Teleflex's (TFX) Urolift Global Expansion Aids Amid Cost Woes

Teleflex TFX continues to report improvement in revenues banking on strategic acquisitions and market development objectives. However, rising expenses weigh on the bottom line. The stock carries a Zacks Rank #3 (Hold).

Teleflex exited the first quarter of 2023 on a bullish note with better-than-expected revenues and earnings. The year-over-year revenue growth was driven by all global product categories and higher overall margins year over year.

Teleflex’s Interventional Surgical and OEM product categories generated double-digit constant currency revenue growth year over year during the first quarter. The company witnessed strength across all geographies. China remained a solid contributor with very high single-digit growth in the quarter. The raised 2023 revenue outlook buoys optimism.

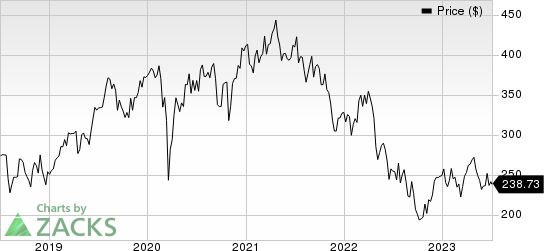

Teleflex Incorporated Price

Teleflex Incorporated price | Teleflex Incorporated Quote

With respect to Teleflex’s market development objectives for UroLift, during the first quarter of 2023, the company witnessed growth in the hospital setting. It continues to expect the U.S. end market for UroLift to continue to improve as it progresses through 2023.

In terms of the international expansion strategy for UroLift, Teleflex made considerable progress in the geographic expansion of UroLift with entry into several new markets during 2022, including Japan and China. The company will spend 2023 training surgeons, building a presence in key cities and continue engaging with the Chinese Urological Society to build acceptance.

Further, following the $976-million acquisition of Vascular Solutions, there has been accelerated growth within Teleflex’s vascular and interventional access product portfolios. During the first quarter of 2023, Vascular access revenues grew 9.2%, led by solid performance across the portfolio.

On the flip side, on the first-quarter earnings call, management stated that through the first two months of the quarter, patient flow declined by another 3.7%. Moreover, Teleflex lowered its GAAP adjusted earnings per share guidance to $8.14 to $8.74, primarily due to a one-time tax item.

Further, escalating expenses put pressure on Teleflex’s operating margin. In the first quarter, the company’s selling, general and administrative expenses rose 13%. Research and development expenses increased 14.1%. Adjusted operating margin saw a 2-bp contraction year over year to 16.5%.

Foreign exchange and a competitive environment remain concerns.

Over the past year, Teleflex has underperformed the industry. The stock has declined 7.4% in this period against a 10.3% rise of the industry.

Key Picks

Some better-ranked stocks in the overall healthcare sector are Penumbra PEN, Lantheus LNTH and Haemonetics HAE, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Penumbra’s stock has risen 173.7% in the past year. The Zacks Consensus Estimate for Penumbra’s earnings per share (EPS) has remained constant at $1.56 for 2023 and at $2.56 for 2024 in the past 30 days.

PEN’s earnings beat estimates in each of the trailing four quarters, the average surprise being 109.42%. In the last reported quarter, the company registered an earnings surprise of 109.09%.

The Zacks Consensus Estimate for Lantheus’ 2023 EPS has remained constant at $5.60 in the past 30 days. Shares of the company have improved 32.2% in the past year against the industry’s 21.6% decline.

LNTH’s earnings beat estimates in each of the trailing four quarters, the average surprise being 25.77%. In the last reported quarter, the company recorded an earnings surprise of 13.95%.

Estimates for Haemonetics’ EPS have increased from $3.29 to $3.55 for 2023 in the past 30 days. Shares of the company have increased 26.5% in the past year against the industry’s 21.6% decline.

HAE’s earnings beat estimates in each of the trailing four quarters, the average surprise being 12.21%. In the last reported quarter, Haemonetics delivered an earnings surprise of 13.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report