TD Holdings (GLG): A Modestly Undervalued Gem in the Metals & Mining Industry?

TD Holdings Inc (NASDAQ:GLG) has seen a significant daily gain of 25.99%, with a 3-month gain of 4.59%. However, it reported a Loss Per Share of 0.11. The question that arises is whether the stock is modestly undervalued? This article aims to provide a comprehensive valuation analysis of TD Holdings. Let's delve deeper.

Introducing TD Holdings Inc

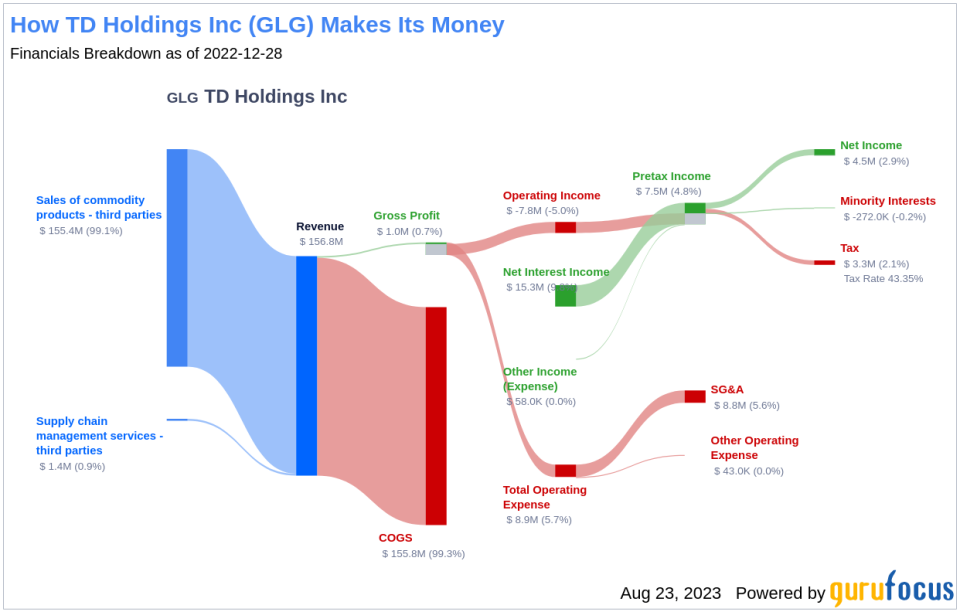

TD Holdings Inc is a prominent player in China's commodity trading and supply chain service business. The company's Commodities Trading Business purchases non-ferrous metal products from upstream suppliers and sells them to downstream customers. Its Supply Chain Service Business serves as a one-stop commodity supply chain service and digital intelligence supply chain platform integrating various stakeholders.

Despite a recent Loss Per Share, TD Holdings' stock price stands at $0.67, with a market cap of $123.20 million. The GF Value, an estimation of fair value, is at $0.88, suggesting the stock might be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that reflects the intrinsic value of a stock. It considers factors such as historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value that the stock should be traded at.

According to this measure, TD Holdings (NASDAQ:GLG) stock appears to be modestly undervalued. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. Given TD Holdings' current price of $0.67 per share and a market cap of $123.20 million, the stock seems modestly undervalued.

Because TD Holdings is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Assessing TD Holdings' Financial Strength

