Teleflex (TFX) Advances Urology Portfolio With New Buyout

Teleflex Incorporated TFX has completed its previously announced acquisition of Palette Life Sciences AB. Through the acquisition, TFX's Interventional Urology offering now includes Barrigel — a biodegradable and sculptable rectal spacer.

On Jul 26, Teleflex announced entering into a definitive agreement to acquire Palette. Per the terms of the agreement, TFX acquired Palette for an upfront cash payment of $600 million at closing, with additional consideration of up to $50 million upon the attainment of certain commercial milestones.

Few Words on Palette Life Sciences

The main offering of Palette Life Sciences is Barrigel, a Non-Animal Stabilised Hyaluronic Acid (NASHA) spacer, that is intended to lessen the amount of radiation given to the rectum during prostate cancer radiation therapy while enhancing tumor management and patient quality of life. In all sites of service, Barrigel enables one-step assembly, which is readily shaped and highly visible on transrectal ultrasonography. It is also biodegradable and reversible.

Additionally, the Palette Life Sciences portfolio includes the tissue bulking drugs Deflux and Solesta, which are based on NASHA and intended to treat pediatric vesicoureteral reflux and fecal incontinence, respectively.

Financial Details

Teleflex expects Palette’s net revenues around $56 million in 2023 on a standalone basis. In 2023, the acquisition is estimated to dilute adjusted earnings per share by 25 cents (excluding non-recurring purchase accounting adjustments and other acquisition and integration-related costs).

Image Source: Zacks Investment Research

The transaction is estimated to generate a high-teens to low 20% revenue growth profile in 2024 and to dilute adjusted earnings per share by approximately 35 cents (excluding non-recurring purchase accounting adjustments and other acquisition and integration-related costs). Following that, the deal is expected to be more accretive to adjusted EPS.

Strategic Efforts

The acquisition will broaden Teleflex Interventional Urology's portfolio, which already has the UroLift System, to include NASHA spacer and tissue bulking products that enhance patient outcomes in urology and urogynecology disorders, colorectal conditions and radiation oncology procedures.

Urologists, radiation oncologists and other experts will have access to more cutting-edge technologies through the purchase of Palette Life Sciences, which will enable TFX to integrate this intriguing technology into its Interventional Urology business line and improve patient care.

The buyout is in line with Teleflex's strategy of acquiring assets that accelerate its rate of expansion. The company anticipates that the transaction will immediately increase the adjusted gross margin and, in the near future, improve the adjusted operating margin.

Industry Prospects

Per Market Research Future, the global urology surgical instruments market size was estimated at $10.9 billion in 2022 and is expected to witness a CAGR of 8.1% from 2023 to 2030. The market is witnessing rapid growth due to numerous factors, including the rising geriatric population, the increasing prevalence of urological problems, and diseases like kidney stones, urinary incontinence and prostate cancer.

With urology being a growing market segment showing positive trends, the company expects the acquisition to further its strategic vision and play a role in providing differentiated technology to urologists and related specialties.

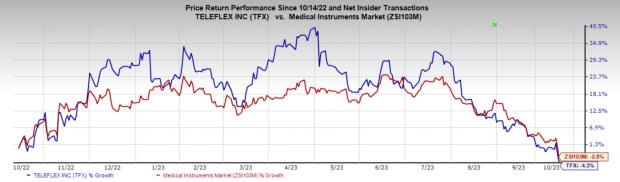

Price Performance

In the past six months, shares of TFX have declined 4.3% compared with the industry’s 2.8% decline.

Zacks Rank and Key Picks

Teleflex currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Quanterix QTRX and Align Technology ALGN, each carrying a Zacks Rank #2 (Buy) at present.

DaVita has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 25.5% against the industry’s 8.9% decline over the past year.

Estimates for Quanterix’s 2023 loss per share have remained constant at 97 cents in the past 30 days. Shares of the company have surged 141.5% in the past year against the industry’s fall of 5.6%.

QTRX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Estimates for Align Technology’s 2023 earnings have moved up from $8.77 to $8.78 per share in the past 30 days. Shares of the company have gained 27% in the past year compared with the industry’s rise of 14.3%.

ALGN’s earnings beat estimates in three of the trailing four quarters and missed in one. In the last reported quarter, it posted an earnings surprise of 9.90%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report