Talos Energy Inc. (TALO) Reports Solid Q4 and Full Year 2023 Results; Aims for Strong 2024 ...

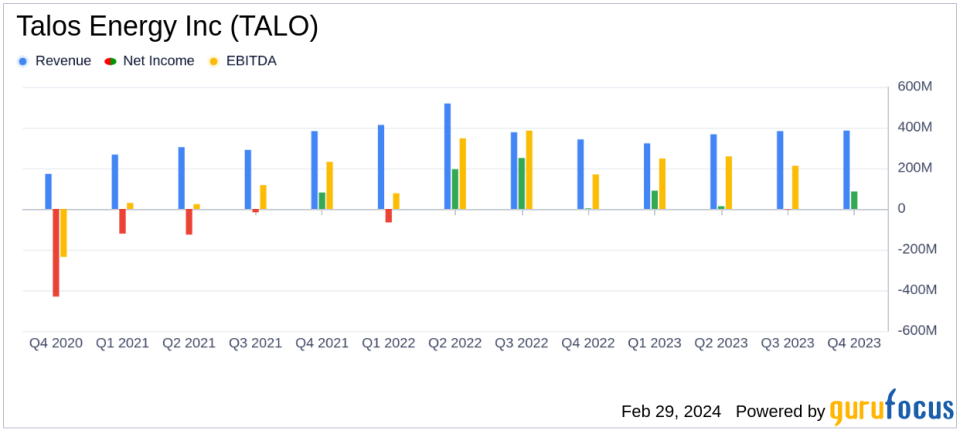

Revenue: $384.9 million for Q4 and $1.46 billion for the full year 2023.

Net Income: $85.9 million for Q4 and $187.3 million for the full year, with diluted EPS of $0.68 and $1.55 respectively.

Adjusted EBITDA: $249.1 million for Q4 and $950.7 million for the full year, excluding hedges.

Production: Averaged 67.7 MBoe/d in Q4 and 66.3 MBoe/d for the full year, predominantly oil-weighted.

Capital Expenditures: $148.1 million for Q4 and $596.5 million for the full year in upstream activities.

Liquidity and Leverage: Approximately $787.9 million in liquidity and a net debt to LTM Adjusted EBITDA ratio of 1.0x.

Reserves: Proved reserves of 152.8 MMBoe, with a pro forma increase to 215.8 MMBoe post QuarterNorth acquisition.

On February 28, 2024, Talos Energy Inc (NYSE:TALO) released its 8-K filing, announcing robust operational and financial results for the fourth quarter and full year ended December 31, 2023. The independent oil and gas company, which specializes in offshore exploration and production, has operations in the United States Gulf of Mexico and offshore Mexico, with revenue generated primarily from the sale of oil, natural gas, and NGLs.

Strategic Developments and Operational Performance

Talos Energy's President and CEO, Timothy S. Duncan, highlighted the company's progress toward becoming a leading offshore exploration and production entity. The fourth quarter saw strong operational performance with 67.7 Mboe/d production, driven by the successful online transition of the Venice and Lime Rock discoveries. The company's strategic transactions, including the acquisition of QuarterNorth, are expected to significantly enhance 2024 production, improve margins, and expand inventory.

The QuarterNorth acquisition is set to close in March 2024, bringing valuable operated infrastructure and deepwater assets to Talos's portfolio. This move is anticipated to accelerate deleveraging and improve credit strength. Additionally, Talos has entered into a joint venture with Repsol S.A. and a decommissioning agreement with Helix Energy Solutions Group, Inc., both of which are poised to contribute to the company's operational efficiency and cost management.

Financial Achievements and Outlook

Talos Energy's financial achievements in 2023, including a net income of $187.3 million and an adjusted EBITDA of $950.7 million, underscore the company's ability to generate profitable growth in the oil and gas industry. The company's focus on maintaining a strong balance sheet is evident in its liquidity position and the management of its debt profile, with a net debt to LTM Adjusted EBITDA ratio of 1.0x.

For 2024, Talos anticipates a year-over-year production growth of approximately 35%-40%, with capital expenditures expected to be below 2023 levels. This disciplined capital allocation strategy is expected to yield significant free cash flow, enabling the company to target a total debt reduction of approximately $400 million and end the year with a leverage ratio of 1.0x or less.

Analysis and Investor Outlook

Talos Energy's strategic acquisitions and operational advancements position the company for a robust 2024. The focus on inventory expansion, margin improvement, and deleveraging is likely to appeal to investors seeking value in the energy sector. The company's commitment to generating material free cash flow and reducing debt further strengthens its investment case.

Value investors and potential GuruFocus.com members may find Talos Energy's strategic direction and financial discipline indicative of a company poised for sustainable growth. The company's ability to navigate the complexities of the oil and gas market while delivering solid financial results is a testament to its operational expertise and strategic foresight.

For a detailed understanding of Talos Energy Inc's financials, operational updates, and future guidance, interested parties are encouraged to review the full 8-K filing.

Investors are invited to join Talos Energy's conference call on February 29, 2024, for further discussion of the fourth quarter and full year 2023 results, as well as the company's outlook for 2024.

For more information on Talos Energy's financial performance and strategic initiatives, please visit the Investor Relations section of the company's website at www.talosenergy.com.

Explore the complete 8-K earnings release (here) from Talos Energy Inc for further details.

This article first appeared on GuruFocus.