resilient economy that has avoided a recession. Its sentiment has also received a significant boost in consumer spending.

The payment technology company remains well-positioned to continue its upward trajectory, supported by a profitable business model, competitive positioning within the industry and an iconic brand.

A beacon of growth in the digital payment revolution

The company boasts a dominant position in a growing market projected to grow by double digits until 2032, amid the digital revolution and the adoption of digital payments. It, therefore, does not come as a surprise that Visa performs in line with large-cap growth stocks. For instance, it has delivered returns of around 101% to shareholders over the past five years.

Investors remain optimistic about Visa's long-term prospects, especially with the growing talk that the U.S. central bank will cut interest rates, which will positively impact consumer spending power.

While the stock is trading at all-time highs, there are a string of factors or catalysts poised to support the upward trajectory. An improved monetary policy environment and solid financial results supplemented by competitive advantage and strategic partnerships should continue to strengthen Visa's sentiments among investors eyeing opportunities in the electronic payment sector.

Stellar financial results

Visa's core business has been growing at an impressive rate with no disturbance amid a deteriorating macroeconomic environment. The U.S. central bank's hike in interest rates to lower inflation was expected to take a significant toll on the economy and the company's core payment business.

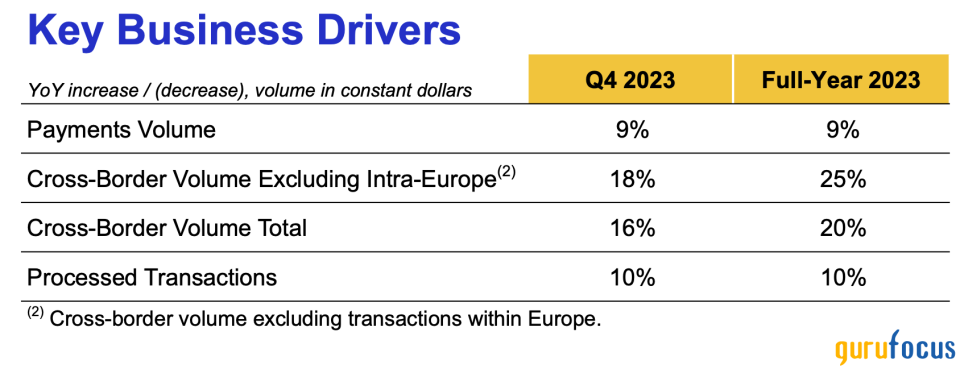

However, the economy has remained resilient amid the high-interest rate environment, allowing the company to generate significant returns from its payment business. For the nine months ending September, the company's sales were up 11%, driven by a 9% increase in total payment volume.

Source: Visa

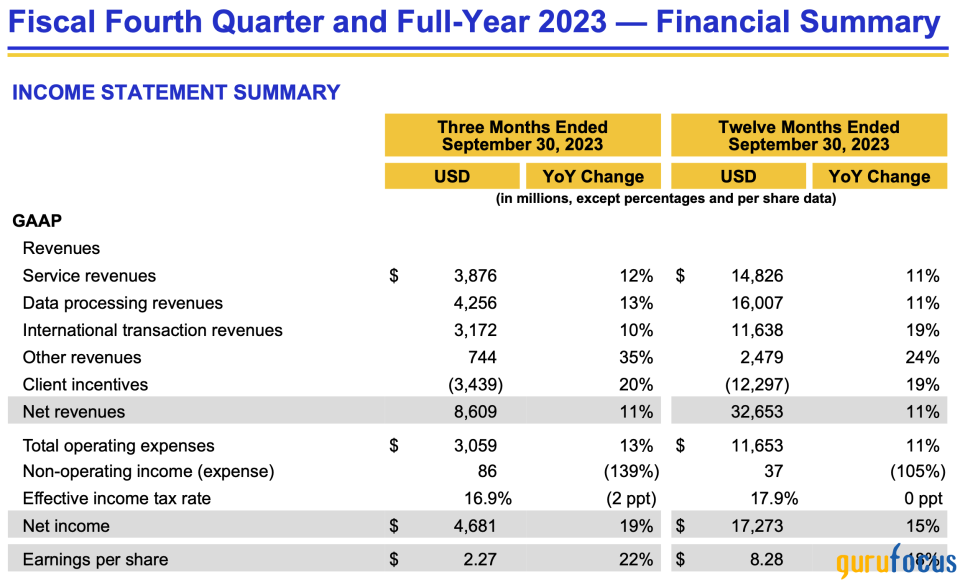

Sales for the three months ended Dec. 31 were up 9% to $8.6 billion, driven by relatively stable growth in overall payment volume and processed transactions. Visa also benefited from strong growth in cross-border volume as consumer spending remained resilient.

