TELUS Corp's Dividend Analysis

Assessing the Sustainability and Growth of TELUS Corp's Dividends

TELUS Corp (NYSE:TU) recently announced a dividend of $0.38 per share, payable on 2024-04-01, with the ex-dividend date set for 2024-03-08. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into TELUS Corp's dividend performance and assess its sustainability.

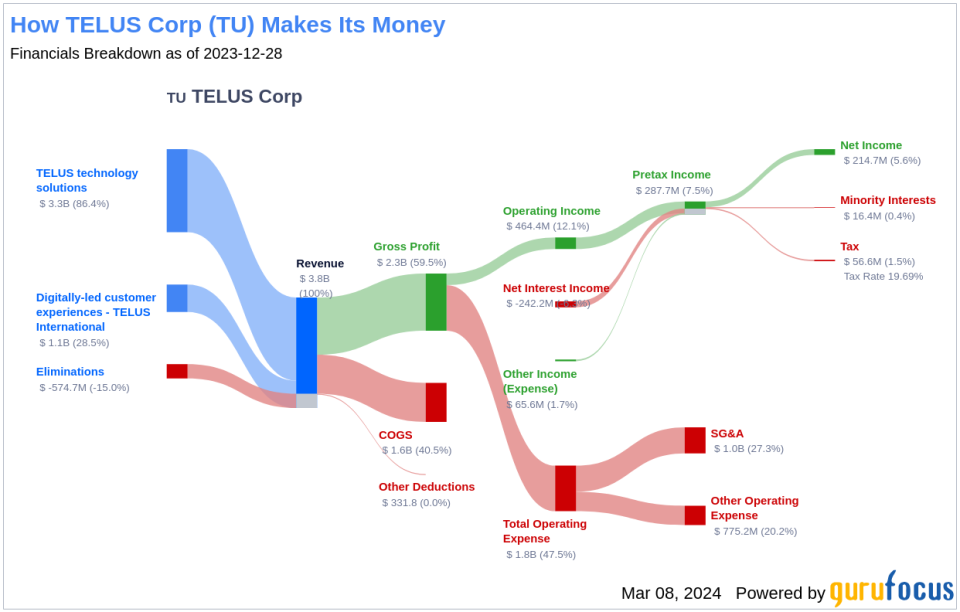

What Does TELUS Corp Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

TELUS Corp is a leading telecommunications company in Canada, providing a wide range of services including mobile phone, internet, television, and landline phone services. With a significant market share in wireless services and a growing presence in various non-telecom industries, TELUS Corp continues to diversify its offerings. The company's commitment to innovation and customer service solidifies its position in the competitive telecom market.

A Glimpse at TELUS Corp's Dividend History

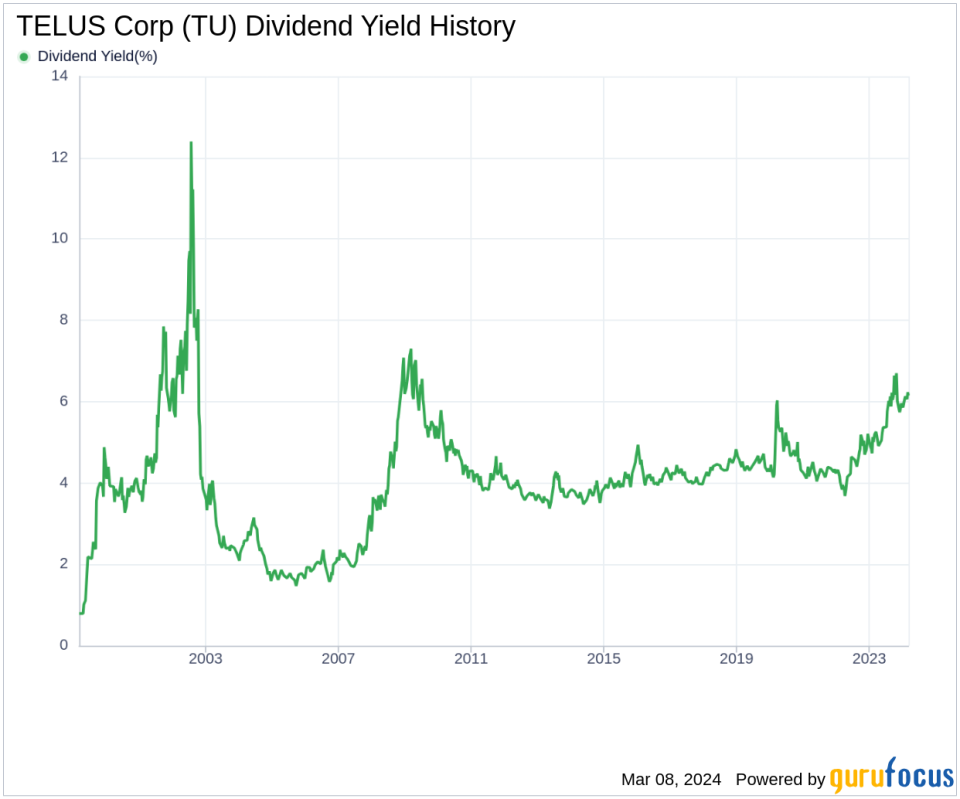

TELUS Corp has a long-standing reputation as a reliable dividend payer, with a history of consistent dividend payments since 1999. The company's dedication to returning value to shareholders is evident in its status as a dividend achiever, having increased its dividend annually for over two decades. This track record reflects TELUS Corp's financial stability and commitment to its dividend policy.

Below is a chart showing annual Dividends Per Share for tracking historical trends.

Breaking Down TELUS Corp's Dividend Yield and Growth

TELUS Corp's current trailing dividend yield of 6.14% and forward dividend yield of 6.32% suggest a positive outlook for dividend growth. The company's past dividend growth rates also paint a promising picture, with a 7.10% three-year, a 6.70% five-year, and a 7.50% ten-year annual growth rate. These figures demonstrate TELUS Corp's ability to consistently increase shareholder value through dividends.

Considering the dividend yield and growth rates, the 5-year yield on cost for TELUS Corp stock is approximately 8.49%, highlighting the potential for attractive long-term returns for investors.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of TELUS Corp's dividends can be gauged by examining its dividend payout ratio. Currently, the ratio stands at 2.72, which may raise concerns about the long-term sustainability of the dividend payments. However, the company's profitability rank of 7 out of 10 suggests robust earnings compared to peers and a solid foundation for future dividend payments.

TELUS Corp's consistent net income over the past decade further supports the company's financial health and its ability to maintain its dividend policy.

Growth Metrics: The Future Outlook

TELUS Corp's growth rank of 7 out of 10 indicates a strong growth trajectory. The company's revenue per share and 3-year revenue growth rate of 4.60% per year outperform more than half of global competitors, showcasing a robust revenue model. However, the 3-year EPS growth rate of -16.00% per year and the 5-year EBITDA growth rate of -13.60% signal areas where the company may need to improve to sustain its dividend growth in the long term.

Conclusion: Evaluating TELUS Corp's Dividend Future

In conclusion, TELUS Corp's impressive dividend history and growth rates reflect a strong commitment to shareholder returns. While the payout ratio and certain growth metrics may raise questions about future sustainability, the company's solid profitability and revenue growth provide reassurance. Investors should continue to monitor TELUS Corp's financial performance and growth prospects to make informed decisions about its dividend potential. For those seeking high-dividend yield stocks, GuruFocus Premium offers the High Dividend Yield Screener, a valuable tool for identifying similar investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.