Teleflex (TFX) Enrolls First Patient in ACCESS-MANTA Registry

Teleflex TFX recently announced the enrollment of the first patient in the ACCESS-MANTA Registry. The international, multicenter, prospective, observational, single-arm clinical registry intends to examine and collect data on the outcomes of the contemporary on-label use of the MANTA Vascular Closure Device (“VCD”) in standard-of-care transcatheter aortic valve replacement (TAVR) procedures, including appropriate patient selection and proper vascular access.

The MANTA VCD — one of the primary product offerings of the company’s Interventional product category — is the first commercially available biomechanical VCD designed specifically for large-bore femoral arterial access site closure. The latest development comes as a boost for the segment.

Significance of the ACCESS-MANTA Registry

The ACCESS-MANTA Registry is set to enroll at least 250 patients in up to 15 major TAVR institutions across the United States and Canada. It will employ the primary objectives of safety defined by VCD large-bore access site-related Valve Academic Research Consortium-3 (VARC-3) major and minor vascular complications within 30 days of the TAVR procedure and effectiveness defined by time to hemostasis or the elapsed time between MANTA Device deployment and the first observed and confirmed arterial hemostasis.

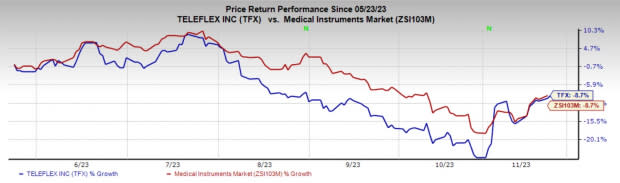

Image Source: Zacks Investment Research

The study will also evaluate technical success, treatment success, ambulation success, discharge readiness and procedure time. Since its first implantation in 2014, receiving its CE mark in 2016 and FDA approval in 2019, the MANTA Device has been well-studied in more than 10,000 patients and more than 70 publications.

News in Detail

Per TFX’s spokesperson, large-bore access site complications are recognized as morbid, driving increased costs and prolonged length of stay. Hence, percutaneous cardiac and peripheral procedures, such as TAVR, which are performed through large-bore arteriotomies, need dedicated closure technology that is safe, effective and procedurally efficient. The MANTA Device demonstrated these attributes in the pivotal SAFE MANTA IDE Clinical Trial — the largest prospective, multi-center study of a purpose-designed large-bore femoral arterial access site closure device to date in the United States.

However, the TAVR practice has since evolved to embrace routine access site imaging, awake procedures, somewhat smaller delivery systems and sheaths, lower-risk patients and considerably higher per-operator experience. Against this backdrop, the ACCESS-MANTA Registry will allow Teleflex to understand the degree to which these changes, coupled with a dedicated device that is optimally deployed, may improve large-bore outcomes.

Industry Prospects

Per a Research report, the global VCD market was valued at $1.5 billion in 2022 and is expected to witness a CAGR of nearly 6.5% by 2032.

Recent Highlights of the Interventional Business

In the last reported third quarter of 2023, Teleflex’s interventional business reported meaningful contributions from balloon pumps, access and closure in the 22.4% year-over-year growth. The company continued to build momentum in the complex PCI (Percutaneous Coronary Interventions) and emerging structural heart portfolios. TFX perceives MANTA as being on the trajectory for strong double-digit growth in 2023.

Earlier in June 2023, Teleflex expanded its Structural Heart portfolio with the Wattson Temporary Pacing Guidewire — the first commercially available bipolar temporary pacing guidewire designed specifically for use during TAVR and balloon aortic valvuloplasty. The full market release of the same is anticipated later this year.

Price Performance

In the past six months, TFX shares have decreased 8.7% compared with the industry’s decline of 8.7%.

Zacks Rank and Key Picks

Teleflex currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Insulet PODD and DexCom DXCM. Haemonetics and DexCom each presently carry a Zacks Rank #2 (Buy), and Insulet sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has decreased 2% in the past year. Earnings estimates for Haemonetics have increased from $3.82 to $3.86 in 2023 and $4.07 to $4.11 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 16.1%. In the last reported quarter, it posted an earnings surprise of 5.3%.

Estimates for Insulet’s 2023 earnings per share have increased from $1.61 to $1.90 in the past 30 days. Shares of the company have dropped 38% in the past year compared with the industry’s decline of 6.4%.

PODD’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 105.1%. In the last reported quarter, it delivered an average earnings surprise of 77.4%.

Estimates for DexCom’s 2023 earnings per share have increased from $1.23 to $1.43 in the past 30 days. Shares of the company have fallen 3.4% in the past year compared with the industry’s decline of 7.3%.

DXCM’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 36.4%. In the last reported quarter, it delivered an average earnings surprise of 47.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report