Telephone and Data Systems Inc Reports Challenging Q4 and Full Year 2023 Results Amid Goodwill ...

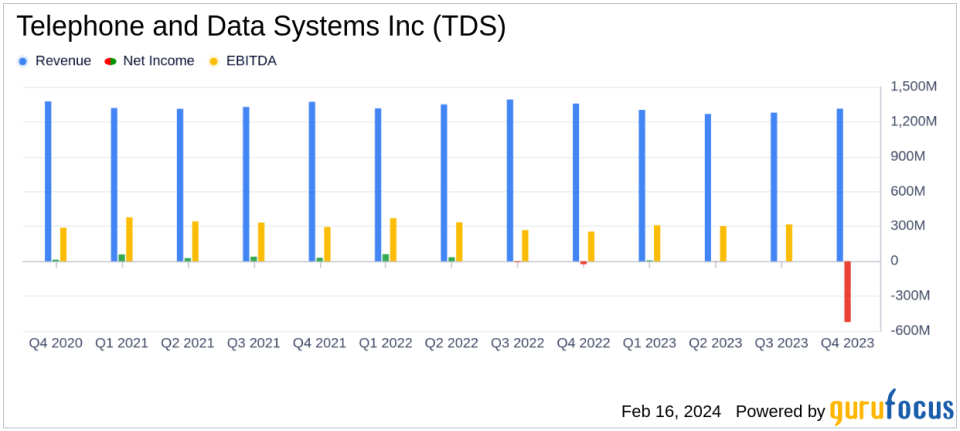

Total Operating Revenues: $1,313 million in Q4 2023, down from $1,357 million in Q4 2022.

Net Loss: $(523) million in Q4 2023 compared to $(43) million in Q4 2022, significantly impacted by a goodwill impairment charge.

Diluted Earnings Per Share (EPS): $(4.64) in Q4 2023, down from $(0.38) in Q4 2022.

UScellular Segment: Postpaid ARPU grew 2%, with fixed wireless customers up 46% to 114,000.

TDS Telecom Segment: Delivered 217,000 fiber service addresses, with residential broadband connections growing 6%.

2024 Guidance: Provides estimated results for UScellular and TDS Telecom, indicating a focus on profitability and network expansion.

On February 16, 2024, Telephone and Data Systems Inc (NYSE:TDS) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The diversified telecommunications operator, which provides mobile, telephone, and broadband services through its UScellular and TDS Telecom segments, faced a challenging year marked by a significant net loss primarily due to a non-cash goodwill impairment charge at TDS Telecom.

Financial Performance Overview

For the fourth quarter of 2023, TDS reported total operating revenues of $1,313 million, a decrease from $1,357 million in the same period the previous year. The net loss attributable to TDS common shareholders was $(523) million, with a diluted loss per share of $(4.64), compared to a net loss of $(43) million and a diluted loss per share of $(0.38) for the fourth quarter of 2022. This loss was significantly impacted by a $547 million goodwill impairment charge at TDS Telecom. Excluding this charge, the net loss for the fourth quarter of 2023 would have been $(12) million, with a diluted loss per share of $(0.11).

For the full year, TDS reported operating revenues of $5,160 million for 2023, down from $5,413 million in 2022. The annual net loss was $(569) million, with a diluted loss per share of $(5.06), compared to a net loss of $(7) million and a diluted loss per share of $(0.07) for 2022. Excluding the goodwill impairment charge, the net loss for 2023 would have been $(58) million, with a diluted loss per share of $(0.53).

Segment Performance and Challenges

The UScellular segment saw a 2% growth in postpaid Average Revenue Per User (ARPU) and an 8% increase in tower rental revenues to $100 million. The segment also generated positive free cash flow and increased cash flows from operating activities. However, it faced challenges in the competitive mobility subscriber environment, which impacted subscriber numbers.

TDS Telecom exceeded its full-year 2023 fiber address goal, delivering 217,000 fiber service addresses and expanding its footprint by 12%. Residential broadband connections grew by 6%, and residential revenue per connection increased by 4%. Despite these achievements, the goodwill impairment charge significantly affected the segment's financial results.

2024 Guidance and Strategic Focus

Looking ahead to 2024, TDS provided guidance for both UScellular and TDS Telecom, with a focus on improving customer results, growth in fixed wireless and towers, and maintaining financial discipline. TDS Telecom plans to increase broadband penetration and revenues across its fiber footprint, aiming for improved profitability.

Additionally, TDS and UScellular are exploring strategic alternatives for UScellular, with the process still ongoing as of the report date. This move could potentially lead to significant changes in the company's structure and strategy.

Conclusion

Telephone and Data Systems Inc's 2023 results reflect the challenges faced in a competitive telecommunications market, compounded by a substantial goodwill impairment charge. However, the company's continued investment in its networks and strategic initiatives aimed at growth and profitability provide a forward-looking perspective for 2024. Investors and stakeholders will be watching closely as TDS navigates the evolving landscape and strives to enhance shareholder value.

For more detailed information, readers are encouraged to review the full 8-K filing and consider joining the teleconference hosted by TDS to discuss these results and future prospects.

Explore the complete 8-K earnings release (here) from Telephone and Data Systems Inc for further details.

This article first appeared on GuruFocus.