Teck (TECK) Reports '23 Production, Updates '24 Outlook

Teck Resources Limited TECK announced fourth-quarter and annual 2023 production and sales volumes.

Production & Sales Update

In the fourth quarter of 2023, the company sold 101,200 tons and produced 103,500 tons of copper. Its annual copper production came in at 296,500 tons, lower than the company’s guidance. The lower production of copper was impacted by a localized geotechnical fault at Highland Valley Copper in August.

Fourth-quarter 2023 sales and production of zinc came in at 164,000 tons and 181,000 tons, respectively. The annual production of 644,000 tons of zinc fell slightly short of the company's expectations due to weather-related challenges in the first quarter of 2023 and equipment failures at Red Dog.

Refined zinc production for the fourth quarter of 2023 was 69,900 tons, whereas sales were 68,100 tons. The annual refined zinc production was lower than the guidance at 266,600 tons. Production was hindered by weather-related challenges in the first quarter and concentrated supply issues in the third quarter as well as the beginning of the fourth quarter.

Steelmaking coal sales for the fourth quarter were 6.1 million tons. The fourth-quarter and annual production of steelmaking coal were 6.4 million tons and 23.7 million tons, respectively. The annual production surpassed the top end of the company’s guidance due to a strong performance.

2024 Guidance

The company predicts total copper production to rise significantly to 465,000-540,000 tons in 2024.

Total zinc concentrate production in 2024 is estimated between 565,000 and 630,000 tons. Production over the next three years is likely to fall because of deteriorating grades at Red Dog and lower zinc production at Antamina, whereas refined zinc production is estimated at 275,000-290,000 tons in 2024. Production is predicted to rise in 2024 due to greater concentrate availability.

Steelmaking coal production in 2024 is estimated to be 24.0-26.0 million tons. Production is predicted to be at this level through 2025 and 2027. The company expects 2024 steelmaking coal adjusted site cash cost of sales between $95 and $110 per ton.

Capital expenditure in 2024 is estimated to be much lower than that recorded in 2023, owing to decreased spending.

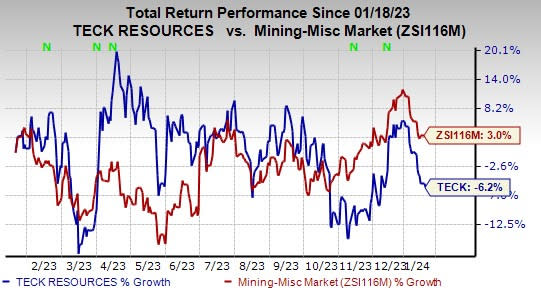

Price Performance

The company’s shares have lost 6.2% in the past year against the industry’s 3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Teck Resources currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Ternium S.A. TX and Osisko Gold Royalties Ltd OR. CRS and TX sport a Zacks Rank #1 (Strong Buy), and OR carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $3.96 per share. The consensus estimate for 2024 earnings has moved 11% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 71.2% in a year.

The Zacks Consensus Estimate for Ternium’s 2023 earnings is pegged at $7.98 per share. It has an average trailing four-quarter earnings surprise of 38.6%. TX’s shares have gained 36.5% in a year.

Osisko Gold has an average trailing four-quarter earnings surprise of 13.4%. The Zacks Consensus Estimate for OR’s 2023 earnings is pegged at 43 cents per share. Earnings estimates have been unchanged in the past 60 days. OR shares rallied 13.4% last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Ternium S.A. (TX) : Free Stock Analysis Report

Osisko Gold Royalties Ltd (OR) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report