TD Synnex (SNX): A Modestly Undervalued Tech Giant?

TD Synnex Corp (NYSE:SNX), a global distributor and solutions aggregator for the IT ecosystem, experienced a daily loss of 5.26% and a 3-month loss of 0.8%. Despite these setbacks, the company's Earnings Per Share (EPS) stand at 7.02. This article aims to unravel whether the stock is modestly undervalued and provide a comprehensive analysis of its valuation. Let's delve into the details.

A Brief Overview of TD Synnex Corp (NYSE:SNX)

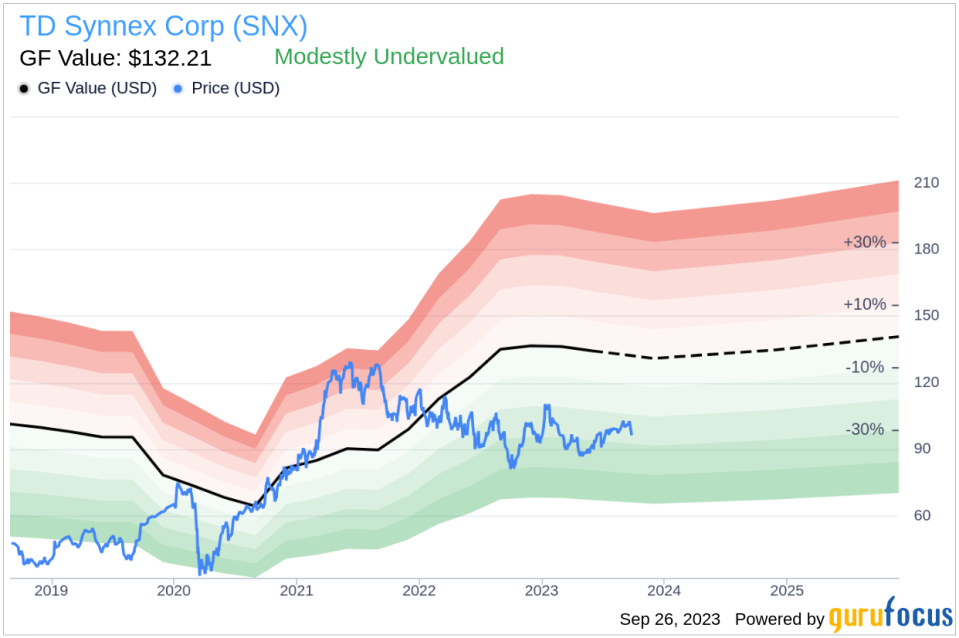

TD Synnex Corp is anchored in some of the most critical technology segments, including cloud, cybersecurity, big data/analytics, IoT, mobility, and everything as a service. With a current stock price of $96.54, the company has a market cap of $9.10 billion. However, our proprietary measure of fair value, the GF Value, estimates it at $132.21, indicating that the stock may be modestly undervalued.

Understanding the GF Value

The GF Value is a unique valuation model that considers historical trading multiples, an internal adjustment based on the company's past performance and growth, and future business performance estimates. It provides an overview of the stock's fair trading value, and the stock price usually fluctuates around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued, and vice versa.

According to our GF Value, TD Synnex (NYSE:SNX) appears to be modestly undervalued. With its current price of $96.54 per share, the stock's future return is likely to be higher than its business growth due to its relative undervaluation.

Link: These companies may deliver higher future returns at reduced risk.

Assessing TD Synnex's Financial Strength

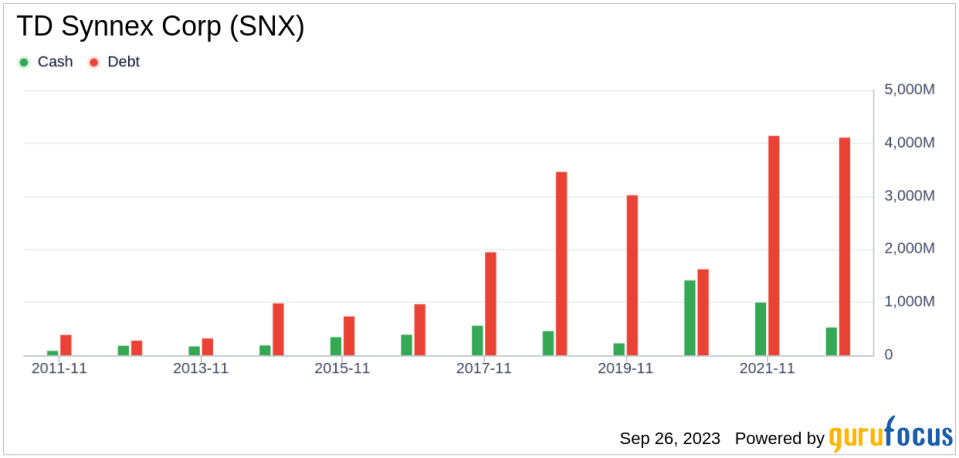

Investing in companies with poor financial strength can lead to a higher risk of permanent capital loss. Therefore, it's crucial to carefully review a company's financial strength before investing. TD Synnex's cash-to-debt ratio of 0.21 ranks worse than 87.61% of companies in the Hardware industry, indicating fair financial strength.

