Telephone and Data Systems (NYSE:TDS) Is Paying Out A Larger Dividend Than Last Year

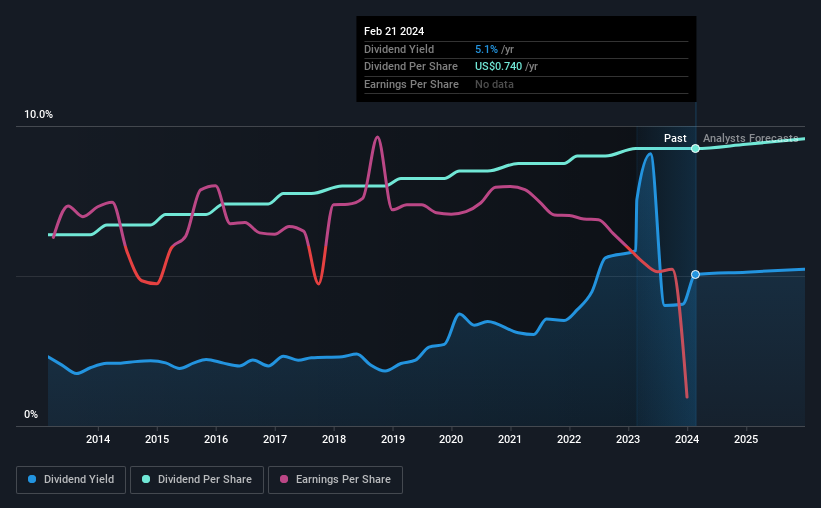

The board of Telephone and Data Systems, Inc. (NYSE:TDS) has announced that the dividend on 28th of March will be increased to $0.19, which will be 2.7% higher than last year's payment of $0.185 which covered the same period. This takes the dividend yield to 5.1%, which shareholders will be pleased with.

View our latest analysis for Telephone and Data Systems

Telephone and Data Systems Doesn't Earn Enough To Cover Its Payments

A big dividend yield for a few years doesn't mean much if it can't be sustained. Despite not generating a profit, Telephone and Data Systems is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Earnings per share is forecast to rise by 109.0% over the next year. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 170% over the next year.

Telephone and Data Systems Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from an annual total of $0.51 in 2014 to the most recent total annual payment of $0.74. This works out to be a compound annual growth rate (CAGR) of approximately 3.8% a year over that time. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Over the past five years, it looks as though Telephone and Data Systems' EPS has declined at around 51% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Telephone and Data Systems' Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Telephone and Data Systems' payments are rock solid. Although they have been consistent in the past, we think the payments are a little high to be sustained. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for Telephone and Data Systems that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.