Tegna Inc (TGNA) Navigates Economic Headwinds with Mixed 2023 Results and Strategic Capital ...

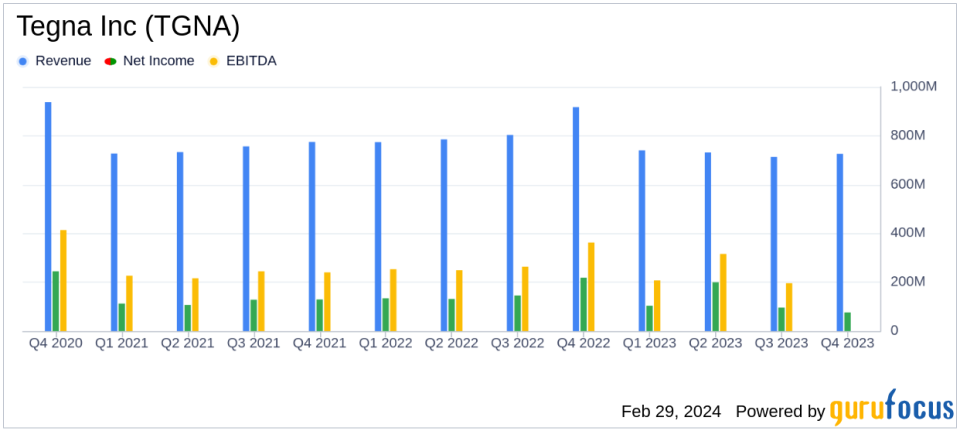

Revenue: Full-year revenue decreased by 11% year-over-year to $2.9 billion.

Net Income: GAAP net income for the year stood at $476 million, with non-GAAP net income at $363 million.

Earnings Per Share: GAAP earnings per diluted share were $2.28, while non-GAAP earnings per diluted share were $1.74.

Adjusted EBITDA: Total company Adjusted EBITDA saw a 34% decrease year-over-year to $742 million.

Free Cash Flow: Free cash flow for the quarter was $130 million, with a two-year trailing percentage of revenue at 20.3%.

Capital Allocation: Plans to return 40-60% of 2024-2025 free cash flow to shareholders, with a $650 million share repurchase authorization.

Strategic Moves: Sale of BMI interest and acquisition of Octillion Media highlight strategic initiatives.

On February 29, 2024, Tegna Inc (NYSE:TGNA) released its 8-K filing, detailing its financial performance for the fourth quarter and full-year 2023. The media company, which operates 64 television stations and 2 radio stations across 51 U.S. markets, faced a challenging year with total company revenue declining by 11% to $2.9 billion, primarily due to the expected reduction in political revenue from the mid-term election cycle. Despite this, Tegna Inc managed to meet or exceed all full-year 2023 guidance metrics and provided a positive outlook for the 2024-2025 period.

Tegna Inc's subscription revenue was $1.5 billion, consistent with the previous year, while Advertising and Marketing Services (AMS) revenue was $1.3 billion, down 5% year-over-year. The company attributed the AMS decline to macroeconomic headwinds and the loss of a national Premion account. However, underlying advertising trends, excluding these factors, were down only 2% year-over-year, with automotive and services categories showing strength.

Operating expenses on a GAAP basis were down 5% to $2.2 billion, while non-GAAP operating expenses saw a slight increase of 1% due to higher programming costs, partially offset by lower non-programming expenses. Net income on a GAAP basis was $476 million, with non-GAAP net income at $363 million. Earnings per diluted share were reported at $2.28 for GAAP and $1.74 for non-GAAP.

Adjusted EBITDA for the full year was $742 million, a 34% decrease from the previous year, reflecting the impact of lower high-margin political and AMS revenues, as well as increased programming costs. Free cash flow for the quarter was reported at $130 million, contributing to a two-year trailing free cash flow as a percentage of revenue of 20.3%.

The company's strategic capital allocation framework aims to return 40-60% of its free cash flow generated in 2024-2025 to shareholders through share repurchases and dividends. This includes a new two-year $650 million share repurchase program. Additionally, Tegna Inc received $153 million in pre-tax cash proceeds from the sale of its ownership interest in BMI, which will be used to support shareholder returns and potential bolt-on acquisitions.

President and CEO Dave Lougee expressed confidence in the company's strategy, highlighting the renewal of key retransmission consent agreements and the acquisition of Octillion Media to bolster Premion's position in the CTV advertising space. Lougee also noted the company's commitment to serving the greater good of communities, as outlined in Tegna's 2023 Impact Report.

Looking ahead, Tegna Inc anticipates generating free cash flow in the range of $900 million to $1.1 billion during the 2024-2025 period. The company's net leverage ratio is expected to remain below 3x at year-end, with corporate expenses projected between $40 million and $45 million.

Despite the challenges faced in 2023, Tegna Inc's strategic initiatives and capital allocation framework set the stage for potential growth and shareholder returns in the coming years. The company's focus on operational efficiency and innovation, coupled with its strong balance sheet, positions it well to navigate the evolving media landscape.

Explore the complete 8-K earnings release (here) from Tegna Inc for further details.

This article first appeared on GuruFocus.