Tapestry (TPR) Set to Report Q2 Earnings: What's in Store?

We expect Tapestry, Inc. TPR to report year-over-year increases in the top and bottom lines when it releases second-quarter fiscal 2024 earnings on Feb 8, before market open.

The Zacks Consensus Estimate for quarterly earnings has been unchanged at $1.45 per share over the past 30 days. The same suggests an increase of 6.6% from the year-earlier quarter’s reported figure. The consensus estimate of $2,055 million for quarterly revenues indicates growth of 1.5% from the prior-year quarter’s actual.

In the last reported quarter, the company’s bottom line outperformed the Zacks Consensus Estimate by a margin of 3.3%. Tapestry has a trailing four-quarter earnings surprise of 10.6%, on average.

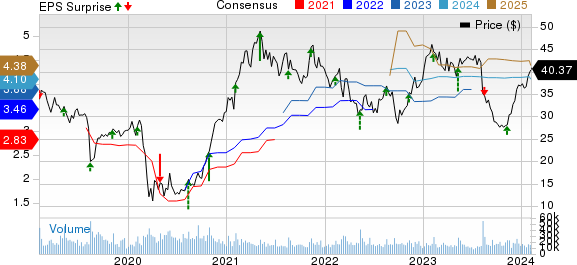

Tapestry, Inc. Price, Consensus and EPS Surprise

Tapestry, Inc. price-consensus-eps-surprise-chart | Tapestry, Inc. Quote

Factors to Note

A focus on customer-centric strategies, the development of omni-channel capabilities, robust brand power, and the prioritization of high-growth segments are expected to have positively impacted Tapestry's performance in the fiscal second quarter. The company has concentrated on enhancing interactions with customers, developing innovative and attractive products, and broadening its digital and data analytics expertise.

TPR's emphasis on fashion innovation and product excellence has been leading to successful launches and branding initiatives. This approach has been not only leading to significant handbag AUR growth but also contributing to top-line gains in small leather goods and lifestyle offerings, further enhancing brand relevance and customer lifetime value.

On its last reported quarter's earnings call, Tapestry guided revenue growth of 2% on a constant-currency basis, adjusting for a slight foreign exchange pressure in the fiscal second quarter. The company also expects earnings of $1.45 per share, indicating a 6-8% year-over-year increase.

Coming to brands, Coach's performance is likely to have been positively impacted in the second quarter due to strong brand recognition, product launches and effective digital marketing strategies. The Zacks Consensus Estimate for the company’s Coach revenues is pegged at $1,496 million in the fiscal second quarter, implying a year-over-year rise of 3.2%.

However, Kate Spade and Stuart Weitzman’s performances are likely to have been impacted in the fiscal second quarter due to competitive market pressures, evolving consumer preferences, and operational challenges in supply chain and production. The Zacks Consensus Estimate for Kate Spade and Stuart Weitzman’s fiscal second-quarter revenues is pegged at $477 million and $83 million, suggesting year-over-year decreases of 2.7% and 2.4%, respectively.

Also, a tough operating environment and foreign exchange headwinds are likely to have been spoilsports. Management expects an FX headwind of approximately 60 basis points for the fiscal second quarter. Meanwhile, any deleverage in selling, general and administrative expenses are likely to have been deterrents.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Tapestry this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Tapestry currently has a Zacks Rank #3 and an Earnings ESP of -1.67%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are three companies, which according to our model, have the right combination of elements to beat on earnings this reporting cycle:

The Gap GPS has an Earnings ESP of +25.37% and currently flaunts a Zacks Rank of 1. GPS is likely to register a bottom-line increase when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 19 cents suggests an increase of 125.3% from the year-ago quarter’s reported number.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Gap’s top line is expected to have declined from the prior-year quarter’s reported number. The consensus estimate for quarterly revenues is pegged at $4.21 billion, suggesting a decline of 0.7% from the prior-year quarter’s reported figure. GPS has a trailing four-quarter earnings surprise of 137.9%, on average.

Abercrombie & Fitch Co. ANF has an Earnings ESP of +3.14% and sports a Zacks Rank of 1 at present. The company is slated to witness top-line growth when it reports fourth-quarter fiscal 2023 results. The Zacks Consensus Estimate for ANF’s quarterly revenues is pegged at $1.43 billion, which suggests growth of 18.9% from the figure reported in the prior-year quarter.

The consensus estimate for Abercrombie & Fitch’s quarterly earnings has moved up by 32 cents over the past 30 days to $2.71 per share, suggesting growth of 234.6% from the year-ago quarter’s reported number. ANF delivered an earnings surprise of 713%, on average, in the trailing four quarters.

lululemon athletica LULU presently has an Earnings ESP of +0.25% and a Zacks Rank of 2. The company is likely to register top and bottom-line growth when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for LULU’s quarterly earnings per share of $4.99 suggests an increase of 13.4% from the year-ago quarter’s reported level.

lululemon has a trailing four-quarter earnings surprise of 9.2%, on average. The consensus estimate for LULU’s quarterly revenues is pegged at $3.19 billion, indicating a rise of 15% from the figure reported in the prior-year quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Tapestry, Inc. (TPR) : Free Stock Analysis Report