Teladoc Health Inc (TDOC) Reports Growth Amidst Challenges in 2023 Earnings

Revenue: Increased by 8% to $2.6 billion in 2023.

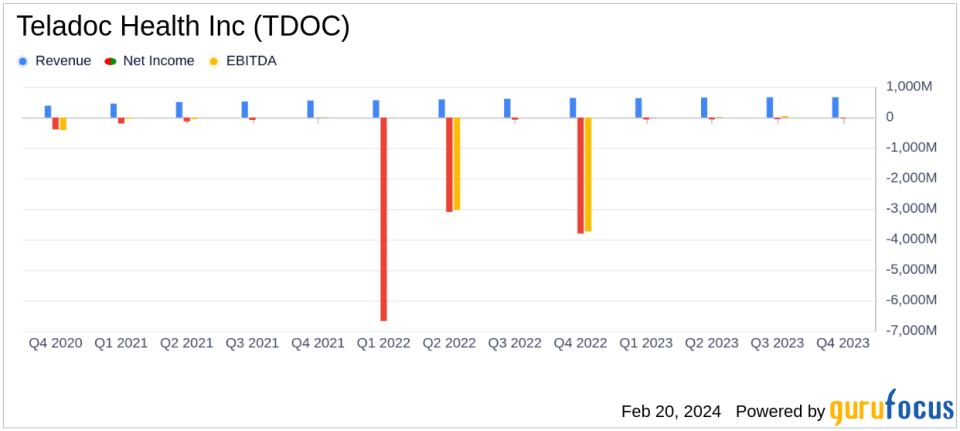

Net Loss: Narrowed significantly to $220.4 million in 2023 from $13.7 billion in 2022.

Adjusted EBITDA: Grew by 33% to $328.1 million, marking the company's most profitable year.

Operating Cash Flow: Improved to $350 million, up from $189.3 million in the previous year.

Free Cash Flow: Increased to $193.7 million from $16.5 million in 2022.

2024 Guidance: Revenue projected between $2.635 - $2.735 billion with adjusted EBITDA of $350 - $390 million.

On February 20, 2024, Teladoc Health Inc (NYSE:TDOC) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a global leader in virtual healthcare, reported a revenue increase of 4% in Q4 and 8% for the full year, reaching $2.6 billion. Despite a challenging macro-economic environment, Teladoc Health achieved a net loss reduction and significant growth in adjusted EBITDA, which rose by 33% to $328.1 million, indicating the company's most profitable year to date.

Company Overview

Teladoc Health is a pioneering provider of virtual health services, offering 24-hour healthcare via mobile devices, the internet, video, and phone. It specializes in telehealth, remote patient monitoring for chronic care management, and connects members with a vast network of physicians and behavioral health professionals. The company generates most of its revenue from subscription-based access fees and has established partnerships with employers, health plans, and health systems, while also directly marketing to consumers and expanding its service offerings.

Financial Highlights and Challenges

The company's financial achievements in 2023 reflect its resilience and strategic focus on margin improvement and bottom-line performance. Teladoc Health's net loss narrowed to $220.4 million, or $1.34 per share, from a significant loss in the previous year, primarily due to non-cash goodwill impairment charges. The adjusted EBITDA increase is a testament to the company's operational efficiency and ability to generate profit despite economic headwinds.

However, challenges remain, as the net loss indicates ongoing pressures on profitability. The company's focus on innovative offerings, such as integrated app experiences and provider-based chronic condition management, are crucial in differentiating Teladoc Health in a competitive marketplace. As the company looks ahead to 2024, it remains committed to serving its global client base and improving its financial standing through operating leverage and expense reduction.

Key Financial Metrics

Important metrics from the income statement include a 4% growth in access fees revenue to $573.9 million and a 3% increase in other revenue to $86.6 million. The U.S. and International revenues also saw growth, with the U.S. segment growing by 2% and the International segment by 15%. The Integrated Care segment's revenue increased by 8%, while the BetterHelp segment's revenue remained flat.

The balance sheet reflects a strong cash position of $1,123.7 million as of December 31, 2023. The cash flow statement shows a robust operating cash flow of $350 million and a free cash flow of $193.7 million, indicating healthy liquidity and financial flexibility.

In 2023 in the midst of a challenging macro-economic environment we reported meaningful progress in generating higher margins and delivering strong bottom-line performance," said Jason Gorevic, CEO of Teladoc Health.

Analysis of Company Performance

Teladoc Health's performance in 2023 demonstrates its ability to grow and optimize its operations in a difficult economic climate. The significant reduction in net loss and the increase in adjusted EBITDA highlight the company's successful cost management and operational efficiencies. The growth in revenue, coupled with the expansion of its service offerings, positions Teladoc Health to continue leading the virtual care industry.

The company's guidance for 2024, with expected revenue growth and adjusted EBITDA improvements, suggests confidence in its strategic direction and operational initiatives. The focus on efficiency programs and cost reductions is expected to yield a net pre-tax expense reduction of approximately $43 million in 2024, further enhancing profitability.

For value investors and potential GuruFocus.com members, Teladoc Health Inc (NYSE:TDOC) presents a case of a company navigating through economic challenges with strategic focus and operational discipline. The company's commitment to innovation and global service delivery, combined with its improving financial metrics, make it a noteworthy entity in the healthcare providers and services industry.

For further details on Teladoc Health Inc's financial performance and strategic outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Teladoc Health Inc for further details.

This article first appeared on GuruFocus.