TechTarget Inc (TTGT) Faces Headwinds Amidst Revenue Decline and Net Loss in Q4

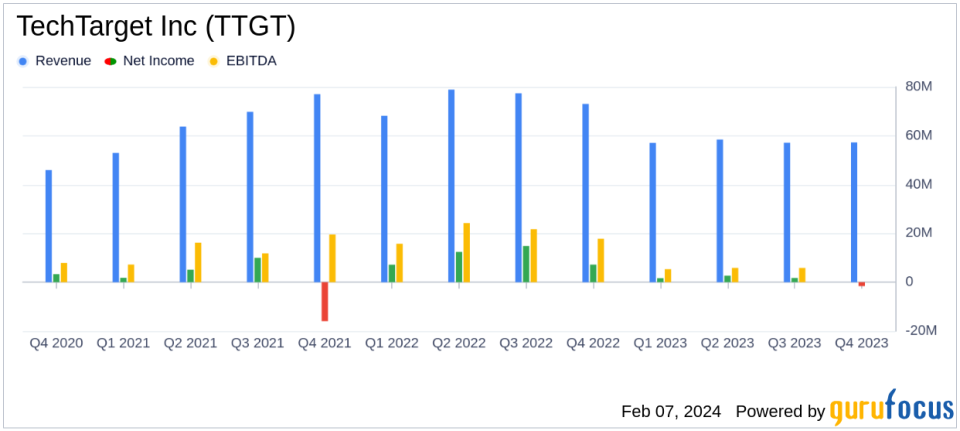

Full Year 2023 GAAP Revenue: Declined by 23% to approximately $230.0 million.

Net Income: Dropped significantly to approximately $4.5 million, an 89% decrease.

Adjusted EBITDA: Decreased by 42% to $70.6 million for the full year.

Q4 2023 Performance: GAAP revenue fell by 22% to $57.3 million, with a net loss of $1.6 million.

Customer Metrics: A decrease in the number of customers and those spending $100k+ and $1mm+.

Strategic Actions: TechTarget announced a strategic combination with Informa Techs digital businesses.

Guidance for 2024: Expects GAAP revenue between $230.0 million and $235.0 million, with net income between $10.9 million and $14.9 million.

On February 7, 2024, TechTarget Inc (NASDAQ:TTGT) released its 8-K filing, revealing a challenging fiscal year with a significant decline in revenue and net income. The company, a global leader in purchase intent-driven marketing and sales data, faced a cautious macro technology environment, leading to a cautious investment in sales and marketing by customers. Despite these challenges, TechTarget remains optimistic about its strategic positioning and the opportunities for growth as the market recovers.

Financial Performance and Challenges

TechTarget's revenue for the fourth quarter was stable, slightly exceeding guidance, but the full year 2023 saw a 23% decline in GAAP revenue to approximately $230.0 million. The net income plummeted by 89% to about $4.5 million, with a net income margin of just 2%. Adjusted EBITDA also fell by 42% to $70.6 million. The company attributes these results to a cautious investment climate among its customers due to uncertainties surrounding inflation, interest rates, and geopolitical issues.

Strategic Positioning and Market Opportunities

Despite the downturn, TechTarget sees potential in the robust investments in R&D by its customers, which could lead to significant new technology products entering the market. The company's organic traffic grew by 14% year-over-year, and it achieved a notable ranking improvement in SEO visibility. TechTarget is also making strategic moves, including a combination with Informa Techs digital businesses, which is expected to provide immediate scale opportunities and diversification.

Financial Tables and Key Metrics

The company's financial tables highlight a decrease in longer-term revenue, which fell by 31% to $85.7 million, representing 37% of total revenue. Cash flow from operations was $72.5 million, with free cash flow at $57.9 million. Key customer metrics show a reduction in the number of customers and those spending significant amounts with the company.

"While sales and marketing levels among our customers were down year over year, investments in R&D remain robust, which provides an opportunity for significant new technology products to be brought to market," stated TechTarget in its shareholder letter.

Looking Ahead

For Q1 2024, TechTarget expects GAAP revenue between $50.0 million and $52.0 million, with a net loss between $(1.1) million and $(0.4) million. The full year 2024 guidance anticipates GAAP revenue between $230.0 million and $235.0 million, with net income between $10.9 million and $14.9 million. The strategic actions taken by TechTarget, including the combination with Informa Techs digital businesses, are aimed at positioning the company to capitalize on the impending recovery of the technology market.

The company's balance sheet as of December 31, 2023, shows approximately $326.3 million in cash, cash equivalents, and short-term investments, with $417 million outstanding in convertible senior notes. TechTarget's disciplined capital allocation and focus on margins and cash flow generation are expected to continue, providing a strong foundation for future growth.

Value investors may find TechTarget's strategic positioning and potential for market recovery compelling, despite the current financial headwinds. The company's focus on innovation, such as the release of IntentMail AI and enhancements to its Priority Engine offering, demonstrates its commitment to maintaining a competitive edge in the B2B data and market access space.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider the implications of TechTarget's performance and strategic initiatives on their investment decisions.

Explore the complete 8-K earnings release (here) from TechTarget Inc for further details.

This article first appeared on GuruFocus.