TEGNA (NYSE:TGNA) Misses Q4 Sales Targets

Broadcasting and digital media company TEGNA (NYSE:TGNA) missed analysts' expectations in Q4 FY2023, with revenue down 20.9% year on year to $725.9 million. It made a non-GAAP profit of $0.43 per share, down from its profit of $0.97 per share in the same quarter last year.

Is now the time to buy TEGNA? Find out by accessing our full research report, it's free.

TEGNA (TGNA) Q4 FY2023 Highlights:

Revenue: $725.9 million vs analyst estimates of $750.8 million (3.3% miss)

EPS (non-GAAP): $0.43 vs analyst expectations of $0.46 (7.1% miss)

Free Cash Flow of $130 million, up 74.5% from the previous quarter

Gross Margin (GAAP): 41.7%, down from 52.8% in the same quarter last year

Market Capitalization: $2.66 billion

“TEGNA is back on offense, operating from a position of strength. Our new capital allocation framework positions us well to execute our business strategy to drive shareholder value in a continually evolving media landscape,” said Dave Lougee, President and Chief Executive Officer.

Spun out of Gannett in 2015, TEGNA (NYSE:TGNA) is a media company operating a network of television stations and digital platforms, focusing on local news and community content.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

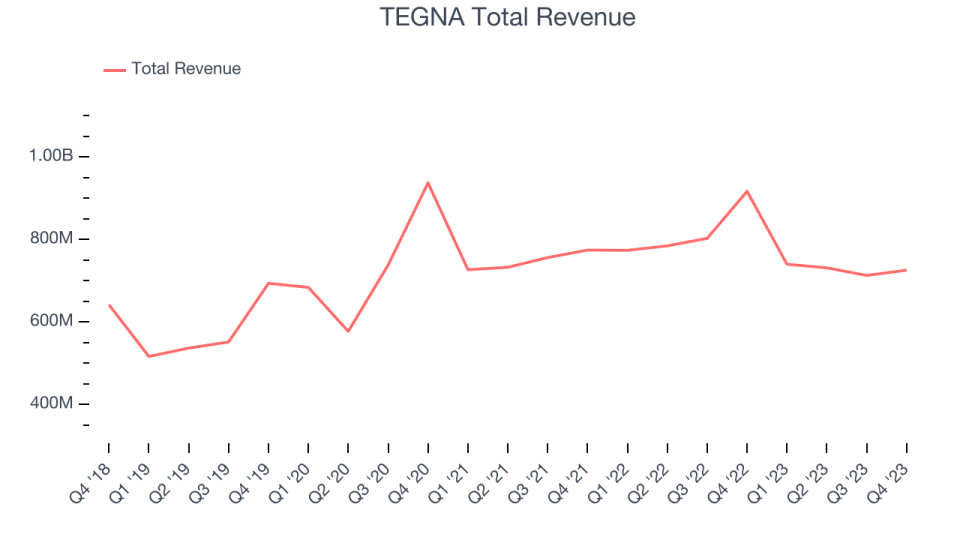

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. TEGNA's annualized revenue growth rate of 5.7% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. TEGNA's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 1.3% over the last two years.

We can dig even further into the company's revenue dynamics by analyzing its most important segments, Subscription and Advertising and Marketing Services, which are 46.7% and 48.5% of revenue. Over the last two years, TEGNA's Subscription revenue (access to content) averaged 2.1% year-on-year growth. On the other hand, its Advertising and Marketing Services revenue (showing advertisements) averaged 4.6% declines.

This quarter, TEGNA missed Wall Street's estimates and reported a rather uninspiring 20.9% year-on-year revenue decline, generating $725.9 million of revenue. Looking ahead, Wall Street expects sales to grow 15% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

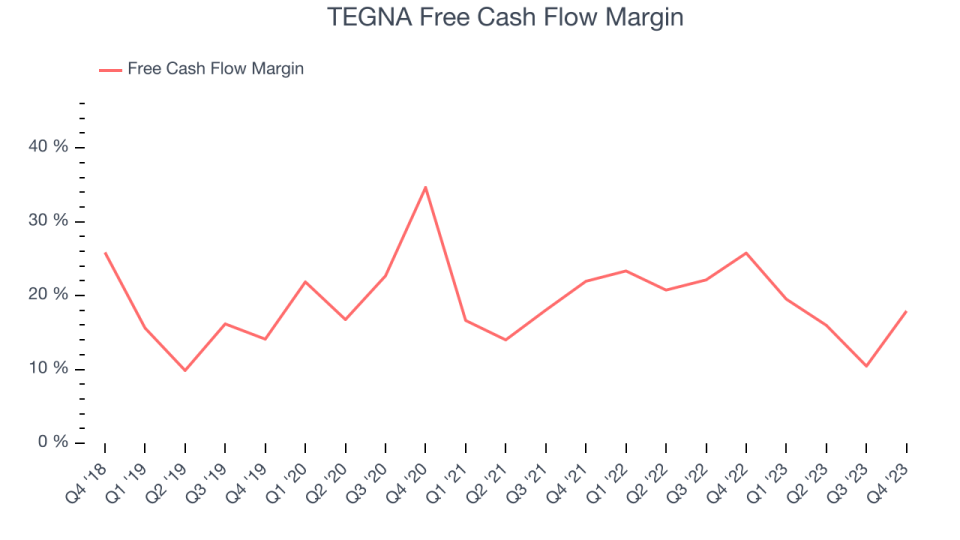

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, TEGNA has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 19.8%, quite impressive for a consumer discretionary business.

TEGNA's free cash flow came in at $130 million in Q4, equivalent to a 17.9% margin and down 45% year on year. Over the next year, analysts predict TEGNA's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 16% will increase to 19.4%.

Key Takeaways from TEGNA's Q4 Results

We struggled to find many strong positives in these results. Its revenue and EPS unfortunately missed Wall Street's estimates as its higher-margin subscription revenue came in lower-than-expected ($339 million vs estimates of $362 million).

The company is also revamping its capital allocation framework and expects to return 40-60% of its free cash flow in 2024-2025 to shareholders in the form of share repurchases and dividends. The remaining free cash flow will be used for organic investments, bolt-on acquisitions, and future debt retirement. Furthermore, on February 8th, 2024, TEGNA sold its interest in BMI (Broadcast Music) to a shareholder group led by New Mountain Capital for ~$153 million in pre-tax cash proceeds.

Overall, this was a mixed quarter for TEGNA, but the company seems to be shaking up its strategy. The stock is flat after reporting and currently trades at $13.65 per share.

So should you invest in TEGNA right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.