Taylor Morrison (TMHC) Q4 Earnings & Revenues Beat, Stock Up

Taylor Morrison Home Corporation TMHC reported mixed results in fourth-quarter 2023, with earnings and revenues topping the Zacks Consensus Estimate. However, the top and the bottom line declined on a year-over-year basis due to softened housing demand, given higher mortgage rates during the period.

Shares of this this homebuilding company inched up 5.6% during the trading session on Feb 14, 2024.

Inside the Numbers

The company reported earnings of $2.05 per share, which topped the consensus mark of $1.76 by 16.5%. The reported figure declined 30% from the prior-year quarter’s figure of $2.93 per share.

Total revenues (including Home closings, Land closings, Financial services and others) of $2.02 billion also beat the consensus mark of $1.86 billion by 8.6% but fell 19% year over year from $2.49 billion.

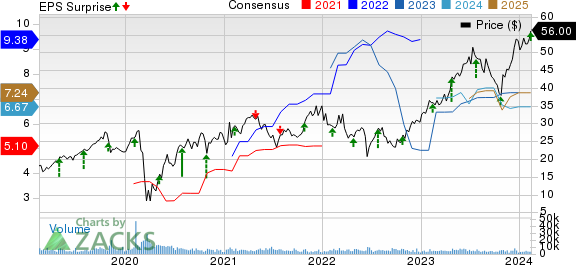

Taylor Morrison Home Corporation Price, Consensus and EPS Surprise

Taylor Morrison Home Corporation price-consensus-eps-surprise-chart | Taylor Morrison Home Corporation Quote

The quarter’s adjusted EBITDA plunged 30.3% to $338.6 million from the year-ago quarter’s levels. Adjusted EBITDA margin contracted 270 basis points (bps) to 16.8% year over year.

Segmental Details

Home Closings: Revenues in the segment totaled $1.94 billion, down 18.5% from the year-ago quarter’s figure. The downside was caused by a 16% year-over-year decline in home closings to 3,190 and a 3% year-over-year fall in average closing price to $607,000.

Net sales orders increased 30% to 2,361 units from the prior year’s reported value of 1,810 units. The upside was backed by a 29% increase in the monthly absorption pace to 2.4 per community and a 1% year-over-year increase in the ending community count to 327. Average net sales order price increased 9% year over year to $629,000.

On a unit basis, backlog at the end of Dec 31, 2023, declined 11.2% from the prior-year quarter’s figure to 5,289 homes and fell 10.3% on a dollar basis to $3.6 billion.

The cancelation rate (as a percentage of gross orders) for the reported quarter was 11.6% compared with 24.4% in the prior-year period.

The adjusted home closings gross margin contracted 40 bps year over year to 24.1%. Selling, general and administrative expenses (SG&A) — as a percentage of home closings revenues — increased 240 bps from the year-ago figure to 9.7%. The upside was due to lower home closings revenues, higher performance-based compensation expenses and external broker commissions.

Financial Services: The segment's revenues increased 16.5% year over year to $43.2 million. The mortgage capture rate was 86% in the fourth quarter, up from 78% a year ago.

Land closings: Revenues in the segment totaled $29.5 million, up 104.8% from the year-ago quarter’s levels. During the quarter, homebuilding land acquisition and development spend totaled $537 million, up 44% from $373 million a year ago.

Amenity and other: The segment's revenues decreased 84.8% year over year to $9.5 million.

2023 Highlights

Total revenues were $7.42 billion, down 9.8% from $8.22 billion reported in the prior year. Home closing revenues were $7.16 billion, down from $7.89 billion reported in 2022.

Earnings were $7.54 per share, down from earnings of $9.35 per share reported in 2022. Total homes closings were 11,495 units in 2023, down 9.1% from 12,647 units in 2022.

Adjusted home closing gross margin was 24%, down 150 bps from 25.5% reported in 2022.

Financials

As of Dec 31, 2023, Taylor Morrison had total liquidity of approximately $1.8 billion, including $799 million cash and cash equivalents and $1.1 billion of total capacity on the company’s revolving credit facilities.

At 2022-end, total liquidity was approximately $1.8 billion, including $724 million in cash and cash equivalents and $1.1 billion of total capacity on its revolving credit facilities.

During 2023, the company repurchased 2.8 million shares for $128 billion. At the end of December 2023, the company had $494 million remaining on its share repurchase authorization.

As of Dec 31, 2023, the net homebuilding debt-to-capital ratio was 16.8%, down from 24% a year ago.

First-Quarter 2024 Outlook

Taylor Morrison expect home closings of approximately 2,700 units compared with 2,541 units a year ago. The average home closing price is expected to be around $600,000, suggesting a fall from $635,000 a year ago.

Home sales gross margin is expected to be in the range of 23 to 23.5% compared with 23.9% in the prior-year quarter.

2024 Outlook

For 2024, the company expects home closings of approximately 12,000 units compared with 11,495 units a year ago. The average home closing price is expected to be around $600,000, suggesting a fall from $623,000 a year ago.

Home closings gross margin is expected to be in the range of 23 to 23.5%, suggesting a fall from 23.9% a year ago. SG&A expenses, as a percentage of home closings revenues, are projected to be in the high-9% range. In the year-ago period, the metric was 9.8%.

Land and development spending is expected to be between $2.3 to $2.5 billion for 2024. Ending active community count is expected to be in the range of 320-325 compared with 324 in the prior-year quarter. The company expects the effective tax rate to be 25%.

Zacks Rank & Recent Construction Releases

Taylor Morrison currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AECOM ACM reported decent results for first-quarter fiscal 2024, with earnings surpassing the Zacks Consensus Estimate. On a year-over-year basis, the top and the bottom line increased, backed by solid organic net service revenues (NSR) growth in its design business.

ACM anticipates generating 8-10% organic NSR growth in fiscal 2024. It expects adjusted EPS in the range of $4.35-$4.55. This indicates a 20% improvement from the fiscal 2023 levels on a constant-currency basis, considering the mid-point of the guidance.

Martin Marietta Materials, Inc. MLM reported mixed fourth-quarter 2023 results, with earnings surpassing the Zacks Consensus Estimate and increasing on a year-over-year basis. Revenues missed the consensus mark but rose year over year.

Going forward, MLM anticipates strong demand for infrastructure, large-scale energy and domestic manufacturing projects. This will largely offset weaker residential demand and the anticipated softening in light non-residential activity. With mortgage rates stabilizing and affordability headwinds receding, MLM fully expects single-family residential construction to recover, as demand still exceeds supply, particularly in its key markets.

Watsco, Inc. WSO reported dismal fourth-quarter 2023 results, with earnings and revenues missing the Zacks Consensus Estimate. On a year-over-year basis, the top line grew while the bottom line dwindled.

The quarter’s results reflect a seasonal sales trend, wherein HVAC equipment witnessed flat sales while sales in other HVAC products declined, year over year. Also, sales volume for commercial refrigeration products was down. Furthermore, high costs and expenses impacted the bottom line of the company.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report