Tapestry Inc (TPR) Reports Strong Q2 Earnings, Raises Fiscal 2024 Outlook

Revenue: Increased to $2.1 billion, up 3% year-over-year.

Gross Margin: Expanded by 300 basis points compared to the prior year.

Operating Profit: Grew by 7% on a reported basis and 14% on a non-GAAP basis.

Earnings Per Share (EPS): Reported at $1.39, a 3% increase, and $1.63 on a non-GAAP basis, up 20%.

Free Cash Flow: Generated over $800 million, surpassing the previous year.

Fiscal 2024 EPS Outlook: Raised to $4.20 to $4.25, indicating 8% to 9% growth.

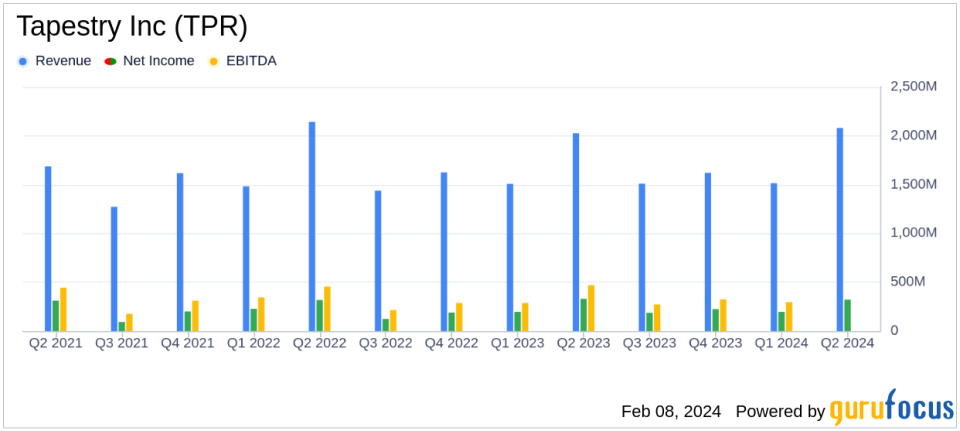

On February 8, 2024, Tapestry Inc (NYSE:TPR) released its 8-K filing, announcing a robust performance for the fiscal second quarter ended December 30, 2023. The company, which houses iconic fashion brands such as Coach, Kate Spade, and Stuart Weitzman, reported a 3% increase in revenue to $2.1 billion, driven by strong international growth and disciplined execution during the holiday season. Tapestry's gross margin saw a significant increase, and operating profit grew on both a reported and non-GAAP basis. The company also reported a substantial increase in diluted EPS, and generated robust operating and free cash flow, exceeding the prior year's figures.

In August 2023, Tapestry announced its agreement to acquire Capri Holdings Limited, which includes the Michael Kors, Versace, and Jimmy Choo brands. This strategic move is expected to expand Tapestry's portfolio and drive future growth.

Financial Performance Highlights

Tapestry's financial achievements this quarter reflect the company's strategic focus on building lasting customer relationships and delivering compelling omni-channel experiences. The acquisition of approximately 2.5 million new customers in North America, half of whom are Gen Z and Millennials, underscores the brand's appeal to a younger demographic. International revenue growth was particularly strong, with a 12% increase at constant currency, led by a 19% growth in Greater China.

The company's gross profit totaled $1.49 billion, with a gross margin of 71.6%, benefiting from lower freight expenses and operational improvements. Selling, general, and administrative (SG&A) expenses were managed effectively, totaling $1.05 billion, or 50.2% of sales on a reported basis. Operating income on a reported basis was $448 million, with an operating margin of 21.5%. Net income stood at $322 million, with earnings per diluted share of $1.39. On a non-GAAP basis, net income was $377 million, with earnings per diluted share of $1.63.

Balance Sheet and Cash Flow

Tapestry's balance sheet remains robust, with cash, cash equivalents, and short-term investments totaling $7.46 billion and total borrowings of $7.74 billion. Inventory control was tight, ending the quarter 15% below the prior year. The company's cash flow from operating activities was an inflow of $827 million, and free cash flow was an inflow of $804 million, both improvements over the prior year.

Outlook and Strategic Moves

With these strong results, Tapestry has raised its EPS outlook for fiscal 2024 to between $4.20 and $4.25, reflecting 8% to 9% growth. The company continues to expect to return approximately $325 million to shareholders through dividend payments. The acquisition of Capri Holdings Limited is progressing, with regulatory approvals moving forward and the transaction expected to close in calendar 2024.

Joanne Crevoiserat, CEO of Tapestry, expressed confidence in the company's vision and its ability to achieve long-term growth, citing the company's commitment to sustainable growth and shareholder value.

"Our second quarter results exceeded expectations, highlighting the power of brand building and disciplined execution. Based on these results, we are raising our EPS outlook for the fiscal year," said Joanne Crevoiserat, CEO of Tapestry.

For investors and value seekers, Tapestry's latest earnings report signals a company that is not only navigating the retail landscape adeptly but is also poised for future expansion and profitability.

Explore the complete 8-K earnings release (here) from Tapestry Inc for further details.

This article first appeared on GuruFocus.