Telekom Deutsche Sells 389,820 Shares of T-Mobile US Inc (TMUS)

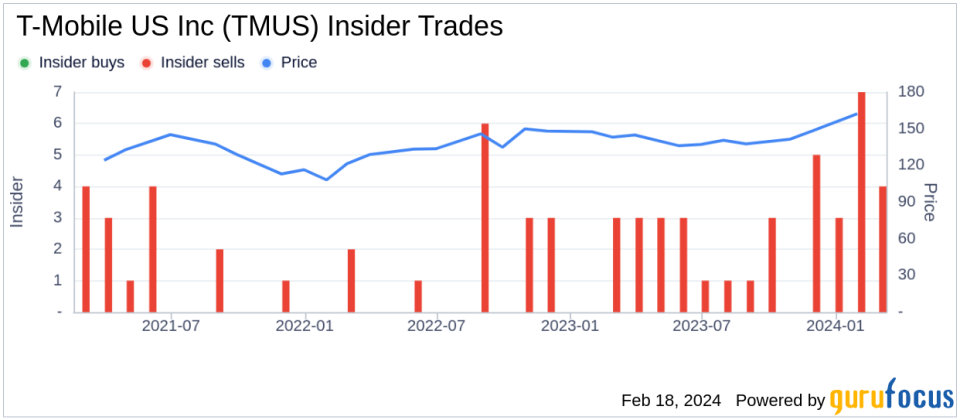

Telekom Deutsche, a director and 10% owner of T-Mobile US Inc (NASDAQ:TMUS), sold 389,820 shares of the company on February 15, 2024, according to a recent SEC filing. The transaction was executed at a stock price of $161.42, resulting in a total value of $62,914,034.40.T-Mobile US Inc is a major wireless network operator in the United States. The company provides wireless voice, messaging, and data services in the U.S., Puerto Rico, and the U.S. Virgin Islands under the T-Mobile and Metro by T-Mobile brands. The company's advanced nationwide 4G LTE network delivers outstanding wireless experiences to millions of customers who are unwilling to compromise on quality and value.Over the past year, Telekom Deutsche has sold a total of 5,847,300 shares and has not made any purchases of T-Mobile US Inc stock. This latest sale continues a trend of insider selling at the company, with a total of 36 insider sells and no insider buys over the past year.

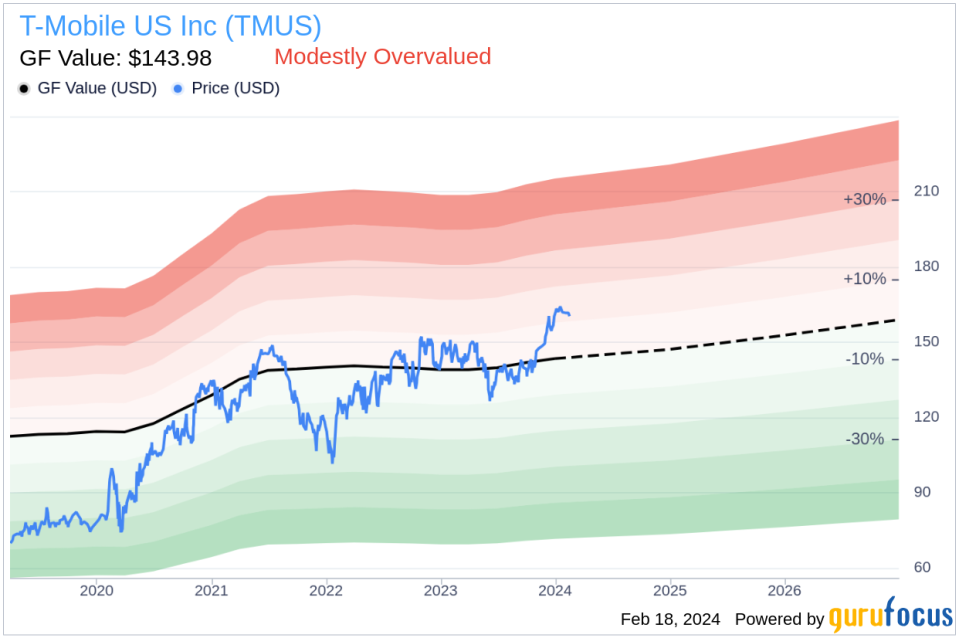

The market capitalization of T-Mobile US Inc stands at $190.385 billion as of the date of the insider's recent sale. The stock's price-earnings ratio is 23.15, which is above the industry median of 15.735 but below the company's historical median price-earnings ratio.According to the GF Value, with a price of $161.42 and a GuruFocus Value of $143.98, T-Mobile US Inc has a price-to-GF-Value ratio of 1.12, indicating that the stock is modestly overvalued.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future business performance estimates provided by Morningstar analysts.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.