GAAP net income for the fiscal first quarter was up 17% to $4.9 billion, or 2.39% per share, up 20% year over year. The increase came as the payment volume on which service revenue is recognized grew by 8%. Also, total processed transactions were 57.5 billion, a 9% increase over the prior year.

The increase in total volume and sales can be attributed to improved cross-border activity with the opening of the global economy following the Covid-19 pandemic. Surprisingly, Visa's annual revenue over the past decade has grown at an average of 13% annually.

Its service revenues from services provided to support client usage of payment services, which account for 34% of its total revenue, grew 11% in fiscal 2023. Similarly, data processing revenues, including sales generated from clearing, settlement and authorization network access, also grew over the same period. International transaction revenues from cross-border transactions that the company handles grew 19%.

Source: Visa

Since 2012, Visa's net income has increased by over 300% despite capital expenditures increasing 179%, affirming its solid profit margins. A 422% net free cash flow increase explains how the company has successfully returned value to shareholders through buybacks and dividends, with its five-year dividend growth rate standing at 15.70%.

Visa continues to exceed expectations despite concerns of an imminent economic slowdown and the rising cost of living. Profitability margins are improving net income, increasing 15% to $17.3 billion, translating to a 53% profit margin in 2023.

Expectations are high that Visa will post modest revenue growth, from high single digits to low teens on average, over the years. While it is a reasonable assumption, it is pretty conservative given the global digital payment infrastructure landscape is still growing.

Cashless transactions are becoming increasingly popular as part of the global digital revolution. As digital payments become the norm, Visa should see an uptick in its network volume, leading to more revenue.

According to Worldpay, some 1.4 billion of the 6 billion adults worldwide do not have a bank account. The massive disparity translates to plenty of room for more digital payment expansion that Visa can tap into. Therefore, steady investments in digital payment technology backed by data security services should allow Visa to deliver the steady growth numbers that investors have come to expect.

Key growth areas

Visa has always stood out in the highly competitive payment solution segment owing to its ability to attract and retain customers. Revenue has continued to grow due to the company's successful client acquisition, strategies and renewal of existing partnerships.

China has become one of the critical markets for payment technology companies as its payments grow at a compound annual rate of 8.39%. Consumer spending on Visa cards in the country has been resilient and continues to gather steam.

In addition, the massive growth of the Chinese e-commerce sector has also translated into booming business for Visa. The rapid growth as part of the digital payment revolution has allowed the company to increase its market share in the country and, in return, boost its revenues.

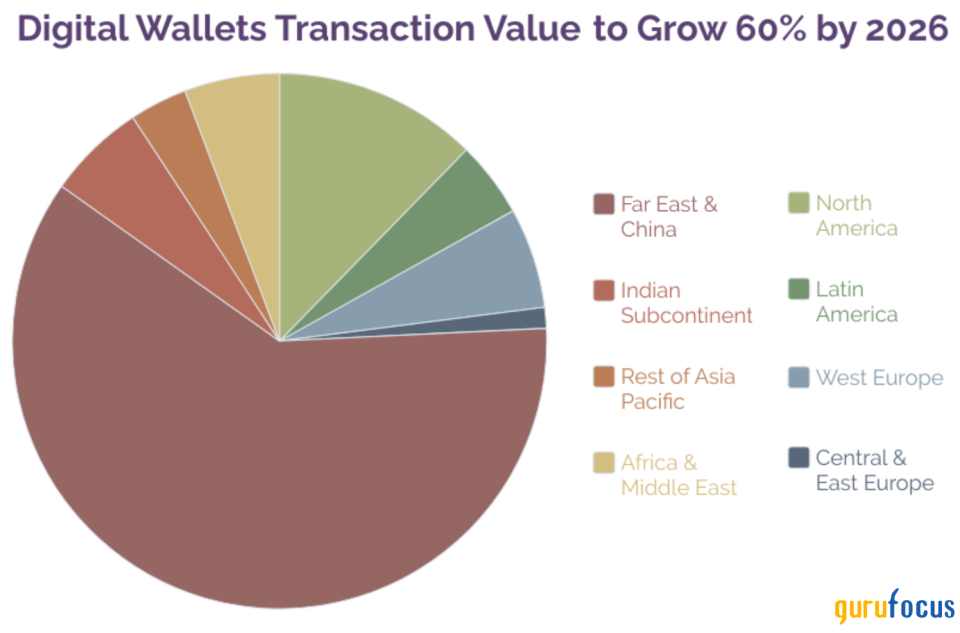

China is not the only frontier that affirms Visa growth metrics and long-term prospects. As the world evolves into a cashless society, exponential growth in mobile payments has helped support its growth rate. The global mobile payment market was valued at about $3 trillion in 2023 and is expected to be worth $18.84 trillion by 2030.

