Tapestry (NYSE:TPR) Posts Better-Than-Expected Sales In Q2

Luxury fashion conglomerate Tapestry (NYSE:TPR) reported Q2 FY2024 results beating Wall Street analysts' expectations , with revenue up 2.9% year on year to $2.08 billion. The company expects the full year's revenue to be around $6.7 billion, in line with analysts' estimates. It made a GAAP profit of $1.39 per share, improving from its profit of $1.36 per share in the same quarter last year.

Is now the time to buy Tapestry? Find out by accessing our full research report, it's free.

Tapestry (TPR) Q2 FY2024 Highlights:

Revenue: $2.08 billion vs analyst estimates of $2.06 billion (1.4% beat)

EPS: $1.39 vs analyst expectations of $1.46 (4.5% miss)

The company reconfirmed its revenue guidance for the full year of $6.7 billion at the midpoint

The company raised its EPS guidance for the full year to $4..23 at the midpoint (above estimates of $4.12)

Free Cash Flow of $803.7 million, up from $54.4 million in the previous quarter

Gross Margin (GAAP): 71.6%, up from 68.6% in the same quarter last year

Market Capitalization: $9.25 billion

Joanne Crevoiserat, Chief Executive Officer of Tapestry, Inc., said, “Our second quarter results exceeded expectations, highlighting the power of brand building and disciplined execution. During the key holiday season, our passionate teams delivered for our customers, fueling brand magic through innovative product, engaging storytelling, and operational excellence. Importantly, we drove record revenue and EPS, while advancing our strategic agenda. Based on these results, we are raising our EPS outlook for the fiscal year.”

Originally founded as Coach, Tapestry (NYSE:TPR) is an American fashion conglomerate with a portfolio of luxury brands offering high-quality accessories and fashion products.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

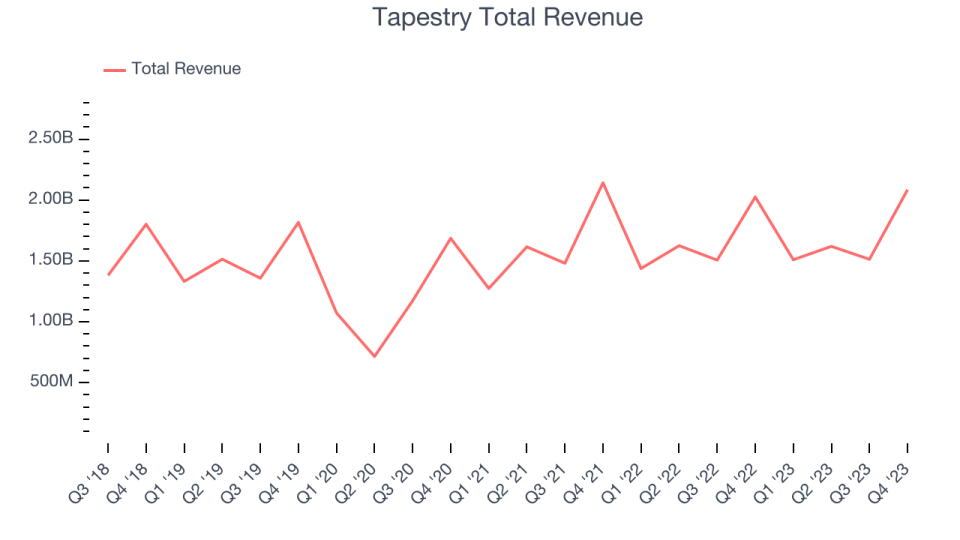

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Tapestry's annualized revenue growth rate of 2.4% over the last 5 years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Tapestry's annualized revenue growth of 1.6% over the last 2 years is in line with its 5-year revenue growth, suggesting the company's demand has been stable. Tapestry also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last 2 years, its constant currency sales averaged 4.4% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see that macroeconomic challenges hindered Tapestry's top-line performance.

This quarter, Tapestry reported reasonable year-on-year revenue growth of 2.9%, and its $2.08 billion of revenue topped Wall Street's estimates by 1.4%. Looking ahead, Wall Street expects sales to grow 1.8% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

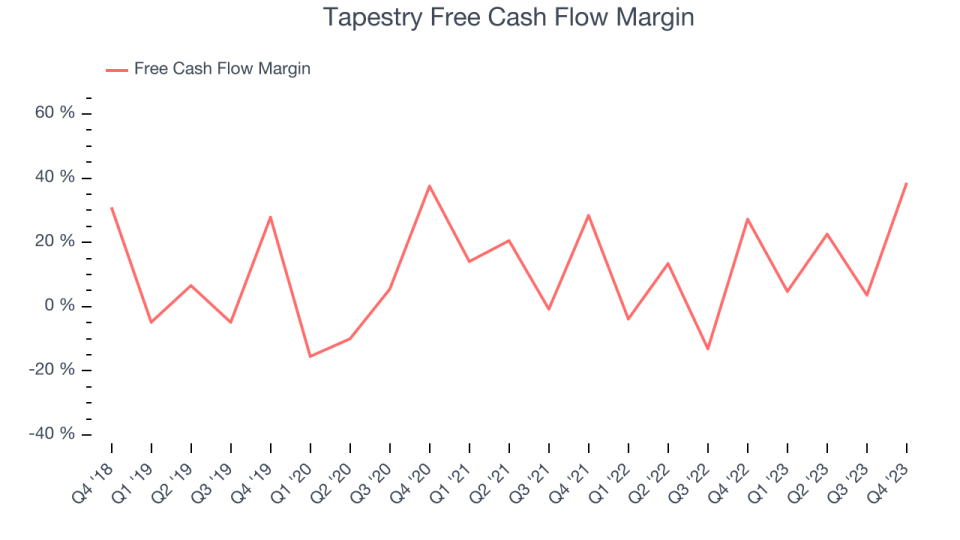

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Tapestry has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 11.6%, slightly better than the broader consumer discretionary sector.

Tapestry's free cash flow came in at $803.7 million in Q2, equivalent to a 38.6% margin, up 45.8% year on year. Over the next year, analysts predict Tapestry's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 19.3% will decrease to 11.1%.

Key Takeaways from Tapestry's Q2 Results

We enjoyed seeing Tapestry raise its EPS outlook, which beat analysts' expectations. We were also glad its constant currency revenue outperformed Wall Street's estimates. On the other hand, its EPS missed analysts' expectations and its full-year revenue guidance was maintained, slightly missing Wall Street's estimates. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 2.6% after reporting and currently trades at $41.41 per share.

So should you invest in Tapestry right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.