Profitability and Growth of TD Synnex

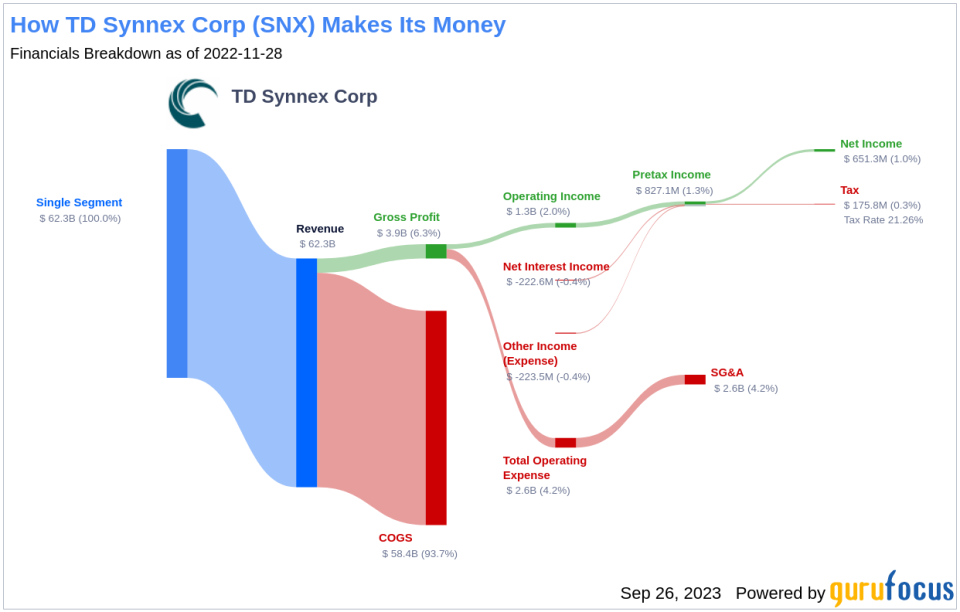

Companies with consistent profitability offer less risk to investors. TD Synnex has been profitable for the past ten years, with a revenue of $60.80 billion and an operating margin of 2.16%. However, its growth ranks worse than 74.25% of companies in the Hardware industry, indicating a need for improvement.

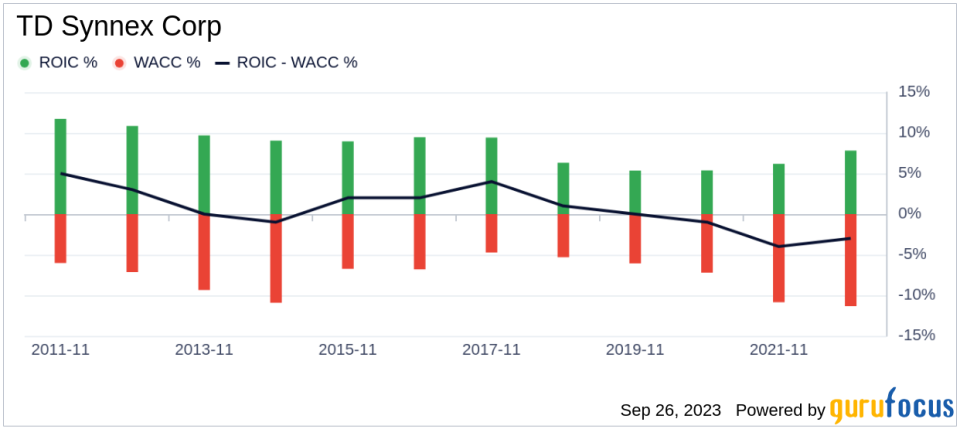

Comparing ROIC and WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can evaluate its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. TD Synnex's ROIC is 7.92, while its WACC is 10.2, indicating a need for further analysis.

Conclusion

In conclusion, TD Synnex (NYSE:SNX) appears to be modestly undervalued. Although the company's financial condition and profitability are fair, its growth could be better. For more information about TD Synnex's stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.