Teledyne Technologies Inc: A High-Performing Stock with a GF Score of 93

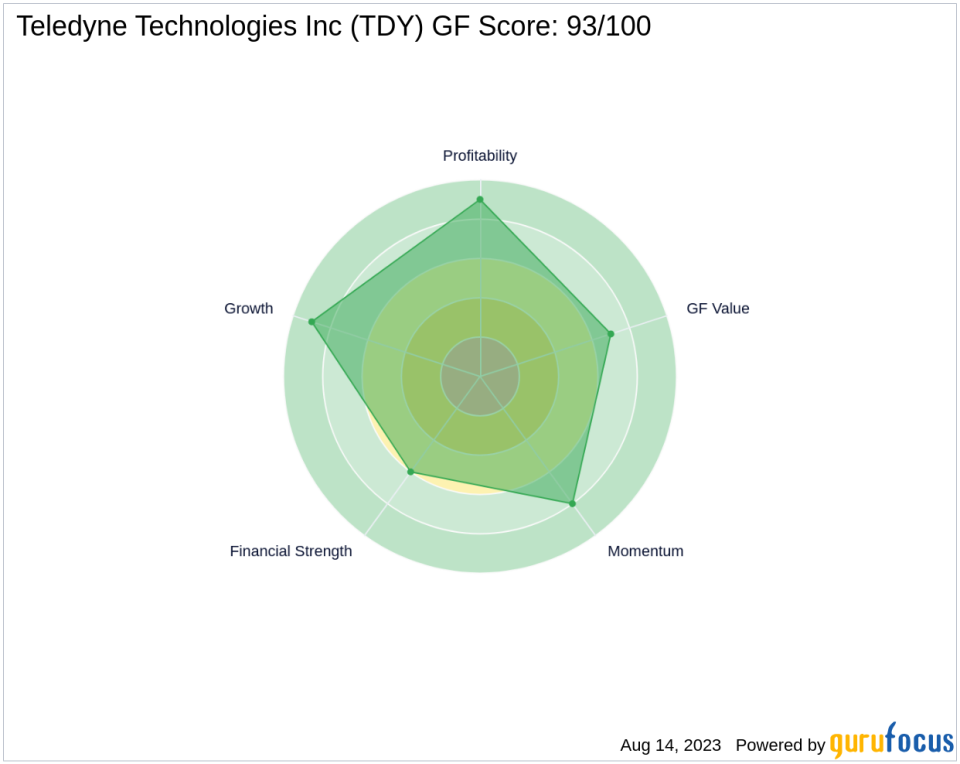

Teledyne Technologies Inc (NYSE:TDY), a leading player in the hardware industry, is currently trading at $399.45 with a market cap of $18.8 billion. The company's stock has seen a gain of 4.19% today, despite a slight loss of 2.71% over the past four weeks. In this article, we will delve into the company's GF Score of 93 out of 100, which indicates the highest outperformance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which is closely correlated with the long-term performances of stocks.

Financial Strength Analysis

Teledyne Technologies Inc has a Financial Strength rank of 6/10. This rank measures the company's financial situation based on its debt burden, debt to revenue ratio, and Altman Z-Score. The company's interest coverage is 11.59, indicating a low debt burden. Its debt to revenue ratio is 0.60, which is relatively low, and its Altman Z score is 3.15, suggesting a low bankruptcy risk.

Profitability Rank Analysis

The company's Profitability Rank is 9/10, indicating high profitability. This rank is based on factors such as operating margin, Piotroski F-Score, trend of the operating margin, consistency of profitability, and Predictability Rank. The company's operating margin is 18.20%, and its Piotroski F-Score is 7, suggesting a healthy financial situation. The company has shown consistent profitability over the past 10 years.

Growth Rank Analysis

Teledyne Technologies Inc has a Growth Rank of 9/10, indicating strong growth in terms of its revenue and profitability. The company's 5-year revenue growth rate is 9.40%, and its 3-year revenue growth rate is 10.70%. Its 5-year EBITDA growth rate is 17.20%, suggesting a strong growth trajectory.

GF Value Rank Analysis

The company's GF Value Rank is 7/10, which is determined by the price-to-GF-Value ratio. This rank suggests that the company's stock is reasonably valued.

Momentum Rank Analysis

Teledyne Technologies Inc has a Momentum Rank of 8/10, indicating strong momentum in its stock price. This rank is determined using the standardized momentum ratio and other momentum indicators.

Competitor Analysis

When compared to its competitors in the hardware industry, Teledyne Technologies Inc holds a strong position. Garmin Ltd (NYSE:GRMN) has a GF Score of 95, Trimble Inc (NASDAQ:TRMB) has a GF Score of 87, and Cognex Corp (NASDAQ:CGNX) has a GF Score of 92. You can find more details about these competitors here.

Conclusion

In conclusion, Teledyne Technologies Inc's overall GF Score of 93 suggests a high potential for outperformance. The company's strong financial strength, high profitability, robust growth, reasonable valuation, and strong momentum indicate a promising future performance. However, investors should continue to monitor the company's performance and market trends for a more comprehensive investment decision.

This article first appeared on GuruFocus.