Teck Resources (TECK) Sells Steelmaking Coal Unit, Shares Up 3%

Teck Resources TECK announced that it has agreed to sell its entire stake in its steelmaking coal business, Elk Valley Resources (“EVR”). The majority of the sale (77%) will be made to Glencore plc GLNCY for an implied enterprise value of $9 billion, and 20% to Nippon Steel Corporation. Proceeds will be used to strengthen TECK’s balance sheet while returning cash to shareholders. It will help the company focus on growing its extensive copper portfolio and thereby capitalize on the energy transition trend. The company’s shares rose 3% on the news.

Glencore will acquire 77% stake in EVR for $6.9 billion in cash, which is payable to Teck at the closing of the transaction, subject to customary closing adjustments. These include receipt of approvals under the Investment Canada Act and competition approvals in several jurisdictions and are expected to occur in the third quarter of 2024.

Nippon Steel Corporation has agreed to acquire a 20% interest in EVR in exchange for its current 2.5% interest in Elkview Operations and $1.3 billion in cash payable to Teck at the closing of the transaction and $0.4 billion paid out of cash flows from EVR.

Nippon Steel Corporation will also enter into a long-term steelmaking coal offtake rights arrangement at market terms, continuing its long-standing commercial arrangement for the purchase of steelmaking coal from the Elk Valley. The Nippon Steel transaction is also subject to customary conditions, including receipt of certain competition approvals, and is expected to close in the first quarter of 2024.

POSCO PKX has also agreed to take up the remaining 3% interest in EVR. This will be in exchange for Posco’s current 2.5% interest in Elkview Operations and its 20% interest in the Greenhills joint venture.

Until the deal is closed, Teck will continue to operate the steelmaking coal business and will retain all cash flows, which are estimated to be around $1 billion.

Following the sale, it is expected that Teck Resources will be well-capitalized to maintain investment-grade credit metrics and to unlock the full potential of its base metals business. The proceeds are expected to be utilized to lower the company’s debt levels, retain additional cash on the balance sheet and pay transaction-related taxes, which are estimated to be approximately $750 million. Teck’s Board will determine the amount and form of a cash return to shareholders following the closing of these transactions.

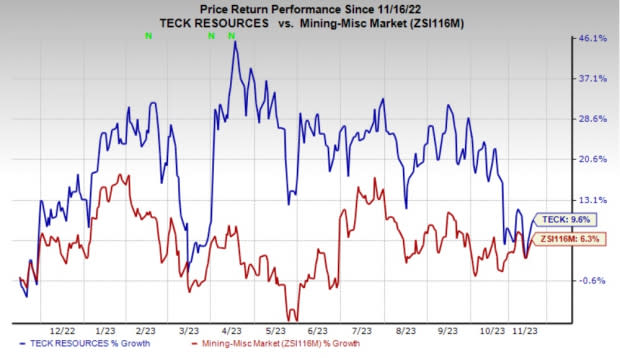

Price Performance

Shares of Teck Resources have gained 9.6% in the past year compared with the industry's 6.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stock to Consider

TECK currently has a Zacks Rank #3 (Hold).

A better-ranked stock from the basic materials space is Carpenter Technology Corporation (CRS), which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 14.3%. The Zacks Consensus Estimate for CRS’ fiscal 2024 earnings is pegged at $3.57 per share. The consensus estimate for 2024 earnings has moved 3% north in the past 60 days. Its shares have soared 70% in a year’s time.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

POSCO (PKX) : Free Stock Analysis Report

Glencore PLC (GLNCY) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report