Targa's (TRGP) Q4 Earnings Beat Estimates, Revenues Miss

Targa Resources TRGP reported fourth-quarter 2022 net income of $1.38 per share, beating the Zacks Consensus Estimate of $1.29. It surged from the year-ago profit of 51 cents per share. The outperformance could be attributed to strong volumes across its systems and low product costs in the reported quarter.

The company’s adjusted EBITDA for fourth-quarter 2022 was $840.4 million, up from $570.6 million in the prior-year quarter.

The fourth-quarter 2022 distributable cash flow was $655.5 million, about 55% higher than $420.7 million in the year-ago period.

Targa Resources paid out a dividend of 35 cents per share and repurchased shares worth $28.0 million during the October-December period. Adjusted free cash flow was $103.1 million, down 57.1% from the fourth quarter of 2021.

Total revenues were $4.6 billion, down 16.3% from the year-ago quarter’s tally. The figure also missed the Zacks Consensus Estimate of $5.4 billion owing to lower commodity sales.

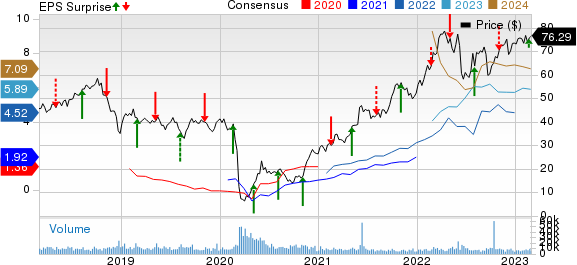

Targa Resources, Inc. Price, Consensus and EPS Surprise

Targa Resources, Inc. price-consensus-eps-surprise-chart | Targa Resources, Inc. Quote

Operational Performance

Gathering and Processing: The segment recorded an operating margin of $544.0 million during the quarter, up 40.5% from the $387.1 million in the year-ago period.

The jump primarily reflects higher Permian Basin volumes that increased 57.4% year over year to an average 4,747.3 million cubic feet per day.

Logistics and Transportation: This unit mainly reflects Targa Resources’ downstream operations. The segment’s operating margin of $441.6 million was up 28.5% year over year.

The rise in adjusted operating margin within the segment was due to various factors, including increased marketing margin, greater volumes of pipeline transportation and fractionation, and higher export volumes of LPG. The higher marketing margin was a result of increased optimization opportunities.

TRGP’s fractionation volumes increased from 611.6 thousand barrels per day to 744.4, indicating a 21.7% increase year over year.

NGL pipeline transportation volumes were up 16% year over year. NGL sales also improved 3%.

Costs, Capex & Balance Sheet

Targa Resources reported product costs of $3.3 billion in the fourth quarter of 2022, down 27.3% from the year-ago quarter.

In the reported quarter, TRGP spent $552.4 million on growth capital programs compared with $179.9 million in the year-ago period.

As of Dec 31, 2022, the company had cash and cash equivalents of $219.0 million and long-term debt of $10.7 billion, with a debt-to-capitalization of around 68%.

Guidance

Targa Resources expects adjusted EBITDA estimate for 2023 in the $3.5-$3.7 billion range.

The company now anticipates 2023 growth capital expenditures between $1.8 billion and $1.9 billion, with net maintenance capital spending at $175 million.

For 2023, Targa expects prices for natural gas, natural gas liquids, and crude oil to be $2.25/MMbtu, 70 cents/gallon, and $75/barrel, respectively.

Zacks Rank and Key Picks

Currently, Targa Resources carries a Zacks Rank #3 (Hold). Meanwhile, investors interested in the energy sector might look at some better-ranked stocks like NGL Energy Partners (NGL) sporting a Zacks Rank #1 (Strong Buy) and Energy Transfer ET and Halliburton HAL both holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NGL Energy Partners: NGL Energy Partners is worth approximately $365.07 billion. Its shares have increased 28.7% in the past year.

NGL Energy Partners LP is a limited partnership company that operates a vertically-integrated propane business with three segments — retail propane, wholesale supply and marketing, and midstream.

Energy Transfer LP: Energy Transfer LP is valued at around $39.80 billion. ET delivered an average earnings surprise of 11.43% for the last four quarters, and its current dividend yield is 9.49%.

Energy Transfer LP currently has a forward P/E ratio of 8.93. In comparison, its industry has an average forward P/E of 10.40, which means Energy Transfer LP is trading at a discount to the group.

Halliburton: Halliburton is valued at around $33.44 billion. In the past year, HAL stock has increased by 40.2%.

TX-based Halliburton Company, headquartered in Houston, is one of the largest oilfield service providers in the world with a trailing four-quarter earnings surprise of roughly 5.87%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

NGL Energy Partners LP (NGL) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

Targa Resources, Inc. (TRGP) : Free Stock Analysis Report