Teleflex (TFX) Q4 Earnings Top Estimates, Operating Margin Falls

Teleflex Incorporated TFX posted adjusted earnings per share (EPS) from continuing operations of $3.38 in the fourth quarter of 2023, down 4% from the year-ago quarter’s figure. However, the metric topped the Zacks Consensus Estimate by 3.7%.

GAAP EPS came in at 66 cents in the fourth quarter compared with $1.65 during the same period last year.

Full-year adjusted EPS was $13.52, reflecting a 3.5% increase from the year-ago period. The metric surpassed the Zacks Consensus Estimate by 0.8%.

Revenues in Detail

Net revenues in the fourth quarter rose 2.1% year over year to $773.9 million, up 0.7% on a constant exchange rate or CER. The top line surpassed the Zacks Consensus Estimate by 0.7%.

Full-year revenues were $2.97 billion, reflecting a 6.6% rise from the year-ago period (up 6.5% at CER). The metric came in line with the Zacks Consensus Estimate.

Segmental Details

Americas’ net revenues of $450.6 million fell 1.6% from the year-ago period’s levels (down 1.9% at CER). This compares with our model’s projection of $455.2 million for the fourth quarter.The decrease was mainly due to slower growth in the Vascular and Surgical business and also reflects the impact of five fewer shipping days.

EMEA’s (Europe, the Middle East and Africa) net revenues of $152.4 million rose 3.1% year over year but decreased 2.7% at CER. The decrease is attributed to Anesthesia and Surgical and the impact of fewer shipping days. Our model projected revenues to be $155.2 million in the fourth quarter.

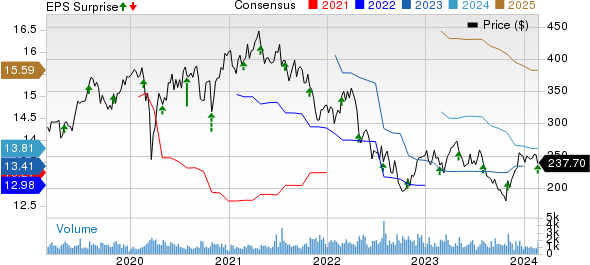

Teleflex Incorporated Price, Consensus and EPS Surprise

Teleflex Incorporated price-consensus-eps-surprise-chart | Teleflex Incorporated Quote

Revenues from Asia (Asia Pacific) rose 12.5% to $ 88.3 million (up 12.6% at CER). Our model’s projection was $84.3 million. The performance was driven by strong commercial execution and solid underlying demand.

OEM (Original Equipment Manufacturer and Development Services) revenues were $82.6 million, an increase of 12.1% year over year (up 10.9% at CER). Our model’s projected revenues were $72.2 million.

Product Revenues in Detail

In the fourth quarter, the Vascular Access segment recorded net revenues of $186.7 million, up 0.1% year over year. This compares with our model’s projection of $188.4 million for the fourth quarter.

The Interventional business registered net revenues of $135.6 million, up 8.5% compared to the same period last year. This compares with our model’s projection of $130.7 million for the fourth quarter.

Within the Anesthesia segment, net revenues fell 1.5% year over year to $98.2 million. This compares with our model’s projection of $101.2 million for the fourth quarter.

The Surgical segment recorded net revenues of $109.6 million, down 0.8% year over year. This compares with our model’s projection of $112.8 million for the fourth quarter.

Revenues in the Interventional Urology segment were $93 million, up 4.3% year over year. This compares with our model’s projection of $90.5 million for the fourth quarter.

OEM recorded revenue growth of $82.6 million, up 12.1% compared to the year-ago figure. This compares with our model’s projection of $77.2 million for the fourth quarter.

The Other product segment’s (consisting of the company’s respiratory products not included in the divestiture to Medline, manufacturing service agreement revenues and Urology Care products) net revenues of $68.2 million registered a year-over-year decline of 7.2%. This compares with our model’s projection of $66 million for the fourth quarter.

Margins

In the reported quarter, gross profit totaled $431.4 million, up 2.2% year over year. The gross margin expanded six basis points (bps) to 55.8% despite a 1.9% rise in the cost of goods sold.

Overall, adjusted operating profit was $134.9 million, down 7.6% year over year. The adjusted operating margin saw an 182-bps contraction year over year to 17.4%.

Liquidity Position

Teleflex exited the fourth quarter of 2023 with cash and cash equivalents of $222.8 million compared to $292 million at the end of 2022.

Cumulative cash flow provided by operating activities from continuing operations at the end of the fourth quarter of 2023 was $511.7 million compared with $342.8 million in the year-ago period.

2024 View

Teleflex provided its financial guidance for 2024.

GAAP revenue growth for 2024 is expected in the range of 3.6%-4.6%. The company’s constant-currency revenue growth expectation for 2024 lies in the 3.75%-4.75% range. The Zacks Consensus Estimate for total revenues is pegged at $3.09 billion.

The company expects 2024 adjusted EPS from continuing operations in the $13.55-$13.95 range. The Zacks Consensus Estimate is currently pegged at $13.81.

Our Take

Teleflex exited the fourth quarter of 2023 with better-than-expected revenues and earnings. The company’s performance demonstrated a solid execution against a stable and improving macro environment. Across the Asia region, revenue growth was broad-based, with strong double-digit increases in Korea, India and China. The expansion of the gross margin instills optimism.

The company is also proceeding with the integration of the Palette Life Sciences AB acquisition, which emphasizes Teleflex’s focus on expanding the use of rectal spacers in the treatment of prostate cancer. In 2024, TFX anticipates new product introductions with a number of launches across its business units.

Meanwhile, the bottom line registered a year-over-year decline in the fourth quarter. The contraction of the adjusted operating margin is concerning.

Zacks Rank and Key Picks

Teleflex currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Stryker Corporation SYK, Cencora, Inc. COR and Cardinal Health CAH.

Stryker, carrying a Zacks Rank #2 (Buy), reported a fourth-quarter 2023 adjusted EPS of $3.46, beating the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion outpaced the consensus estimate by 3.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker has an estimated earnings growth rate of 11.5% for 2025 compared with the S&P 500’s 9.9%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 5.1%.

Cencora, carrying a Zacks Rank #2, reported a first-quarter fiscal 2024 adjusted EPS of $3.28, which beat the Zacks Consensus Estimate by 14.7%. Revenues of $72.3 billion outpaced the Zacks Consensus Estimate by 5.1%.

COR has an earnings yield of 5.75% compared with the industry’s 1.85%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 6.7%.

Cardinal Health, sporting a Zacks Rank #1, reported second-quarter fiscal 2024 adjusted earnings of $1.82, which beat the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion improved 11.6% on a year-over-year basis and also topped the Zacks Consensus Estimate by 1.1%.

CAH has a long-term estimated earnings growth rate of 15.3% compared with the industry’s 11.8% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report