Talkspace Inc (TALK) Reports Significant Reduction in Net Loss and Operating Expenses for Q4 ...

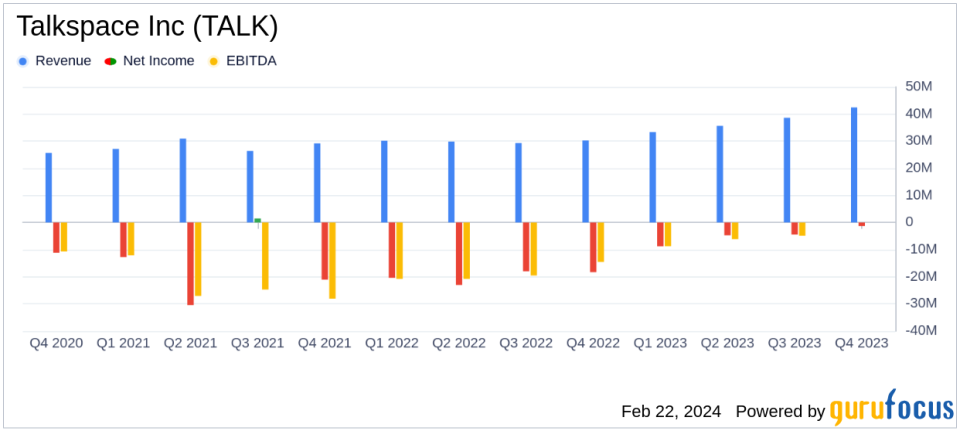

Revenue Growth: Talkspace Inc (NASDAQ:TALK) reported a 40% increase in Q4 revenue and a 25% increase for the full year.

Net Loss Improvement: Net loss improved by 93% in Q4 and 76% for the full year, indicating a substantial reduction in losses.

Operating Expense Reduction: Operating expenses decreased by 37% in Q4 and 32% for the full year, reflecting successful cost management.

Adjusted EBITDA: Adjusted EBITDA loss improved by 97% in Q4 and 77% for the full year, moving closer to profitability.

Share Repurchase Program: The Board of Directors authorized a share repurchase program of up to $15 million over the next 24 months.

2024 Guidance: Revenue is expected to be between $185-$195 million with adjusted EBITDA of $4-$8 million.

On February 22, 2024, Talkspace Inc (NASDAQ:TALK) released its 8-K filing, detailing the fourth quarter and full year 2023 financial results. The company, a leading virtual behavioral healthcare provider, has shown a significant improvement in its financial health, with a notable increase in revenue and a substantial reduction in net loss and operating expenses.

Financial Performance Highlights

The fourth quarter saw a 40% increase in revenue to $42.4 million, driven by a 138% increase in Payor revenue. For the full year, revenue climbed by 25% to $150.0 million, with Payor revenue up by 123%. Despite the revenue growth, the company experienced a 24% decline in the number of Consumer active members at year end.

Gross profit rose by 30% in Q4 to $21.0 million, with a slight decline in gross margin to 49.4%. The full year gross profit increased by 23% to $74.4 million, with the gross margin at 49.6%. Operating expenses were significantly reduced, down 37% in Q4 to $23.6 million and down 32% for the full year to $97.6 million.

The net loss showed a marked improvement, with Q4 net loss at $1.3 million, a 93% improvement from the previous year, and the full year net loss at $19.2 million, a 76% improvement. Adjusted EBITDA loss for Q4 was $0.3 million, a 97% improvement, and for the full year, it was $13.5 million, a 77% improvement.

Strategic Developments and Future Outlook

Dr. Jon Cohen, CEO of Talkspace, highlighted the pivotal year for the company, emphasizing the strategic execution that has fortified the foundation for 2024. Jennifer Fulk, CFO of Talkspace, pointed out the strategic measures that have strengthened the financial foundation and operational efficiency, setting the stage for sustained profitable growth.

"2023 was a pivotal year for Talkspace, demonstrating our commitment to strategic execution. Our achievements and streamlined strategy have significantly fortified our foundation for 2024. We're poised for substantial growth in Payor revenue and continue to lead in covered mental healthcare," said Dr. Jon Cohen, CEO of Talkspace.

"The strategic measures we've implemented throughout the past year have significantly strengthened our financial foundation and operational efficiency. Our disciplined approach to cost management and investment in scalable capabilities have not only enhanced our operating leverage but also positioned us well for sustained profitable growth," said Jennifer Fulk, CFO of Talkspace.

For 2024, Talkspace expects revenue to be in the range of $185 million to $195 million, with adjusted EBITDA between $4 million to $8 million. Additionally, the company announced an initial share repurchase program of $15 million, signaling confidence in the company's value and future prospects.

Conclusion

Talkspace Inc (NASDAQ:TALK) has demonstrated a strong turnaround in its financial performance, with significant growth in revenue and a reduction in losses. The company's strategic focus on Payor revenue and cost management has paid off, as reflected in the improved net loss and adjusted EBITDA figures. With a positive outlook for 2024 and a new share repurchase program, Talkspace is positioning itself for profitable expansion and value creation for its shareholders.

For detailed financial tables and further information, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Talkspace Inc for further details.

This article first appeared on GuruFocus.