TC Energy (TRP) Q2 Earnings Miss Estimates, Sales Beat

TC Energy TRP reported second-quarter 2023 adjusted earnings of 71 cents per share, which missed the Zacks Consensus Estimate of 73 cents. The bottom line also decreased from 78 cents reported in the year-ago period. This underperformance could be attributed to weak results in the Liquids Pipelines, and Power and Storage segments.

TC Energy’s comparable EBITDA of C$2.47 billion in the reported quarter was up from C$2.37 billion in the prior-year quarter.

Revenues of $2.85 billion beat the Zacks Consensus Estimate of $2.74 billion. The figure also increased 4% year over year. This outperformance could be attributed to strong results of the Canadian Natural Gas Pipelines segment.

TRP’s board of directors announced a quarterly dividend of 93 Canadian cents per common share for the quarter ending Jun 30, 2023. The dividend is payable on Oct 31, 2023, to shareholders of record at the close of business on Sep 29, 2023.

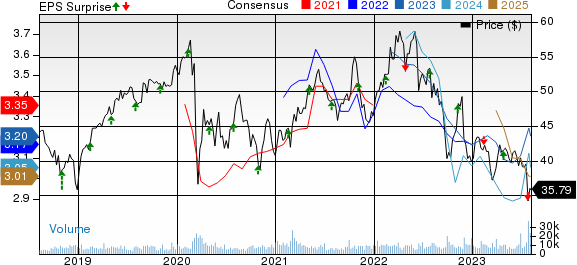

TC Energy Corporation Price, Consensus and EPS Surprise

TC Energy Corporation price-consensus-eps-surprise-chart | TC Energy Corporation Quote

Segmental Information

Canadian Natural Gas Pipelines reported a comparable EBITDA of C$780 million, up 14.5% from the year-ago quarter’s level. The figure also beat our projection of C$685 billion.

This increase was largely due to the impact of higher flow-through costs on Canadian rate-regulated pipelines and increased rate-base earnings on the NGTL System.

U.S. Natural Gas Pipelines reported comparable EBITDA of C$925 million, indicating a 1.1% increase from the prior-year quarter’s recorded number. The figure, however, fell short of our projection of C$927.2 billion.

The year-over-year upside was due to higher earnings from adjusted net revenues, following the FERC-approved settlement for an increase in transportation rates, effective August 2022. The improvement can also be attributed to growth projects placed in service, and higher realized earnings related to the U.S. natural gas marketing business, partially offset by higher operational costs.

Mexico Natural Gas Pipelines reported comparable EBITDA of C$193 million, up 1.6% from the year-ago quarter’s figure of C$190 million. The figure, however, fell short of our projection of C$194.5 billion.

The year-over-year improvement was primarily due to the north section of the Villa de Reyes pipeline (VdR North) and the east section of the Tula pipeline (Tula East) being placed into commercial service in the third quarter of 2022. This was partially offset by an equity income loss from Sur de Texas, primarily due to peso-denominated financial exposure.

The Liquids Pipelines’ comparable EBITDA of C$341 million depreciated from the prior-year quarter’s level of C$363 million. The figure also missed our projection of C$343.1 billion.

This downtrend can be attributed to lower uncontracted volumes in the Keystone Pipeline System regarding the Milepost 14 incident. It was also due to lower rates and volumes on the U.S. Gulf Coast section of the pipeline, partially offset by higher long-haul contracted volumes from the 2019 Open Season, which was commercialized in 2022.

Power and Storage registered a comparable EBITDA of C$217 million, down 13.9% from the year-ago quarter’s level of C$252 million. The figure also missed our projection of C$217.5 billion.

The downtrend was due to lower natural gas storage spreads. Bruce Power contributed more due to fewer planned outage days and higher contract prices. Canadian Power increased earnings owing to higher realized power prices.

Expenditure and Balance Sheet

As of Jun 30, 2023, TC Energy’s capital investments amounted to C$2.99 billion.

TRP had cash and cash equivalents worth C$1.09 billion and long-term debt of C$46.07 billion, with a debt-to-capitalization of 60.9%.

Key Updates

TRP expects to spend C$11.5-C$12 billion on capital programs in 2023.

By 2024, TRP plans to maintain business growth at a rate of 3-5%, limit annual net capital expenditures to C$6-C$7 billion. It also considers lowering leverage and returning additional capital to shareholders.

Zacks Rank and Other Key Picks

Currently, TRP carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks for investors interested in the energy sector are Murphy USA MUSA, sporting a Zacks Rank #1 (Strong Buy), and Evolution Petroleum EPM and Archrock AROC, both carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Murphy USA is valued at around $6.55 billion. In the past year, its shares have risen 5.6%.

MUSA currently pays a dividend of $1.52 per share, or 0.51% on an annual basis. Its payout ratio currently sits at 6% of earnings.

Evolution Petroleum is worth approximately $319.05 million. EPM currently pays a dividend of 48 cents per share, or 5.20% on an annual basis.

The company currently has a forward P/E ratio of 8.88. In comparison, its industry has an average forward P/E of 13.60, which means EPM is trading at a discount to the group.

Archrock is valued at around $2.01 billion. It delivered an average earnings surprise of 15.08% for the last four quarters and its current dividend yield is 4.67%.

Archrock is a provider of natural gas contract compression services and aftermarket services of compression equipment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

TC Energy Corporation (TRP) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

Archrock, Inc. (AROC) : Free Stock Analysis Report