The growth is attributed to mobile payments, which enable instant money transfers as a secure substitute for cash-based transactions. Visa Checkout is an easy and smart online checkout program that has allowed payment technology to tap into the massive opportunities around mobile payments. The payment scheme enables customers to make payments online via any device in collaboration with some of the biggest payment networks, including Apple Pay.

Visa is also benefiting from a fundamental change in consumer behavior. The acceptance of digital payments, with the proliferation of mobile devices and merchants accepting mobile payments, has translated to increased transactions that the company processes. Hence, as digital payments replace cash in various transactions, Visa should be able to generate significant fees for processing multiple transactions.

Strategic partnerships for rapid growth

Visa continues to experience high teen growth in the number of transactions it processes by expanding its global network of partners and extending its current agreements with the likes of PayPal (NASDAQ:PYPL) and Netflix (NASDAQ:NFLX).

Its massive reach in the electronic payment sector is affirmed by the fact the company has over 4.3 billion cards globally. In addition, its network and solutions are used by over 130 million merchant locations across the globe and handle over 276.3 billion transactions.

The payment giant has inked strategic partnerships that are strengthening its competitive edge. Late last year, it expanded its foothold in the Chinese market following a deal with a fintech division of Tencent Financial Technology.

The strategic partnership will enable Weixin users to receive inbound remittances in their digital wallets. The partnership is expected to expand Visa Direct's network reach to more than 1 billion Weixin users in one of the world's largest inbound remittance markets. Visa has set its sights on the Chinese market at a time when digital wallets are the fastest-growing financial instruments and are expected to exceed 5 billion by 2026.

Source: Paymentscardsandmobile

The strategic partnership with Tencent Financial Technology builds on previously announced collaborations with Thunes and TerraPay, which have also implemented Visa Direct capabilities. The strategic partnerships have increased the company's reach to over 8.5 billion endpoints, including over 3 billion cards, 3 billion accounts and 2.5 billion digital wallets.

Additionally, as per the personal finance expert, Enoch Omololu, Visa's collaborations are pivotal for its penetration into fast-growing markets, facilitating digital wallet transactions worldwide and bolstering its presence in Africaa region of significant growth potential, highlighted by a $1 billion investment commitment. Hence, these moves are critical to Visa's long-term strategy, enhancing its leadership in the digital payments industry by leveraging emerging fintech networks and expertise.

Finally, in Canada, Visa is partnering with Plug and Play, the venture capital and accelerator company expected to entrench its reach in the country's fintech market. The country's fintech industry is in a robust growth phase, with a compound annual growth rate of 25% through 2029.

Navigating regulatory hurdles in the electronic payment sector

Regulatory hurdles pose the biggest challenge to Visa's achievement of its growth rates. The electronic payment landscape faces increased regulatory scrutiny and tight consumer protection regulations that could affect the company's operations.

As a dominant player commanding over 40% of the market, Visa will always be at the center of regulatory challenges. Any changes on the regulatory front could affect the company's dominance in the sector, which in turn could affect its performance. For example, the enactment of Europe's Second Payment Services Directive, which permits third-party payment providers to access customer data, poses a significant threat to Visa's intermediary role in payment processing.

In the U.S., the passing of the FedNow Service introduced a real-time payment system that reduces credit risks for financial institutions, and its inclusion of banks and unions on all levels poses significant risks. The new service is a competitor for Visa's network, which could inhibit its online payment and merchant service revenue.

Conclusion

Amid a challenging macroeconomic environment fuelled by high interest rates, Visa's core business has held firm, as depicted by robust revenue and earnings growth. The company has navigated the challenging environment nicely, with the stock gaining over 40% over the past year. Solid underlying fundamentals at the back of expansion in China, strategic partnerships and the introduction of new payment solutions affirm the company's growth metrics and long-term prospects.

This article first appeared on GuruFocus.