Teleflex (TFX) Rides on Urolift Prospects Amid Cost Pressures

Teleflex TFX banks on strong UroLift system prospects. The Vascular Solutions business has been contributing to the company’s top line quite handsomely. Yet, escalating operating expenses are putting immense pressure on the bottom line. Teleflex currently carries a Zacks Rank #3 (Hold).

The company’s flagship minimally invasive technology, UroLift, is gaining market share, banking on its success in treating lower urinary tract symptoms due to benign prostatic hyperplasia (BPH). Currently, more than 425,000 men have been treated with the UroLift System in select markets worldwide.

Despite being impacted by the ongoing macro headwinds, the preference for UroLift over other outpatient BPH treatments continued to be driven by strong clinical results. Several studies on UroLift have demonstrated rapid symptom relief and recovery, no new sustained sexual dysfunction and durable results.

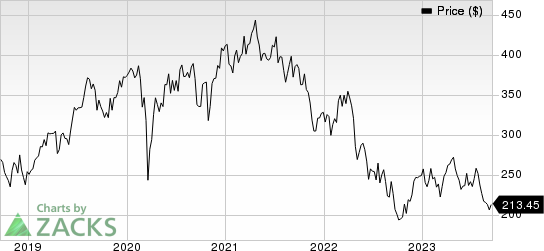

Teleflex Incorporated Price

Teleflex Incorporated price | Teleflex Incorporated Quote

With respect to Teleflex’s market development objectives for UroLift, during the second quarter of 2023, TFX witnessed year-over-year growth for UroLift in the hospital setting. The overseas launch activities continue to progress in line with expectations with Japan UroLift usage, which is growing in line with the company’s expectations. Management stated that at present, 97% of physicians using UroLift also treat prostate cancer.

In terms of an international expansion strategy for UroLift, Teleflex made considerable progress in its geographic expansion with entry into several new markets during 2022, including Japan and China. The company will spend 2023 training surgeons, building its presence in key cities and continuing to engage with the Chinese Urological Society to build acceptance.

Further, the Vascular Access product category is gaining from the offering of devices that facilitate a variety of critical care therapies and other applications, with a focus on helping reduce vascular-related complications.

The Interventional product category is benefiting from the offering of devices that facilitate a variety of applications to diagnose and deliver treatment via the vascular system of the body. These products primarily consist of a variety of coronary catheters, structural heart support devices, peripheral intervention products and mechanical circulatory support platforms used by interventional cardiologists, interventional radiologists and vascular surgeons.

On the flip side, Teleflex has been grappling with escalated expenses for a while. Deteriorating international trade, with global inflationary pressure leading to a tough situation related to raw material and labor costs, as well as freight charges and rising interest rates, all have put the medical device space in a tight spot.

Apart from this, Teleflex has implemented a number of restructuring, realignment and cost reduction initiatives, including facility consolidations, organizational realignments and reductions in workforce. While the company has historically realized some efficiencies from these initiatives, it may fail to realize the benefits of these or future initiatives to the expected extent. All these issues are putting pressure on the bottom line.

In the second quarter, Teleflex’s selling, general and administrative expenses rose 2.9%, while research and development expenses rose 6.8%. Management noted that the adjusted operating margin was 26.6% in the second quarter and decreased 90 basis points year over year due to increased headcount and employee-related expenses, investments to grow the business and the inclusion of Standard Bariatrics.

Meanwhile, Teleflex competes with companies, ranging from small start-up enterprises to larger and more established companies that have access to significantly greater financial resources. Furthermore, extensive product research and development and rapid technological advances characterize the market in which it competes. According to Teleflex, it competes primarily on the basis of clinical superiority and innovative features that enhance patient benefit, product reliability, performance, customer and sales support and cost-effectiveness.

Over the past year, shares of Teleflex have declined 4.2% compared with the industry’s 0.5% drop.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, Quanterix QTRX and SiBone SIBN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Haemonetics’ stock has gained 15.2% in the past year. Earnings estimates for Haemonetics have increased from $3.56 to $3.74 in 2023 and $3.96 to $4.07 in 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.39%. In the last reported quarter, it posted an earnings surprise of 38.16%.

Estimates for Quanterix’s 2023 loss per share have narrowed from $1.19 to 97 cents in the past 30 days. Shares of the company have gained 166.1% in the past year against the industry’s decline of 5.3%.

QTRX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Estimates for SiBone’s 2023 loss have narrowed from $1.42 to $1.27 per share in the past 30 days. Shares of the company have gained 21.5% in the past year against the industry’s fall of 5.1%.

SIBN’s earnings beat estimates in all the trailing four quarters, the average surprise being 20.37%. In the last reported quarter, SiBone delivered an earnings surprise of 26.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report

SiBone (SIBN) : Free Stock Analysis Report