Target Corp (TGT) Reports Soaring Earnings: EPS Jumps Nearly 50% in Full-Year 2023

Adjusted EPS: Surged to $8.94 for full-year 2023, nearly 50% higher than the previous year.

Operating Income: Grew by nearly $2 billion, with a margin rate of 5.3%.

Cash Flow: Operations cash flow more than doubled to $8.6 billion from $4.0 billion in 2022.

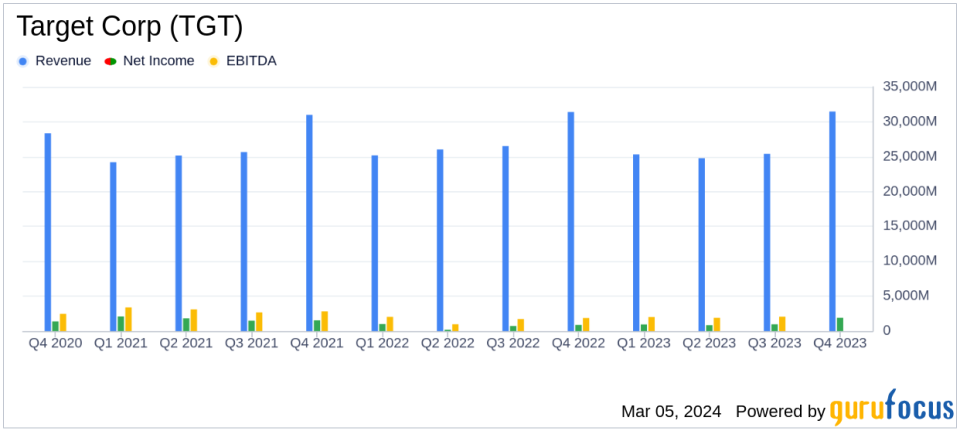

Revenue: Full-year sales slightly decreased by 1.7% to $105.8 billion, with an additional week of sales in 2023.

Dividends: Paid dividends of $508 million in Q4, reflecting a 1.9% increase per share.

Stock Repurchase: No shares repurchased in Q4; approximately $9.7 billion remaining under the repurchase program.

ROIC: After-tax return on invested capital improved to 16.1% from 12.6% in the previous year.

On March 5, 2024, Target Corp (NYSE:TGT) released its 8-K filing, disclosing its fourth-quarter and full-year earnings for 2023. The report highlighted a significant increase in earnings per share (EPS) and operating income, alongside robust cash flow generation. Despite a slight decline in full-year sales, the company's strategic focus on efficiency and inventory management paid off, leading to a substantial improvement in profitability.

Target, the nation's sixth-largest retailer, is renowned for its compelling in-store shopping experience and diverse product offerings. With over 1,900 stores across the United States and more than $100 billion in sales, Target has established itself as a dominant player in the retail sector. The company's success is underpinned by its ability to maintain appropriate inventory levels and deliver value to its customers through trendy apparel, home goods, and essentials.

Financial Performance and Challenges

Target's fourth-quarter GAAP and Adjusted EPS stood at $2.98, a 57.6% increase from the previous year, surpassing the expected range. The full-year Adjusted EPS reached $8.94, nearly 50% higher than in 2022. This impressive performance reflects the company's operational efficiency, which delivered savings of over $500 million in 2023. However, Target did face a 4.4% decline in total comparable sales during the fourth quarter, with a 1.7% decrease in full-year sales. This decline was partially offset by sales from non-mature stores and an additional week in the fiscal year.

Despite these challenges, Target's operating income margin rate improved significantly, contributing to a nearly $2 billion increase in operating income dollars. The company's cash from operations more than doubled, highlighting its strong cash-generating capabilities. Additionally, Target's focus on maintaining appropriate inventory levels resulted in lower markdown rates and more effective operations.

Income Statement and Balance Sheet Highlights

Target's full-year total revenue of $107.4 billion marked a 1.6% decrease compared to 2022, mainly due to a decline in sales. The fourth-quarter operating income margin rate was 5.8%, up from 3.7% in the previous year, while the full-year gross margin rate increased to 26.5% from 23.6% in 2022. These improvements were attributed to lower markdowns, freight costs, and favorable category mix.

The balance sheet showed a healthy cash and cash equivalents position of $3.8 billion, up from $2.2 billion the previous year. Inventory levels were managed down to $11.9 billion from $13.5 billion, reflecting Target's efficient inventory management. Total assets increased to $55.4 billion, while total liabilities and shareholders' investment also saw an uptick, aligning with the company's growth trajectory.

"Our teams efforts changed the momentum of our business, further improving our sales and traffic trends in the fourth quarter while driving profitability well ahead of expectations," said Brian Cornell, chairman and chief executive officer of Target Corporation.

Looking Ahead

For the first quarter of 2024, Target anticipates a comparable sales decline of 3 to 5 percent, with GAAP and Adjusted EPS expected to range from $1.70 to $2.10. For the full year, the company forecasts a modest increase in comparable sales and an EPS range of $8.60 to $9.60.

Target's strong performance in a challenging retail environment underscores the company's resilience and strategic agility. The retailer's ability to adapt and innovate, particularly through its new Target Circle membership program, positions it for continued profitable growth in the future.

For detailed financial tables and further information on Target's earnings, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Target Corp for further details.

This article first appeared on GuruFocus.