TechTarget Inc (TTGT): A Strong Contender in the Interactive Media Industry with a GF Score of 83

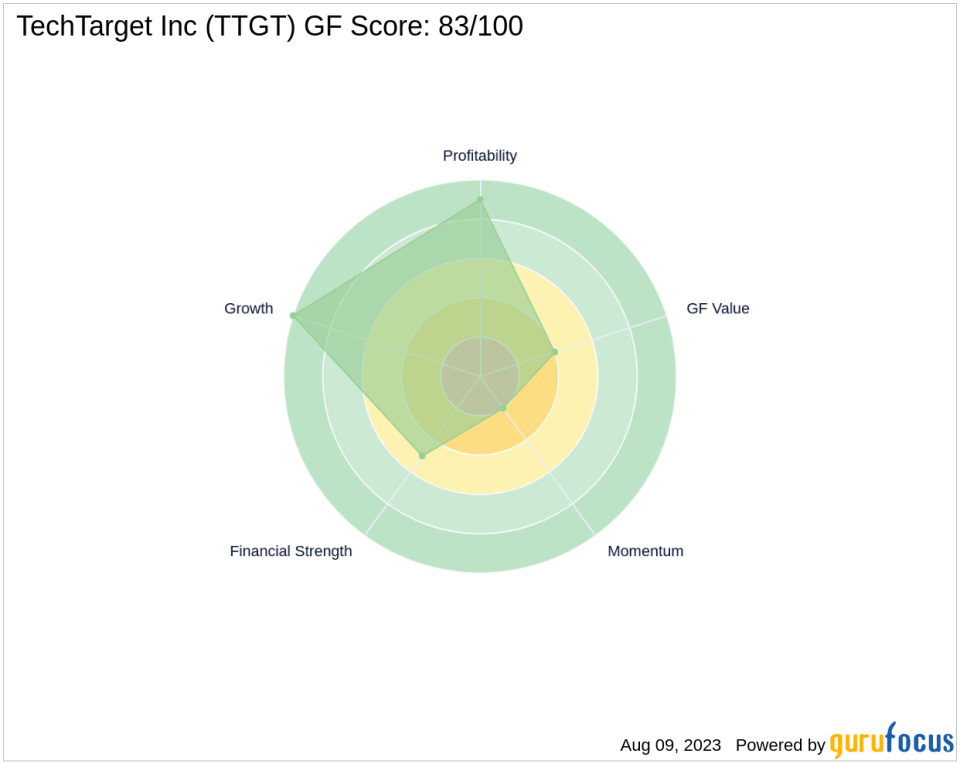

TechTarget Inc (NASDAQ:TTGT), a prominent player in the Interactive Media industry, is currently trading at $32.47 with a market cap of $911.341 million. The company's stock price has seen a gain of 10.95% today and a 4.20% increase over the past four weeks. According to the GF Score, TechTarget has a score of 83 out of 100, indicating good outperformance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which is closely correlated with the long-term performance of stocks.

Financial Strength Analysis

TechTarget's Financial Strength rank stands at 5/10. This rank measures the robustness of a company's financial situation, considering factors such as debt burden, debt to revenue ratio, and Altman Z-Score. TechTarget's interest coverage is 46.44, indicating a low debt burden. However, its debt to revenue ratio is 1.68, and its Altman Z-Score is 2.27, suggesting room for improvement in its financial strength.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, indicating high profitability. This rank is based on factors such as operating margin, Piotroski F-Score, trend of the operating margin, consistency of profitability, and Predictability Rank. TechTarget's operating margin is 17.72%, and its Piotroski F-Score is 7, both of which are strong indicators of profitability. The company has also shown consistent profitability over the past 9 years.

Growth Rank Analysis

TechTarget's Growth Rank is 10/10, reflecting strong growth in terms of revenue and profitability. The company's 5-year revenue growth rate is 20.20%, and its 3-year revenue growth rate is 22.70%. Additionally, its 5-year EBITDA growth rate is 33.90%, indicating robust growth.

GF Value Rank Analysis

The company's GF Value Rank is 4/10, which is determined by the price-to-GF-Value ratio. This rank suggests that the company's stock is currently overvalued.

Momentum Rank Analysis

TechTarget's Momentum Rank is 2/10, indicating that the company's stock has low momentum compared to other stocks.

Competitor Analysis

When compared to its competitors in the Interactive Media industry, TechTarget stands out with a higher GF Score. Thryv Holdings Inc (NASDAQ:THRY) has a GF Score of 56, Taboola.com Ltd (NASDAQ:TBLA) has a GF Score of 19, and Nextdoor Holdings Inc (NYSE:KIND) has a GF Score of 17. This comparison suggests that TechTarget is a strong contender in its industry.

Conclusion

In conclusion, TechTarget's overall GF Score of 83 indicates good outperformance potential. The company's strong profitability and growth ranks, coupled with its solid financial strength, make it a compelling choice for investors. However, its low GF Value and Momentum ranks suggest that the stock may be overvalued and lacks momentum. Therefore, investors should exercise caution and conduct further research before investing in TechTarget.

This article first appeared on GuruFocus.