TD Synnex Corp (SNX) Navigates Market Challenges, Aligns with Analyst EPS Projections

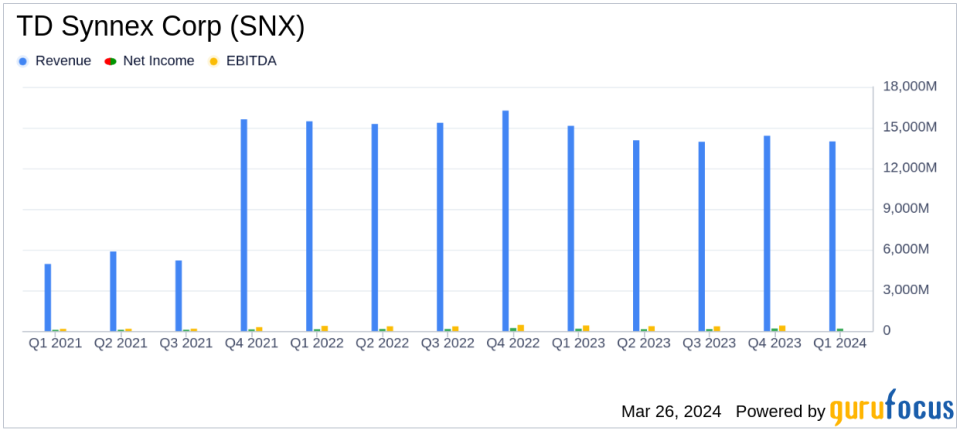

Revenue: $14.0 billion, within the outlook range but a 7.6% decrease from the prior fiscal first quarter.

Net Income: $172 million, slightly below analyst estimates but a 3.1% increase from Q1 FY23.

Earnings Per Share (EPS): Reported GAAP EPS of $1.93, aligning with analyst projections and showing a 10.3% increase from the previous year.

Gross Margin: Improved to 7.20%, up 57 basis points from the prior fiscal first quarter.

Free Cash Flow: $344 million, a significant improvement from a negative free cash flow in the prior fiscal first quarter.

Share Repurchase: New $2 billion share repurchase authorization announced, supplementing the existing program.

Dividend: Quarterly cash dividend increased to $0.40 per common share, up 14% from the prior fiscal year.

On March 26, 2024, TD Synnex Corp (NYSE:SNX) released its 8-K filing, detailing the financial results for the fiscal first quarter ended February 29, 2024. The company, a leading distributor and solutions aggregator for the IT ecosystem, reported a revenue of $14.0 billion, which aligns with their outlook range but represents a 7.6% decrease from the prior fiscal first quarter. Despite the revenue decline, TD Synnex Corp achieved a net income of $172 million, which is slightly below the analyst estimates of $251.6 million but marks a 3.1% increase from the same quarter last year. The reported GAAP EPS of $1.93 meets the analyst projection of $2.8423 and shows a 10.3% increase from the prior fiscal first quarter.

TD Synnex Corp's gross margin saw a notable improvement, rising to 7.20%, which is up 57 basis points from the prior fiscal first quarter. This margin expansion is attributed to the presentation of additional revenues on a net basis, which positively impacted gross margin by approximately 23 basis points. The company also reported strong free cash flow of $344 million, a significant turnaround from the negative free cash flow of $140 million reported in the prior fiscal first quarter.

Additionally, TD Synnex Corp has demonstrated its commitment to shareholder returns by announcing a new $2 billion share repurchase authorization, which supplements the existing program with approximately $197 million remaining. Furthermore, the Board of Directors declared a quarterly cash dividend of $0.40 per common share, which is a 14% increase from the prior fiscal year.

Financial Performance and Strategic Initiatives

TD Synnex Corp's financial achievements are significant in the context of the IT hardware industry, which is characterized by thin margins and intense competition. The improvement in gross margin and the generation of healthy free cash flow are indicative of the company's operational efficiency and strategic initiatives to optimize its product mix and manage costs effectively.

CEO Rich Hume commented on the results, stating, "We generated strong results in our fiscal first quarter, driven by our expansive portfolio and an improving IT demand environment. This resulted in record margins, EPS at the upper end of our expectations, healthy free cash flow and robust capital returned to shareholders."

We are leveraging our strong relationships across the business partner ecosystem along with our robust core and strategic technology portfolios to accelerate growth for our partners, while continuing to produce strong returns for our shareholders."

The company operates in three geographical segments: the Americas, Europe, and Asia-Pacific and Japan (APJ). While all regions faced revenue declines, the company managed to improve operating income in Europe and APJ, showcasing the effectiveness of its regional strategies.

Looking Ahead

For the fiscal 2024 second quarter, TD Synnex Corp provided an outlook with revenue expected to be between $13.3 billion and $14.9 billion, and net income projected to be between $139 million and $183 million. The diluted earnings per share are forecasted to be in the range of $1.59 to $2.09, with non-GAAP diluted earnings per share expected to be between $2.50 and $3.00.

The company's performance in the fiscal first quarter, despite revenue headwinds, demonstrates resilience and an ability to navigate market challenges effectively. TD Synnex Corp's focus on margin improvement, cash flow generation, and shareholder returns positions it as a company of interest for value investors seeking stability and consistent performance in the dynamic IT hardware industry.

Explore the complete 8-K earnings release (here) from TD Synnex Corp for further details.

This article first appeared on GuruFocus.