Telephone and Data Systems Inc's Meteoric Rise: Unpacking the 188% Surge in Just 3 Months

Telephone and Data Systems Inc (NYSE:TDS), a diversified telecommunications operator, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by a staggering 187.63%, from $9.99 to $18.98. This impressive performance has been accompanied by a market cap of $2.14 billion. Over the past week, the stock price has seen a gain of 3.94%, indicating a strong upward trend.

When comparing the current GF Value of $19.09 with the past GF Value of $19.95, it's clear that the stock is currently fairly valued. This is a significant shift from three months ago when the stock was considered a possible value trap. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates.

Company Overview: Telephone and Data Systems Inc (NYSE:TDS)

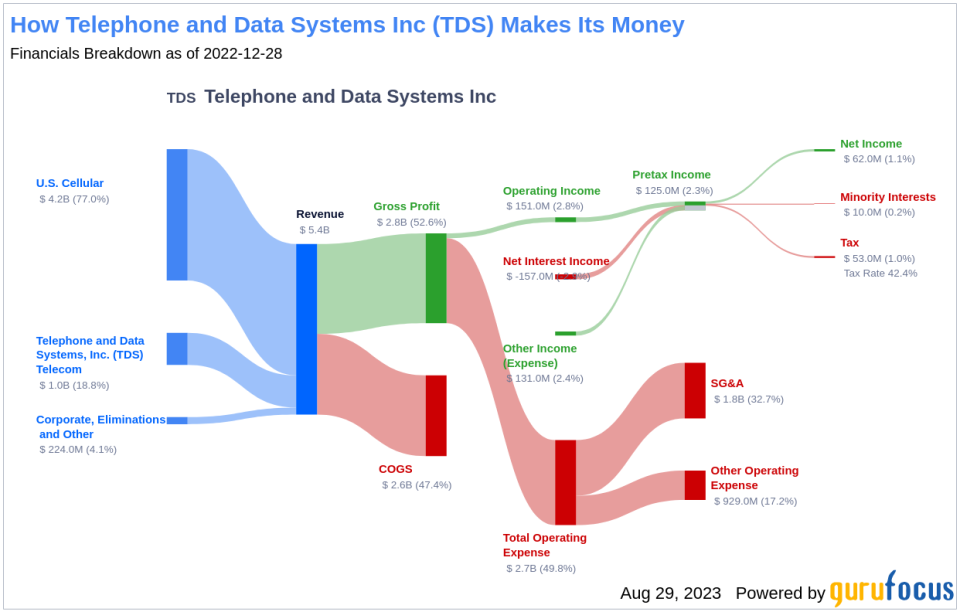

Telephone and Data Systems Inc operates within the Telecommunication Services industry, providing mobile, telephone, and broadband services. The company's revenue is primarily generated from its UScellular and TDS Telecom segments.

Profitability Analysis

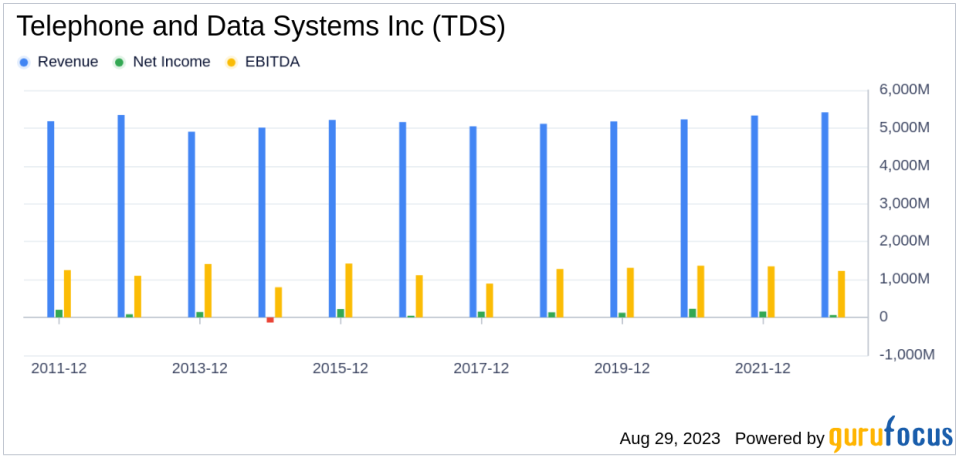

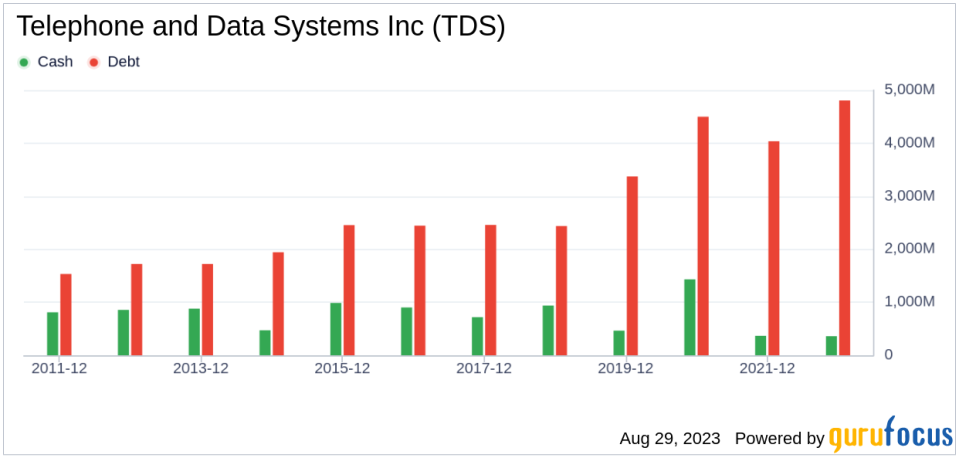

Telephone and Data Systems Inc has a Profitability Rank of 6/10, indicating a moderate level of profitability compared to its industry peers. The company's Operating Margin stands at 1.13%, better than 24.55% of the companies in the industry. However, the company's ROE and ROA are -0.46% and -0.19% respectively, which are lower than the industry average. The company's ROIC of 1.08% is better than 31.73% of the companies in the industry. Over the past 10 years, the company has been profitable for 9 years, better than 66.05% of the companies in the industry.

Growth Prospects

The company's Growth Rank is 5/10, indicating moderate growth compared to its industry peers. The company's 3-Year Revenue Growth Rate per Share is 2.10%, better than 45% of the companies in the industry. The 5-Year Revenue Growth Rate per Share is 1.00%, better than 45.69% of the companies in the industry.

Major Holders

The top three holders of Telephone and Data Systems Inc's stock are Mario Gabelli (Trades, Portfolio), Caxton Associates (Trades, Portfolio), and Barrow, Hanley, Mewhinney & Strauss, holding 1.86%, 0.03%, and less than 0.01% of the company's stock respectively.

Competitive Landscape

Telephone and Data Systems Inc operates in a competitive industry with major players such as Globalstar Inc (GSAT) with a market cap of $2.37 billion, Liberty Latin America Ltd (NASDAQ:LILA) with a market cap of $1.93 billion, and InterDigital Inc (NASDAQ:IDCC) with a market cap of $2.23 billion.

Conclusion

In conclusion, Telephone and Data Systems Inc has shown impressive stock performance over the past three months, with a significant surge in its stock price. The company's profitability and growth prospects are moderate compared to its industry peers. The company's stock is held by notable investors and operates in a competitive industry. The company's current position and future prospects make it a stock to watch in the Telecommunication Services industry.

This article first appeared on GuruFocus.