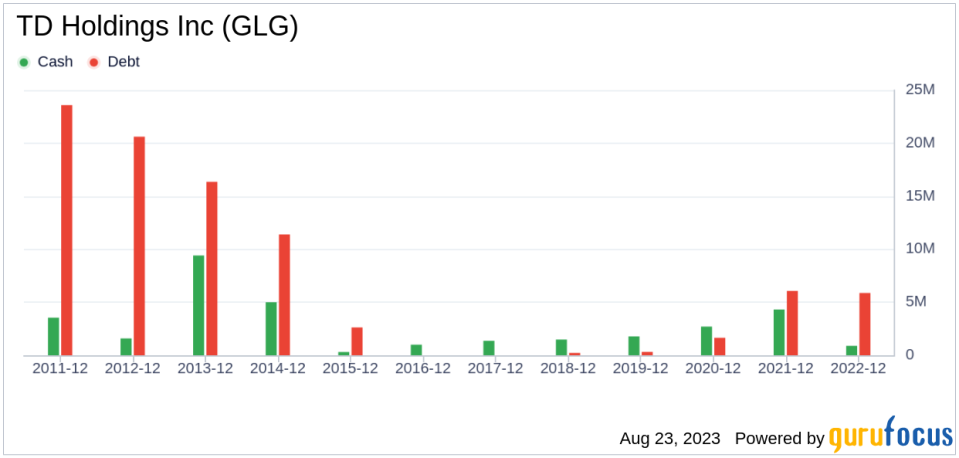

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to review a company's financial strength before deciding to buy shares. TD Holdings has a cash-to-debt ratio of 0.2, which ranks worse than 86.8% of 2591 companies in the Metals & Mining industry. Based on this, GuruFocus ranks TD Holdings's financial strength as 7 out of 10, suggesting a fair balance sheet.

Profitability and Growth

Investing in profitable companies, especially those that have demonstrated consistent profitability over the long term, poses less risk. TD Holdings has been profitable 3 over the past 10 years. Over the past twelve months, the company had a revenue of $124.10 million and Loss Per Share of $0.11. Its operating margin is -12.83%, which ranks worse than 64.92% of 838 companies in the Metals & Mining industry. Overall, GuruFocus ranks the profitability of TD Holdings at 3 out of 10, which indicates poor profitability.

Growth is probably the most important factor in the valuation of a company. The 3-year average annual revenue growth of TD Holdings is 84.5%, which ranks better than 95.32% of 598 companies in the Metals & Mining industry. However, the 3-year average EBITDA growth rate is 0%, which ranks worse than 0% of 1849 companies in the Metals & Mining industry.

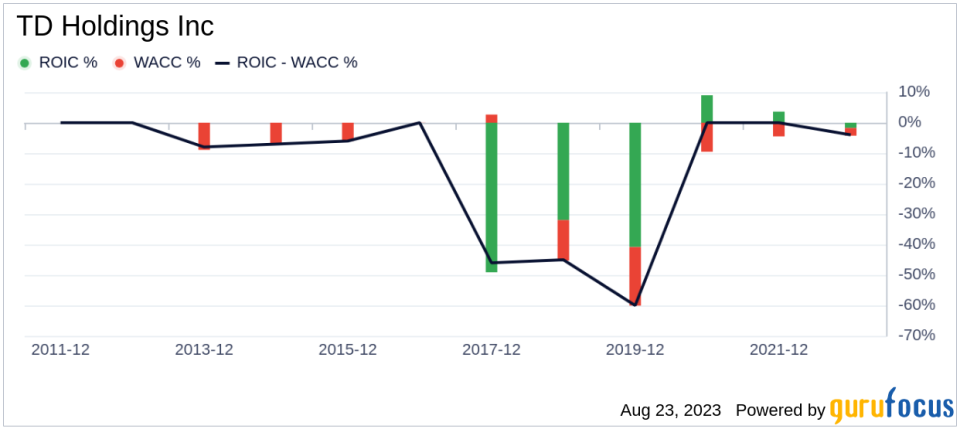

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can also help assess its profitability. For the past 12 months, TD Holdings's ROIC is 69.94, and its cost of capital is 1.85, suggesting the company is creating value for shareholders.

Conclusion

In conclusion, TD Holdings (NASDAQ:GLG) appears to be modestly undervalued. The company's financial condition is fair, but its profitability is poor. Its growth ranks worse than 0% of 1849 companies in the Metals & Mining industry. To learn more about TD Holdings stock, you can check out its 30-Year Financials here.

To find out the high quality companies that may deliever above average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.